Experienced Bergen County IRS Tax Settlement Lawyer Serving Tax Payers throughout New Jersey

Here’s the most important thing you must know about obtaining tax relief and pursuing an offer in compromise:

The Internal Revenue Service offer in compromise program is a privilege, not a right, and few taxpayers qualify.

If you’re unsure if you’re eligible use our offer in compromise eligibiliy calculator

This may be a surprising fact given all the TV commercial, radio advertisements, and internet ads you see promising “immediate relief” or “tax relief in 10 minutes.”

More than 95% of the offers in compromise I submit are accepted. This isn’t because of some secret loophole or strategy I utilize but because I will not even file an offer in compromise unless I believe it has a high chance of success.

Unfortunately, there are law firms and tax resolution companies who will file offers in compromise despite knowing the offer has little to no chance of being accepted. And they will charge you a premium to do so. I do not operate like that. If it looks like you pre-qualify, we’ll move forward with the offer. If you don’t, we’ll discuss other options for you such as an innocent spouse claim, a penalty abatement, or an installment agreement. Either way, I will make sure you have enough information to make an informed decision.

What You Should Know About the IRS Offer in Compromise Program:

- What are three grounds under which the IRS will accept an offer in compromise?

- How to settle tax debt with an IRS offer in compromise

- What is an IRS offer in compromise doubt as to collectability?

- What is reasonable collection potential?

- How to pay for an IRS offer in compromise

- What is an IRS offer in compromise doubt as to liability?

- What is the difference between an IRS offer in compromise doubt of colectibility and an IRS offer in compromise doubt of liability?

- When to propose an IRS offer in compromise effective tax administration?

An IRS offer in compromise (“IRS OIC”) is a way for taxpayers to settle their federal tax debt. The IRS gets its authority to settle tax liabilities under 26 U.S.C. section 7122(a). From the IRS’s perspective, the goal of an offer in compromise is to collect as much as possible, as early as possible, while costing the government as little as possible.

From the Government’s Perspective, an IRS Offer in Compromise Is Utilized to Collect as Much as Possible, as Early as Possible, While Costing Them as Little as Possible.

There are three grounds under which the IRS will accept an offer in compromise:

- Doubt as to collectability

- Doubt as to liability

- Effective tax administration

IRS OIC Tip #1: Make Sure All Tax Returns Are Filed Prior to Submitting an Offer in Compromise.

Whether you submit an IRS offer in compromise based on doubt as to collectability, doubt as to liability, or effective tax administration, all tax returns need to have been filed prior to submitting the IRS OIC. If all tax returns have not been filed, the IRS will send back the offer without review.

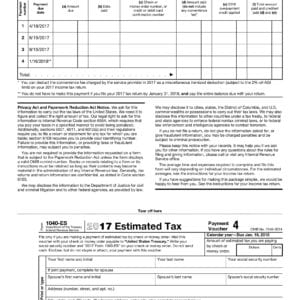

IRS OIC Tip #2: Make Sure You Are Current on Your Estimated Tax Payments.

If you’re a W-2 wage earner, you must have sufficient withholding from your paychecks. If you’ve added dependents to your W-4 to reduce the taxes withheld, contact your HR department and submit an updated W-4 that reflects the proper withholding.

If you’re self-employed, you must be making estimated tax payments. Estimated tax payments are due 4 times a year: April 15, June 15, September 15, and January 15 of the following year. You can base the payments either on what you paid in tax last year or on what you think you’ll need to pay this year. When the IRS reviews an offer in compromise, one of the first issues they look for is whether estimated tax payments are being made. If estimated tax payments are not being made, they will usually allow you to catch up to the full amount, but this can be difficult if the offer is filed late in the tax year since there could be a large lump sum due. Keep up on the payments throughout the year to avoid this.

Tax Debt You Can Compromise

Almost all taxes, penalties, and interest can be settled through an IRS offer in compromise. This includes income taxes, payroll taxes, failure to pay penalties, failure to file penalties, negligence penalties, and fraud penalties. You can even use an offer in compromise to settle the Trust Fund Recovery Penalty (although you may have to let time pass).

IRS Offer in Compromise Doubt as to Collectability

If you are looking to file an IRS offer in compromise, it probably will be an offer in compromise doubt as to collectability. For offers in compromise doubt as to collectability, it is all about your reasonable collection potential. The IRS will settle the liability if the amount you offer equals or exceeds the reasonable collection potential.

What is Reasonable Collection Potential?

Reasonable collection potential is the amount of money the IRS could reasonably expect to collect on the tax liability before the Collection Statute Expiration Date (i.e. before they run out of time). To help determine reasonable collection potential, the IRS publishes national and local standards for expenses like food, housing and utilities, car payments, and car expenses.

IRS OIC Tip #3: Beware of National and Local Standards.

Many people will come to my office after their offer in compromise has been rejected. One of the most common reasons their offers are rejected is because they are not aware of national and local standards. National and local standards will often limit your actual expenses. For instance, if you pay $1,000 a month for your vehicle, this expense will almost always be limited to the standard, which is currently $485. The IRS utilizes national and local standards to provide uniformity and to prevent people who live luxurious lifestyles from settling their tax debts.

You can find the national and local standards here. Should you use the expense you pay or the national or local standard? It depends. For most expense items, you must use the lesser of what you pay or the national or local standard. But for some items, such as food and clothing, the IRS accepts the national standard even if you pay less. (But good luck having a food and clothing budget below the national standard—it’s currently $1,650 for a family of four and includes food, housekeeping supplies, clothing, personal care products and “miscellaneous” expenses.)

For other items, such as out of pocket health care expenses, the IRS will usually allow the greater of what you pay or the standard, so long as you have documentation to prove you are paying more.

Calculating Reasonable Collection Potential

If you think of reasonable collection potential as a math formula, it looks like this:

Reasonable Collection Potential = (future income potential x 120) + equity in assets

To have the best chances of getting an offer accepted, your reasonable collection potential should be less than the amount you owe.

Let’s break it down piece by piece:

Future Income Potential

Future income potential is the difference between your monthly income and your reasonable monthly expenses, again remembering the national and local standards. As a formula, it looks like this:

future income potential = gross monthly income – reasonable monthly expenses

If you are a W-2 wage earner, gross income is straightforward. Depending on how often you’re paid, you take your gross wages per pay period and calculate your monthly wages. Here’s the math:

| If you’re paid: | Calculate the monthly amount by: |

| Weekly | Multiplying by 4.3 |

| Biweekly (every 2 weeks) | Multiplying by 2.17 |

| Semimonthly (twice a month) | Multiplying by 2 |

If you are a salaried employee, this is even easier as the gross monthly income will not change (barring any bonuses or raises). If you’re an hourly employee, calculate a few months of income to determine what your gross wages are on average. Gross wages do not consider withholdings for taxes, medical or dental insurance, or any other deductions you see on your paystub.

If you’re self-employed, things are more complicated. As most self-employed people know, income will fluctuate dramatically. Some months you may make no money, while other months you may see a windfall. To account for this, the IRS allows you to provide a profit and loss statement for the past 6-12 months or use numbers from last year’s tax return if you do not expect your income to change much.

All income—not just wages—must be included. If you have rental income, dividends, interest income, alimony, or child support, it must be included as income for the offer in compromise.

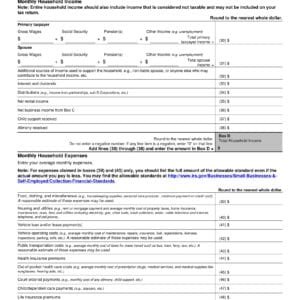

Monthly Expenses

The IRS does not allow all expenses. Some are limited by national and local standards. Others will not be allowed at all. For instance, if you send your children to private schools, the IRS will not give you credit for this expense, barring very exceptional circumstances. Here are some expenses the IRS allows:

- Food, clothing and miscellaneous items

- Housing and utilities

- Vehicle loan or lease payment

- Vehicle operating costs (gas, insurance maintenance)

- Public transportation costs

- Health insurance premiums

- Out of pocket health care costs

- Court-ordered payments

- Child/dependent care payments

- Life insurance premiums

- Current monthly taxes

- Secured debts, including government guaranteed student loans

Like income, these expenses are calculated monthly.

Equity in Assets

Another component to determine ability to pay is equity in assets. Assets include:

- Cash and investments

- Retirement accounts

- Life insurance policies (if there’s a cash value)

- Real estate

- Vehicles

Two things to remember about assets: First, for most assets except cash, the IRS only uses the Quick Sale Value of the asset. For purposes of the IRS calculation, you’ll take credit only for 80% of the fair market value of the asset, not 100%. Second, you can offset the asset value by whatever loan is against the asset. So if you have a mortgage on a piece of real estate, you’ll be able to deduct this from the value of the home.

IRS OIC Tip #4: Don’t Lie on the Offer in Compromise.

It seems like common sense, but taxpayers are often tempted to lie on their offer in compromise. This is a bad idea and can result in more than just tax problems. Offers in compromise are signed under penalty of perjury. In addition, the IRS makes great effort to verify the information on the offer. For instance, if you leave out a car or motorcycle, the IRS may pull DMV records and discover the omission. This is not a great way to start the offer.

Once you have your future income potential and know your equity in assets, it’s straightforward to see if you’ll qualify for an offer. Let’s run through a quick example. David owes $100,000 to the IRS. His future income potential is $500 per month, and he has $10,000 in equity in all his assets after factoring the Quick Sale Value and any loans against the assets. The formula would be:

Reasonable Collection Potential = ($500 x 120) + $10,000.

Simplified, David’s reasonable collection potential is $70,000. If everything is completed properly and the IRS makes no adjustments, David would likely qualify for an offer in compromise.

How Much Will the IRS Settle For?

There are two ways to pay for an IRS offer in compromise, but we will only go over one: the lump sum payment. For a lump sum payment, the IRS requires 20% of the offer amount when the OIC is submitted. If the offer is accepted, the remaining amount is due in 5 months.

IRS OIC Tip #5: Be Prepared to Wait 6-18 Months for the IRS to Review Your Offer.

Many taxpayers are concerned about coming up with the funds for an offer in compromise. But because the IRS has a backlog of offers to review, you’ll usually have at least 6 months to come up with the additional funds. This doesn’t include the 5 months the IRS gives you to pay after the offer is accepted.

The amount offered can be represented by another formula:

amount offered = (future income potential x 12) + equity in assets

This is like the reasonable collection potential formula above, except that the future income potential is multiplied by 12 months instead of 120 months. Using David’s example above, if his future income potential is $500 per month and his equity is assets is $10,000, David should offer $16,000 to settle his IRS tax liability. Of that $16,000, 20% or $3,200 is due at the time the offer is submitted. The remaining $12,800 would be due 5 months after the offer is accepted.

IRS Offer in Compromise Doubt as to Liability

As the name indicates, an IRS offer in compromise doubt as to liability should be used when there’s legitimate doubt the tax is owed. If you’ve already challenged the tax owed in tax court or another court, there is no doubt as to liability. Generally, you could have contested the amount owed during an audit or at appeals or hopefully both. But sometimes taxpayers are unaware they are being audited until years later. Moreover, there are usually other procedural avenues that can be taken to contest a liability, such as filing an audit reconsideration. An offer in compromise doubt as to liability is one more weapon at a taxpayer’s disposal.

An IRS offer in compromise doubt as to liability must be completed on a Form 656-L.

How Much Will the IRS Settle For?

Whereas an IRS OIC doubt as to collectability is based on your ability to pay, an OIC doubt as to liability is based on what the correct tax should be. An IRS offer in compromise doubt as to liability will only succeed if you have documentation to prove your case.

IRS Offer in Compromise Effective Tax Administration

There are two situations where you should purpose an IRS offer in compromise effective tax administration: (1) collection of the tax would create an economic hardship, or (2) there are extraordinary circumstances compelling public policy or equity. These offers in compromise are rarely accepted and should only be pursued in extreme circumstances.

IRS OIC Tip #6: Be Wary of Tax Professionals Who Instantly Say You Qualify.

Without knowing how much you owe and your ability to pay, it’s very difficult to know if you are a viable candidate to file an offer in compromise. When searching for a law firm to help with your IRS offer in compromise, be skeptical of anyone who instantly says you qualify. Don’t be afraid to ask questions. And if it sounds too good to be true, it probably is.

What’s the Benefit of Having Paladini Law Represent You for an IRS Offer in Compromise?

Education and Experience: I have a Master of Laws in Taxation from a top 10 tax law program. I worked at one of the largest and best tax controversy firms in southern California and have done successful offers for taxpayers owing anywhere from $30,000 to over $1 million. There are many intricacies to an offer in compromise, many of which can only be learned by doing enough of them.

Honest Evaluation: I will not file an IRS offer in compromise unless I am very confident it will get accepted. I’ll never guarantee a successful offer, but you can trust that we would not be filing it unless I felt your changes were high.

Client Focused: Owing money to the IRS is stressful. I return all phone calls, texts, and emails within 24 hours—even on weekends. I send frequent updates on the case, and I frequently move things around my schedule to accommodate phone conferences and meetings with clients. It’s not only my goal to provide extraordinary results, but also to make sure you feel confident and relaxed in the approach we take.

IRS OIC Success Stories

Two success stories come to mind involving IRS offers in compromise: First, I had a small case where the client owed less than $50,000. Hiring a tax attorney for help was a huge investment for this client. And the client was nervous about proceeding with the IRS OIC. The client wanted a guarantee the offer would succeed. I told the client I could not do that, but in my evaluation, there was a 90% plus chance of success. Sure enough, months after we submitted the offer (and after some back and forth with the IRS), we received the acceptance letter. The client was ecstatic.

In another IRS OIC, the client was well known in the community and owed over $1,000,000. It was an extremely difficult offer because the client’s income was well into the six figures. The offer took longer than usual to negotiate, but the offer was accepted. I’ll never forget the client being so happy because the liens would be released and he’d be able to open a credit card again.

Offer in Compromise FAQs

What Is an IRS Offer in Compromise?

An Offer in Compromise is something that is offered by the Internal Revenue Service (IRS) as a method by which taxpayers can settle their outstanding tax debt. Federal law gives the IRS authority to settle tax liabilities, although very few taxpayers qualify for an IRS Offer in Compromise (“IRS OIC”). The goal of an IRS OIC is to collect as much money from a taxpayer as possible, as soon as possible, while minimizing the cost to the government. There are only three bases for an IRS OIC.

When Will the IRS Accept an Offer in Compromise?

There are three reasons why the IRS may accept an Offer in Compromise. First, if there is doubt as to whether the agency can collect the debt (i.e., whether you could pay the tax liability before the statute of limitations expires), the IRS may accept an OIC. Second, the IRS will accept an OIC if there is doubt as to your liability for the tax debt. Third, the IRS may agree to an OIC based on effective tax administration if the collection of the debt would create an economic hardship or if there are reasons involving extraordinary circumstances, compelling public policy, or equity. This type of IRS OIC is very rarely made. If you have questions about your eligibility for an Offer in Compromise, consult with a New Jersey tax attorney.

How Can I Pay an IRS Offer in Compromise?

There are two ways to pay an IRS OIC: (1) periodic payments; or (2) a lump sum payment. To make periodic payments, you must submit an initial payment with an application for an Offer in Compromise. You must then continue to pay down the balance in monthly installments while the IRS considers your offer. If it is accepted, then you will continue to make payments under the terms of the OIC. To make a lump sum payment, you must submit 20% of the offer amount when you file an application. If the offer is accepted, then you must pay the remaining amount within 5 months of acceptance. It may take as long as 6 to 18 months for the IRS to review your OIC.

Contact an NJ Tax Attorney to discuss Tax Relief

I’ve helped clients throughout New Jersey obtain tax relief via an offer in compromise and I may be able to do the same for you. Below is a review from one of my previous clients:

If you want to see if you can obtain tax relief from an offer in compromise, give me a call or complete a contact form.