NJ tax audits can put businesses out of business. Fortunately, we were able to prevent that by saving our client $383,982.06 through an NJ closing agreement.

Unprecedented Tax Challenge

Our client was a successful contractor in the state. Unfortunately, he “won” the tax audit lotto and was subject to a brutal audit. NJ has draconian authority when it comes to tax audits. They can make an arbitrary assessment if they deem your tax records insufficient. While seemingly unbelievable, the state can come up with almost any number they think you should owe in tax—regardless of whether that number is practical.

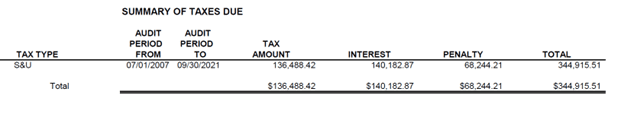

And that’s exactly what happened to our client, who did not keep proper books and records for the business. The result was two assessments—one for additional sales tax due in the amount of $344,915.51:

The second was for additional income taxes due for $189,065.55:

Strategic Tax Resolution

NJ Closing Agreements are a unicorn in the tax world. They can settle tax liabilities for less than what’s owed, but they are incredibly rare. In this case, we attempted to secure two separate closing agreements for the sales and income tax.

The Results

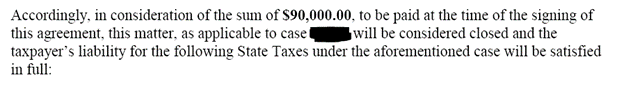

The result was a closing agreement that resolved the outstanding liabilities and did so with a remarkable reduction, saving the business $254,915.51 in taxes. The sales and use tax case was settled for $90,000:

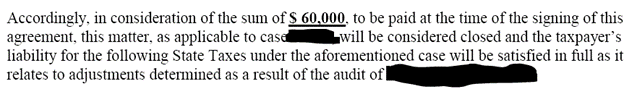

The personal liability was settled for $60,000:

Beyond the Numbers

The implications of these savings extend beyond mere numbers. This agreement means the client can continue business operations rather than being forced to shut down.

What You Need to Learn from This

Don’t put yourself in a situation where you rely on a closing agreement to settle your state tax debt. Closing agreements are rarely granted, and the state often won’t settle for anything less than the full tax due plus some of the interest.

Rather, you should keep detailed books and records so that if you are ever audited, the state never has a chance to make an arbitrary determination. This means having a skilled bookkeeper update your accounting through software like QuickBooks. In addition, you want to make sure you are saving the source documentation, such as:

- bank statements

- inventory records

- invoices for goods or services sold

- receipts

By preparing yourself ahead of time for an audit, you never need to rely on a closing agreement.

Unlock Your Path to Financial Freedom

Schedule Your Free Consultation Today