Introduction: When Life Gives You Lemons, Negotiate With the IRS

Imagine waking up one day to find a mountain of debt on your doorstep, courtesy of the IRS and your former spouse. That’s exactly what happened to Samantha (name changed for confidentiality), a single, divorced mom who suddenly found herself staring down the barrel of a $92,080 tax debt. Most would crumble; Samantha decided to make lemonade. But not just any lemonade—she went for the hard stuff, ready to negotiate her way out of a seemingly impossible situation. This is the story of how she turned financial ruin into a tale of triumph, and it’s bound to inspire anyone facing their own Goliath.

The Shock of Discovery: When the IRS Comes Knocking

Facing the Fear Head-On

Samantha’s ordeal began with an unexpected letter from the IRS, claiming she owed $92,080 in back taxes. As if being a single mom wasn’t challenging enough, her ex-husband’s refusal to pay alimony was the cherry on top of her stress sundae. The fear of losing everything loomed large. Samantha’s story wasn’t over; it was just getting started.

The Weight of the World: A Mother’s Resolve

Samantha felt the weight of the world on her shoulders, burdened not just by debt but by the fear of being unable to provide for her three kids. Thoughts of losing her home, her children’s future, and her own sanity were constant companions. Yet, it was this pressure that forged her determination to fight back. Samantha’s resolve highlights a powerful truth: when protecting those we love, we find strength we never knew we had.

Facing Her Fears: The Turning Point

The decision to take on the IRS didn’t come easy. Samantha wrestled with doubt, fear, and the stigma of asking for help. Trusting someone with her financial and emotional vulnerability was a leap of faith. Yet, in choosing to fight, Samantha lit a spark of courage that would illuminate her path to freedom.

Seeking Help: A Beacon in the Storm

Reaching out for legal help was Samantha’s game-changer. She feared the cost, the judgment, and the unknown. But what she found was a law firm that offered not just a strategy but hope. This partnership proved to be her beacon through the storm, guiding her toward a resolution she hardly dared to dream of.

The Path to Resolution: Charting a New Course

Negotiating with the IRS was a journey through uncharted waters for Samantha. Yet, with a seasoned navigator by her side, she began to see a way through. This wasn’t a battle; it was a carefully choreographed dance, and Samantha was learning the steps to lead.

Riding the Emotional Waves: The Highs and Lows

Samantha’s story was far from a straight line to success. It was a rollercoaster of hope, fear, anxiety, and determination. Yet, each dip brought her closer to her goal, and every high reminded her of what she was fighting for. This emotional journey underscores the resilience of the human spirit in the face of adversity.

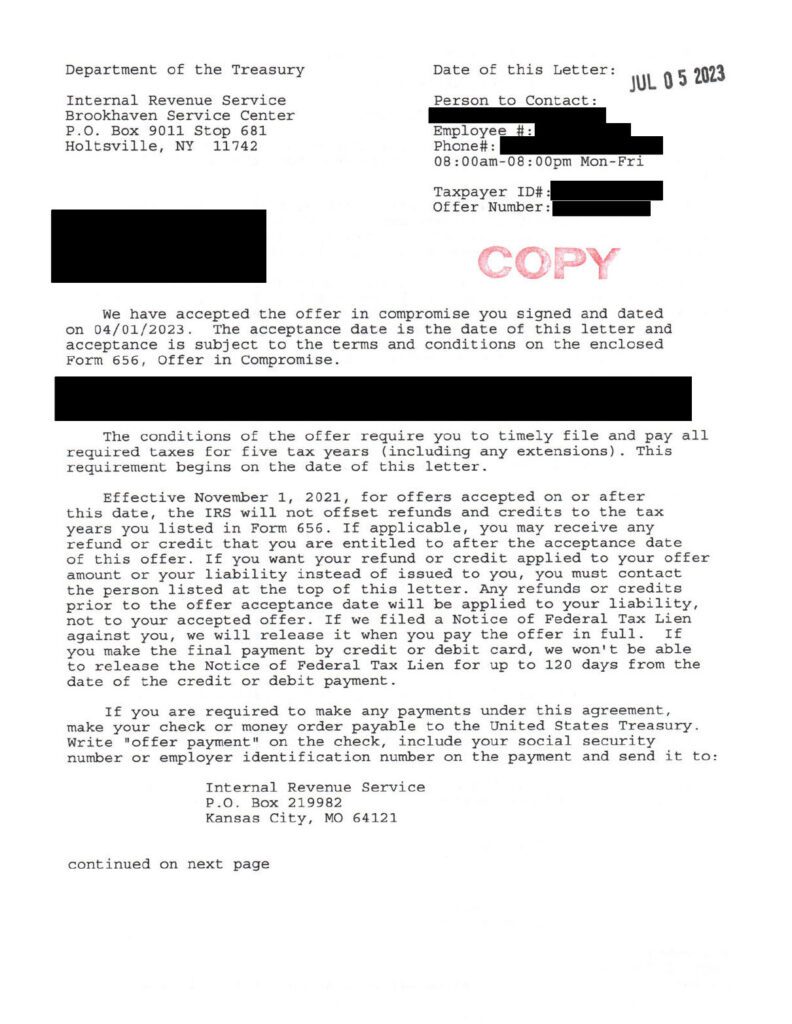

The Moment of Victory: A New Dawn

The day Samantha settled her $92,080 tax debt for $3,992 marked not just a financial victory but a personal revolution. It was a testament to her bravery, her determination, and the power of expert guidance. This moment of triumph was her new dawn, offering a future filled with possibilities.

Conclusion: A Future Unchained

Samantha’s journey from despair to empowerment is a beacon for anyone navigating their own financial storms. Her story is a testament to the fact that it’s possible to turn even the direst situations around with the right support, determination, and willingness to fight.

For anyone feeling overwhelmed by tax debt, remember Samantha’s story. You’re not alone, and there’s a path forward that doesn’t involve facing the IRS alone. If you’re ready to take the first step towards financial freedom, we’ll walk that path with you.

Ready to Rewrite Your Story? Schedule a Free Consultation Today

Let’s start crafting your victory tale. Reach out for a free consultation, and together, we’ll explore your options, strategize your approach, and start you on your path to becoming single, divorced, and debt-free. Your future self will thank you.