IRS Wage Garnishment Overview – New Jersey Wage Garnishment Attorney

When you’re dealing with IRS wage garnishment, it can feel overwhelming. Suddenly, a portion of your paycheck goes to the IRS, leaving you struggling to cover everyday expenses. Wage garnishment is one of the IRS’s most powerful tools for collecting unpaid taxes, and it can cause extreme financial hardship for taxpayers.

If you’re facing wage garnishment in New Jersey, understanding your rights and knowing how to respond can make a huge difference. At Paladini Law, we’re here to help you navigate this challenging situation and work toward a solution that enables you to regain control over your finances. Call 201-381-4472 or fill out our contact form to discuss your situation with our New Jersey wage garnishment lawyer.

Overview of IRS Wage Garnishments

When you owe back taxes, the IRS can legally claim a part of your income to pay off your debt. This process, called “wage garnishment” or “wage levy,” directly impacts your take-home pay and financial stability.

Wage garnishment means you’ll see a smaller paycheck, making it challenging to cover basic living expenses. The IRS may continue garnishing your wages until your debt is resolved or another arrangement is made. Ignoring the garnishment can make the situation worse.

The IRS has a strong legal arm to seize many assets, but you have options. A skilled wage garnishment attorney can help assess your financial situation, communicate with the IRS on your behalf, and work toward solutions to reduce or stop the garnishment.

Role of a New Jersey Wage Garnishment Attorney

A wage garnishment attorney in New Jersey can provide essential support throughout the garnishment process, including:

- Assessing your financial situation: They will review your finances and help you understand your options.

- Representing your interests in negotiations with the IRS: Having an attorney means you have someone to advocate for your best interests and negotiate directly with the IRS, often leading to better outcomes.

- Strategies to reduce or release garnishments: Your attorney will work to reduce or eliminate the garnishment, aiming for a manageable solution like a payment plan or an Offer in Compromise.

- Long-term tax resolution planning: Beyond immediate relief, attorneys help clients develop strategies to stay on top of taxes in the future, so they’re not faced with garnishment again.

At Paladini Law, we are a tax law firm serving clients nationwide. Many clients come to us when the IRS is already garnishing their wages, while others use our services to prevent a wage garnishment before it happens.

IRS Wage Garnishments: What to Expect in New Jersey

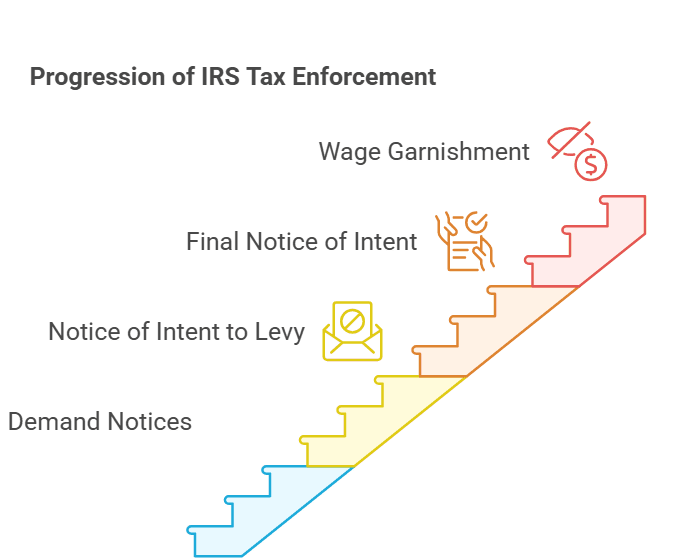

If you owe back taxes, the IRS will send you several notices and demands to pay. Eventually, the IRS will send a Notice of Intent to Levy, or Notice CP504. This will give you a chance to pay or make arrangements. Generally, you have 30 days to pay your past-due taxes or make payment arrangements.

If you don’t respond to that notice and don’t make the necessary arrangements, the IRS will send a Final Notice of Intent to Levy and Your Right to a Hearing. You now have 30 days to pay or request a hearing. If you don’t do either, the IRS will move forward with the garnishment. Your employer is legally obligated to comply with IRS wage garnishment, deducting the specified amount from your wages and forwarding it to the IRS.

Wage garnishments can apply to various forms of income, including wages and salaries, bonuses and commissions, and retirement income. Under federal and New Jersey law, you cannot get fired for a wage garnishment.

Common Questions About IRS Wage Garnishments

Here are some frequently asked questions about wage garnishment:

Steps to Take if You Receive a Wage Garnishment Notice

Receiving a wage garnishment notice doesn’t mean you’re out of options. Here’s what to do:

- Contact a tax attorney: An attorney can help you assess the garnishment and discuss ways to challenge or reduce it.

- Review the validity of the garnishment: Ensuring the garnishment is valid and accurate can help in case of errors.

- Explore options for appeal or negotiation: An attorney can appeal or negotiate to minimize the garnishment’s impact.

A New Jersey wage garnishment attorney can help you with longer-term solutions, including:

- Payment plans: A manageable payment plan can resolve your tax debt without garnishment.

- Offer in Compromise: An Offer in Compromise allows you to settle your debt for less than the full amount.

- Innocent Spouse Relief: If your spouse’s actions caused the debt, you might qualify for relief.

Working with a tax attorney can make a significant difference. A wage garnishment attorney has the experience and skills needed to understand IRS rules, advocate effectively, and personalize strategies based on your financial situation. With professional help, you have a better chance of resolving your tax issues and avoiding long-term financial strain.

Contact a New Jersey Wage Garnishment Lawyer Today

Wage garnishments are a serious matter, but you don’t have to face them alone. At Paladini Law, we understand the impact garnishments can have on your life, and we’re here to help you find a way forward. Contact us today for a consultation, and let’s work together to get you back on track. Call Paladini Law at 201-381-4472 or complete our online contact form to schedule your consultation.