One of our clients hit the jackpot in a high-stakes game with the IRS. After an intense audit scrutinizing over $10 million in gambling winnings, the taxpayer emerged with a ruling of ‘no change.’ This story of precision, perseverance, and a pristine record of gambling earnings stood up to the federal government’s scrutiny.

A Gamble with the IRS

Gambling winnings are fully taxable and must be reported on your tax return. So when a taxpayer racks up over $10 million in winnings reported on W-2G forms, it’s akin to drawing a royal flush in the eyes of the IRS—rare enough to warrant a closer look.

The taxpayer found themselves in the hot seat as the IRS thoroughly reviewed their reported winnings. The sum in question was a staggering $10,214,371. This amount of winnings to the IRS was as attention-grabbing as a loud slot machine signaling a win.

The Audit Ante-Up

An IRS audit is daunting for any taxpayer, especially when the amounts involved reach the multi-million dollar range. The agency is known for its rigorous examination process, and a taxpayer facing such scrutiny might feel like the odds are stacked against them.

But in this game, the taxpayer held a strong hand. Armed with meticulous records, receipts, and thorough documentation that would impress any accountant, we were ready to prove that every dollar “won” was eventually lost (and then some).

No Change: A Rare Ruling

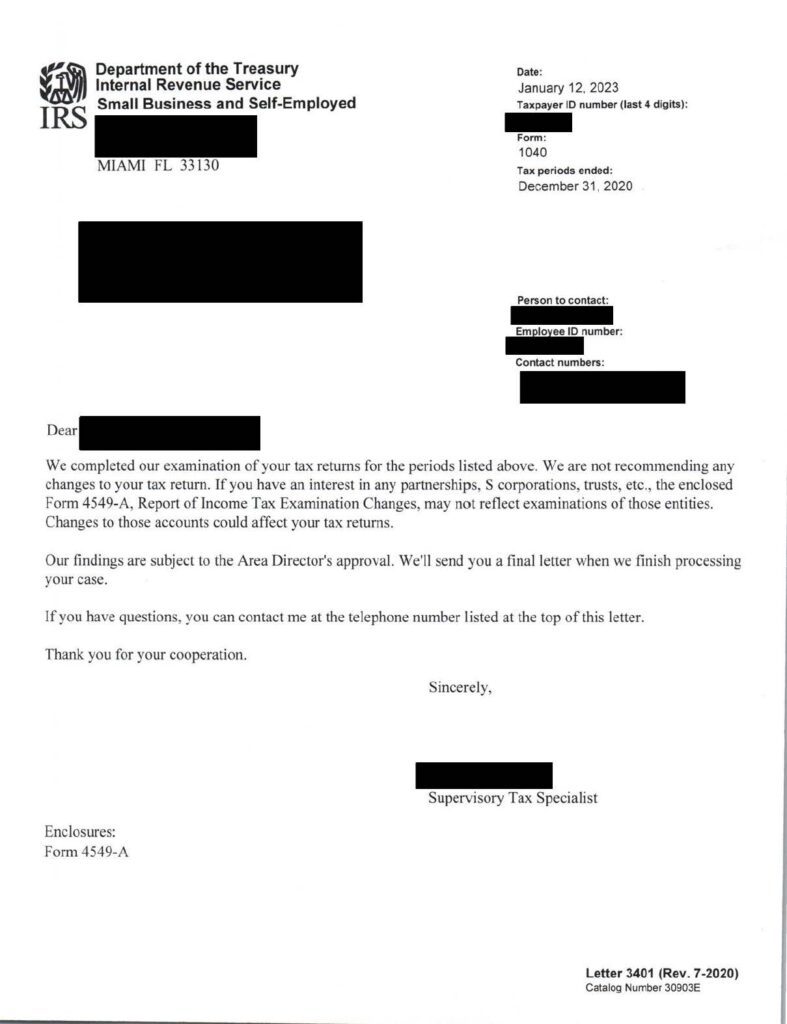

As the audit concluded, we received news that’s as rare as a perfect bet at the track: a no-change ruling. This outcome means that the IRS found the original tax return accurate, requiring no amendments or additional payments:

Such an outcome is particularly notable given the amount of money involved. It speaks volumes about diligent record-keeping and the adept navigation of tax laws related to gambling winnings.

Lessons for the Lucky

This case highlights a crucial lesson for all taxpayers who gamble: keep detailed records. The IRS requires you to keep an accurate diary or similar record of your losses and winnings. Your records should show your winnings separately from your losses.

Here are a few takeaways for any taxpayer to keep in mind:

- Document Thoroughly: For every win and loss, keep detailed records. Date and type of gambling, name, and address of the gambling establishment, names of people present with you, and amounts won or lost.

- Understand the Tax Code: Gambling winnings are taxable, and understanding how they fit into your tax return is crucial.

- Report with Accuracy: When winnings reach significant sums, it’s essential to report to the letter of the law.

- Seek Professional Help: When dealing with large sums, a tax professional can help you navigate the complex waters of tax reporting.

The Takeaway

The taxpayer’s success story is a testament to the power of meticulous record-keeping and understanding the tax implications of gambling winnings. In the face of an IRS audit, preparation and precision can make all the difference.

For those who find themselves similarly fortunate at the casino, racetrack, or any gambling venue, remember that luck should be reserved for gambling, not tax compliance.