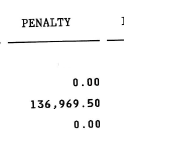

Recently, we successfully filed a penalty abatement for a client with the New Jersey Division of Taxation, resulting in a waiver of over $136,969.50 in penalties.

The abatement, which represents a significant financial reprieve for the client, resulted from our submitted penalty abatement form.

The Challenge

The clients faced a daunting challenge when they encountered a very large and unexpected tax liability resulting from the sale of their business. To add insult to injury, NJ tacked on almost $137,000 in additional penalties since the tax was not paid on time.

This was on top of the tax due, which was nearly $1,000,000. Such financial burdens can cripple an individual’s or business’s financial stability and future.

The Strategy

Understanding the significant impact of the penalties, we took immediate action. Our firm’s seasoned tax professionals reviewed the client’s case in detail, examining the circumstances that led to the penalty. Committed to providing personalized service, we prepared a comprehensive penalty abatement form outlining the reasons for abatement eligibility.

The Resolution

The result of this dedicated effort was an unequivocal success. The New Jersey Division of Taxation reviewed the submission and granted a full waiver of the penalties, acknowledging the validity of the arguments presented by our firm. The client was relieved from the burden of the penalties, preserving much-needed capital and offering peace of mind.

Implications for Future Taxpayers

If you’re dealing with a tax liability with the State of New Jersey, you must explore all options available, including a penalty abatement.