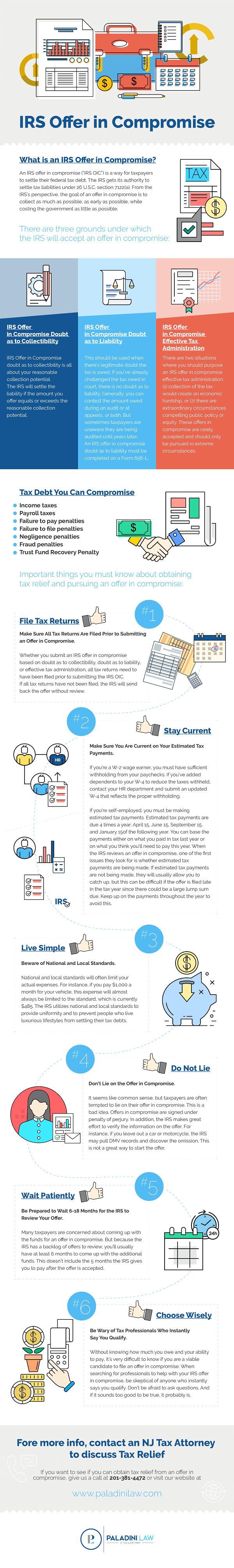

The IRS wants their money, but that doesn’t mean they strive to squeeze every penny from a consumer or business.

Instead, the IRS deploys multiple repayment methods and plans that suit the needs of the taxpayer. One of those methods is the Offer in Compromise (OIC).

The OIC carries unique advantages for taxpayers because the IRS can collect as much as possible – but also settle for less than the initially owed amount. This OIC option reduces costs and the time the IRS must wait and saves the taxpayer the hassle of making regular payments and paying outrageous amounts of fees and interest.

What Debts Qualify for an OIC?

Personal income taxes are the most popular use of an OIC, but the IRS allows for multiple back-owed taxes to pass through an OIC.

Some of the most common debts taxpayers can compromise with the federal government include:

- Personal income tax

- Business tax

- Payroll tax

- Failure to pay penalties

- Failure to file penalties

- Fraud penalties

- Negligence penalties

- Trust fund penalties

Essential Considerations: What Qualifies a Taxpayer for an OIC

Regardless of the amount due or the history of the taxpayer, the IRS has stringent requirements for using an OIC. To receive tax relief from an OIC, taxpayers must first:

File All Tax Returns

Just like the Installment Agreement, an OIC requires that the taxpayer file all past tax returns. All returns must be submitted before sending in the OIC to the IRS. If the IRS does not have all returns on record, they do not review the OIC and return it to the sender.

Keep Up-to-Date with Estimated Tax Payments and Withholding

To show the IRS your request is in good faith, you must keep up with all withholding and estimated tax payments.

For W-2 earners, claim the proper deductions on your W-4 withholding and update your forms to reflect an appropriate withholding before submitting your OIC.

For self-employed earners, estimated tax payments must be submitted to the IRS on time. Estimated tax payments are due four times a year: April, June, September, and January of the new year. Calculating estimated tax payments can be complicated. Therefore, you should consult with a tax professional to see what your estimated tax payments are for the current tax year.

Expenses

When you fill out an OIC, your expenses are given to the IRS for them to determine your financial stability. The amounts allowed are set based on national and area-based standards. If you have exquisite cars, a larger than necessary house, and high credit card debt, the IRS might limit the actual expenses you pay to the national and local standards.

Be Honest Regardless of Outcome

You are burdened with heavy tax debt, and you are desperate to get out of it. While you might be tempted to leave off details or skew the truth, it is not in your best interest to do so.

Always be honest with the IRS and in your OIC. You sign the OIC under penalty of perjury, which means you commit a crime by submitting a false document.

Consult a Tax Attorney

While you could complete the OIC yourself and submit it, the chances of approval are much lower without an attorney. An attorney has experience handling IRS negotiations, including OICs.

Let the attorneys at Paladini Law help you complete an OIC and ensure that you not only qualify, but that your request meets all IRS requirements to avoid further delays.

Schedule a tax consultation at 201-381-4472 or contact us online regarding your OIC.