This year, millions of taxpayers will find themselves staring down the barrel of an LT38 letter. What does this IRS notice mean? Should you panic? Let’s dive in to find out.

Key Takeaways

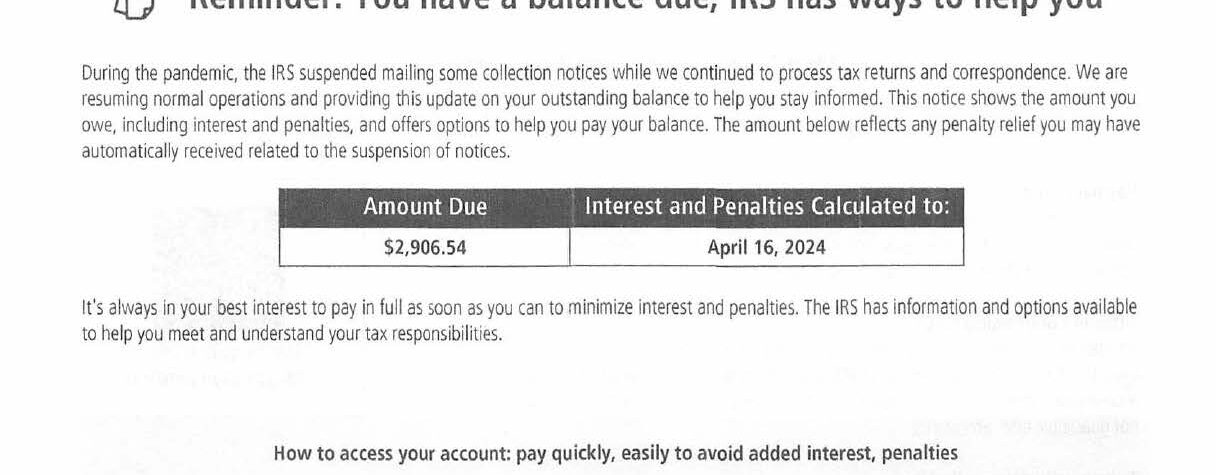

- The LT38 notice signifies the IRS’s intent to pursue collections on outstanding tax debts and offers automatic penalty relief for eligible taxpayers with assessed taxes below $100,000 for tax years 2020 and 2021. Other tax years do not qualify for automatic penalty relief.

- Recipients of the LT38 notice are encouraged to file any missing tax returns, settle tax bills in full, or arrange payment plans and installment agreements designed for their financial situation.

- Ignoring an LT38 notice can lead to severe consequences, including enforced collection actions such as wage garnishment, bank levies, and accrual of penalties and interest, emphasizing the importance of prompt and proactive responses to the notice.

LT38 Explained: Understanding the Beast

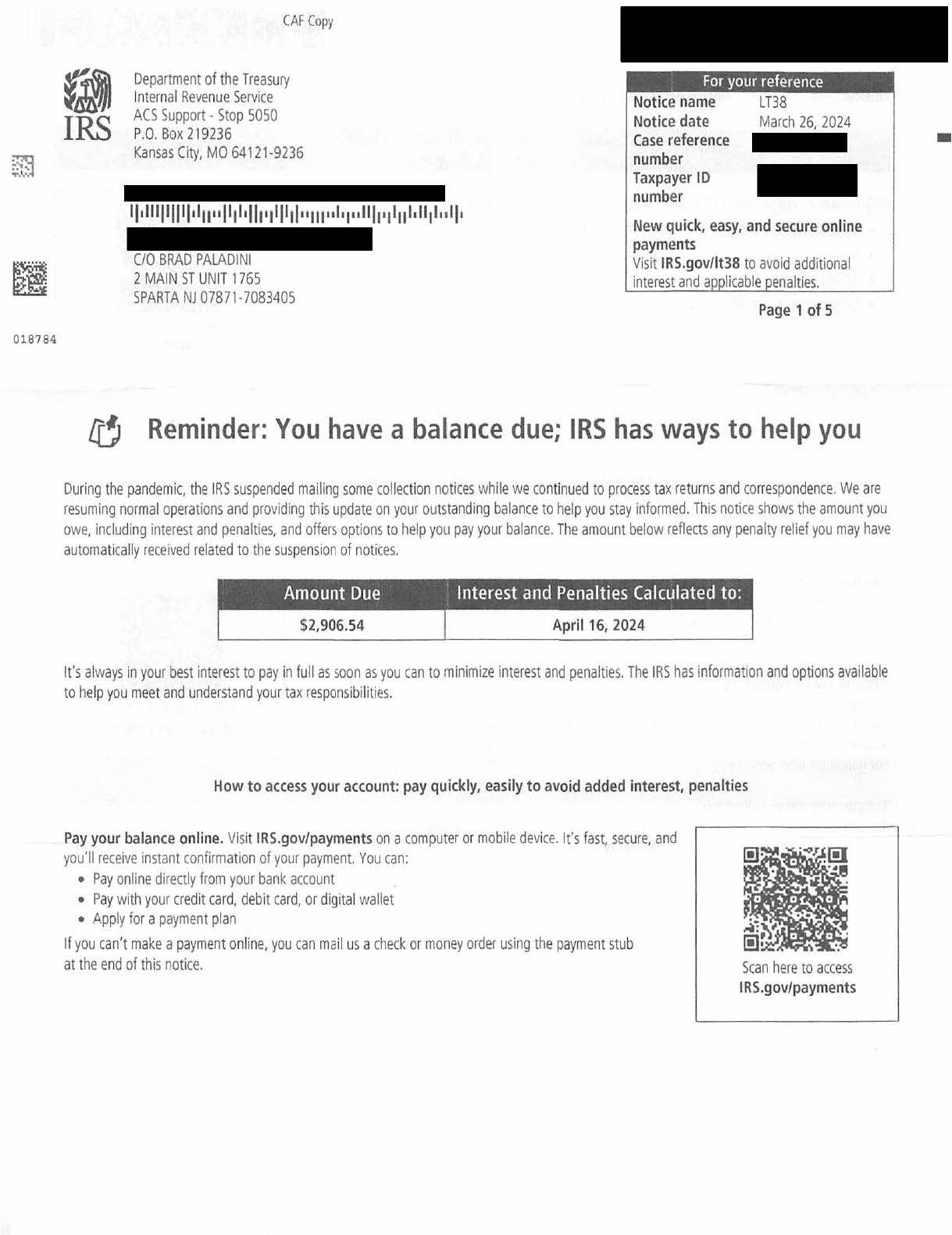

The LT38 notice alerts you that the IRS is dusting off its collection machinery after a pandemic-induced hiatus and is ready to tackle outstanding tax balances head-on. If this notice lands in your hands, it’s time to sit up and take note. The LT38 notice prompts you to file any missing tax returns and a nudge towards settling your tax bill or exploring viable payment alternatives if your wallet doesn’t stretch that far.

However, the LT38 notice isn’t solely about your debt. It also highlights the possibility of penalty relief for those who meet the criteria, offering a reprieve to eligible taxpayers who might otherwise face the burden of additional financial liabilities. The LT38 notice serves as a warning signal that the IRS is ready to get back to business collecting outstanding tax debt.

For some, the notice may give the good news of automatic penalty relief. In contrast, for others, it’s a stark warning against inaction, hinting at the dire consequences of ignoring these IRS’s letters.

Who is Eligible for Automatic Penalty Relief?

Some taxpayers were offered a life preserver because of the IRS’s delay during the pandemic. The IRS provides automatic penalty relief for taxpayers whose assessed taxes are under the $100,000 limit for 2020 and 2021—no need to complete any forms or applications. No automatic relief exists for taxpayers owing more than $100,000, but they may still qualify for a penalty abatement on other grounds. There’s no automatic relief for other tax years.

The Consequences of Ignoring Your LT38 Notice

Ignoring an LT38 notice could be disastrous. The IRS may begin to take enforced collection actions, claiming a share of your wages, dipping into your bank accounts, seizing your state tax refund, or seizing other assets to settle the debt of unpaid taxes. Your tax bill will swell with the relentless accumulation of penalties and interest, including the failure to pay penalty, worsening a bad situation.

Furthermore, the IRS might escalate its collection efforts for those who ignore this warning notice. The IRS could assign an IRS Revenue Officer, a specialized debt collector, who personally investigates you and your financial situation to collect the assessed tax. If you’re missing a tax return, the Revenue Officer will also work to secure that return or recommend that the IRS files one for you. No taxpayer wants to find themselves in this situation, where the IRS’s actions become more forceful and your options for resolution narrow.

The key to avoiding enforced collections is taking action. The IRS will send many automated collection reminder notices to taxpayers who owe back taxes. And there are many options to resolve this, such as making monthly payments. But if you ignore the balance due notices, the IRS will try to get your attention another way—by taking money from you to collect the outstanding tax liability. All this can be avoided by taking action before the IRS acts for you.

Steps to Take After Receiving an LT38 Notice

When you receive the LT38 notice, think of it as a guide to resolution, not a symbol of impending doom. Start by verifying any recent payments; if they were made within the last three weeks, you might already be clear. Sometimes, notices are issued before the IRS behemoth realizes you’ve already paid.

Next, ensure all your tax returns are filed, especially if the notice indicates any are missing. You cannot resolve your unpaid taxes if a tax return is missing. Finally, approach your tax bill with a strategy.

Resolving Disputes Over Your Tax Bill

If you dispute the amount stated in your LT38 notice, promptly contact the IRS for clarification or submit proof of payment. A return you’ve filed may have gone missing in the IRS’s system, or perhaps it wasn’t properly processed due to identity theft.

Dealing with Tax Debt

Facing financial hardship can feel overwhelming, but assistance is available. If you owe back taxes, the IRS offers many different options. The IRS can place your account in “currently not collectible” status, effectively pausing the collection storm until you can find your financial footing. Although this doesn’t erase your tax debt, it grants you a reprieve from the IRS’s collection efforts.

The IRS offers payment plans and installment agreements for taxpayers who cannot settle their unpaid tax bills in one payment. These manageable monthly payments prevent the unpaid balance from snowballing into a greater financial burden. If your debt is substantial, be prepared to share detailed financial information using Form 433-F to establish a payment plan that doesn’t leave you adrift.

Alternatively, an Offer in Compromise could be the key to settling your debt for less than the full amount, provided that paying the full amount would plunge you into further financial distress.

Proactive Measures to Prevent Future LT38 Notices

To prevent future LT38 notices, it is wise to maintain timely compliance. Ensure that your tax returns are filed promptly. In addition, you may need to adjust your withholdings or make estimated tax payments to ensure that you don’t owe again.

Why CPAs Aren’t Always Your Best Ally

You might think a CPA is your North Star in these murky waters, but when it comes to the LT38, they might not have the celestial navigation skills you need. CPAs are skilled in numbers, not the high-stakes negotiation and legal interpretation this situation demands. It’s like bringing a fish to a swordfight—it might be sharp, but it’s not the right tool for the job.

The Value of Specialized Legal Representation

Having a seasoned captain at your helm makes all the difference in tax disputes. A tax attorney is not just any member of your crew; they’re the swashbuckling hero equipped for battles with the IRS. They understand the language of the sea (or in this case, tax law) and can navigate through the treacherous waters of tax debt.

Dispelling the Fog: Common Myths About Seeking Legal Help

Many fear seeking legal counsel is akin to firing a cannonball directly into their finances. However, the true treasure lies in understanding that specialized legal representation is an investment in your peace of mind and financial health.

What Does Help Look Like?

Amidst the complexities of LT38 notices, tax attorneys act as experienced guides. They:

- Assess your specific situation, clarifying the IRS’s demands and the potential repercussions should you fail to respond.

- Negotiate your tax debt with the IRS to secure favorable outcomes.

- Pursue penalty relief if you don’t automatically qualify.

A tax attorney can be instrumental in:

- selecting the best payment plan or relief option that aligns with your financial reality and deals with your tax liability

- providing guidance and advice on tax laws and regulations

- negotiating with the IRS on your behalf to prevent an IRS levy, reduce penalties and interest

- representing you in tax court, if necessary

Enlisting the help of a tax professional could be the deciding factor in finding a sustainable solution to your tax quandary.

Summary

Remember, the LT38 notice is not the end but a beginning—a call to action that, when answered promptly and effectively, can lead to a fair and manageable resolution. With the right approach and resources, you can turn the tide in your favor and sail toward a future free of unnecessary tax turmoil.

Frequently Asked Questions

Don’t Navigate These Waters Alone

Set Sail Towards Resolution