There are lots of people in this country who try to capitalize on the stress and anxiety that comes when you receive a notice of taxes due from the IRS.

Have You Seen These?

On TV:

- “We’ll settle your IRS debt for pennies on the dollar”

- “We can drastically reduce your tax debt”

- “We will eliminate interest and penalties”

- “Get tax relief in 60 second or less”

In Your Mailbox:

- “You may qualify for a government plan to help settle your tax debt”

- “This warrant has been issued against the above named debtor because of the tax debt that has not been paid in full.”

Here’s How They Try to Scare You:

| It looks official, but it’s not. They know to contact you because the debt is recorded as a judgment or tax lien. |  |

| The language is intentionally frightening. |  |

| The deadline is really soon, which adds to the anxiety. By the time this actually lands in your mailbox, there may be only 4 to 5 days before the declared deadline. |  |

| The “call to action” is for the recipient to call a toll-free number. We’ve obscured it for obvious reasons, but would you expect to see a government agency’s name come up if you search for the phone number? That’s not what you’ll find! |  |

These so-called tax relief organizations are just mills that employ lots of sales people and very few attorneys.

Here’s how they commonly work:

- Aggressive TV presence combined with an aggressive sales team who prey on consumer fears about the IRS.

- Often use delaying tactics to lengthen the process – until they finally report that you no longer qualify for relief or say that the IRS has rejected your offer.

- Promises of a money back guarantee – but it expires in just 15 days.

- Offers an initial analysis for $500 or less and then upsell you drastically once you’re committed to using them.

- Assure you there is a tax attorney on the case, when in reality there are only one or two tax attorneys who are responsible for thousands of clients.

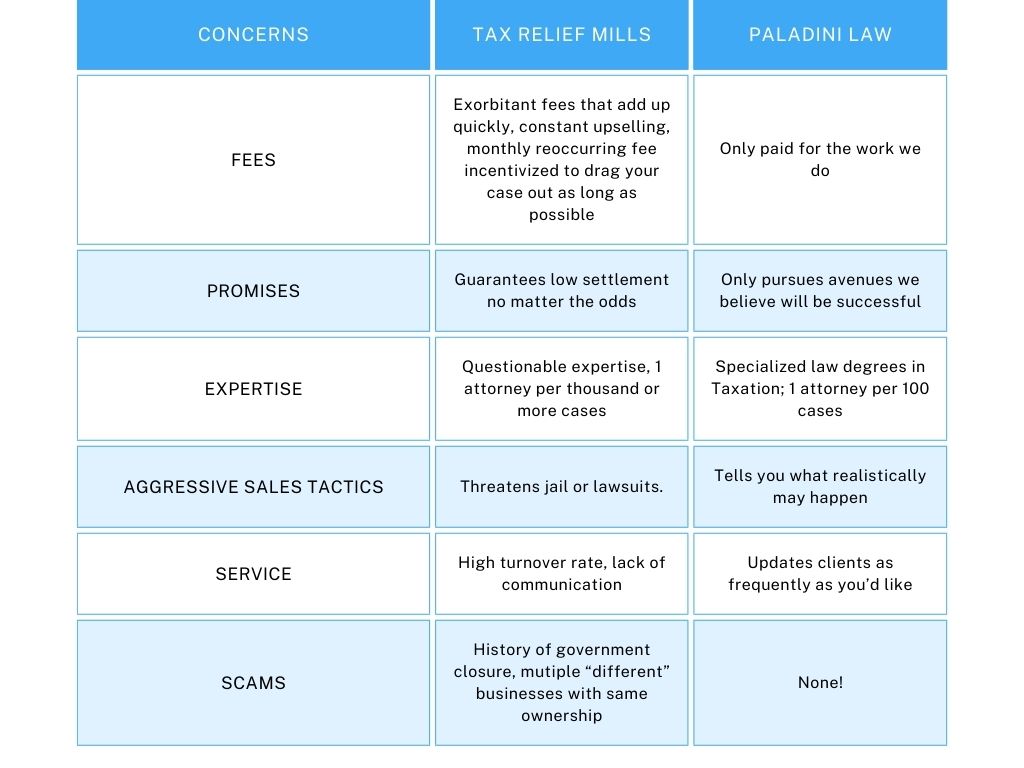

Compare Our Approach with Theirs

Paladini Law is Different

At Paladini Law, we understand that dealing with tax debt can be overwhelming and stressful. That’s why we’re committed to saving you money and providing peace of mind and a path to financial freedom.

Significant Savings: On average, our clients experience a remarkable financial turnaround, saving an average of $35,000 (as calculated for 2023). While individual results vary, our dedicated team works tirelessly to ensure each client’s best possible financial outcome.

More Than Just Numbers: We recognize that the value we bring extends beyond dollar amounts. For many of our clients, our services are a lifeline to:

- Peaceful Nights: Say goodbye to sleepless nights. Our expert handling of your tax issues means you can rest easy, knowing that your case is in capable hands.

- Direct Government Dealing: Navigating government bureaucracy can be daunting. We take this burden off your shoulders, dealing with the government directly so you don’t have to.

- Lifting the Weight Off Your Shoulders: Tax debt’s emotional and mental toll shouldn’t be underestimated. Our clients frequently express immense relief at having the weight of tax issues lifted from their lives.

A Partner in Your Corner: At Paladini Law, you’re not just another case file. We understand the personal impact of tax challenges and are committed to providing empathetic, effective solutions tailored to your unique situation.

What You Should Do When Faced with a Tax Bill You Can’t Pay:

Contact a reputable tax attorney with demonstrated experience in dealing with the IRS – schedule a free consultation with us (link).

We know getting an official IRS letter is no fun. Keep in mind IRS deadlines for response are real. Don’t put off reaching out to a tax attorney.

A tax attorney can work with a client in any state – it’s a federal matter, so you have the option to work with any tax attorney you choose.