Imagine receiving an unexpected visit from an IRS Revenue Officer at your home or business. It’s a situation that can be overwhelming and intimidating. But fear not! In this comprehensive guide, we’ll explore the world of Revenue Officers and equip you with the knowledge and tools to navigate these encounters. Prepare to dive deep into Revenue Officers’ roles, powers, and limitations, learn how to deal with them effectively, and discover strategies for negotiating and resolving tax issues.

By understanding the inner workings of Revenue Officers, you’ll be better positioned to handle any tax situation that comes your way. Whether seeking professional representation, maximizing allowable expenses, or simply trying to identify fake IRS agents, this guide covers you. So, let’s embark on this journey together and demystify the complex world of Revenue Officers!

Table of Contents

Understanding the Role of Revenue Officers

A Revenue Officer is an employee of the Internal Revenue Service (“IRS”) responsible for collecting delinquent taxes and securing overdue tax returns. These tax collectors have the authority to levy wages and bank accounts but cannot make arrests. Their primary focus is securing delinquent tax returns and working with taxpayers to resolve outstanding tax liabilities.

Make no mistake about it: A Revenue Officer works for the IRS. They are not your advocate. Their job is to get you to pay as quickly as possible.

The Power of Revenue Officers

IRS Revenue Officers are authorized to:

- Issue summonses

- File federal tax lien and levies

- Contact employers and other third parties for delinquent tax collection

- Conduct interviews

- Analyze financial records

- Take necessary steps to guarantee tax compliance, such as securing delinquent tax returns

- Recommend foreclosure on real estate or seizure of other property

- Refer cases to the IRS’s criminal division

The quest to collect unpaid taxes endows Revenue Officers with substantial power, especially when dealing with an outstanding tax bill.

Still, one must remember that Revenue Officers are not omnipotent agents acting without restraint. Tax collection rules and regulations bind them, and they must adhere to the appropriate procedures and protocols. So, while they possess the power to take action, they also operate within a framework that ensures fairness and transparency in the tax collection process.

Or at least, that’s the theory.

Limitations of Revenue Officers

Despite their considerable authority, Revenue Officers have certain limitations. For instance, they do not have the power to arrest taxpayers, but they can refer cases for criminal investigation. They focus on collecting unpaid taxes and ensuring tax compliance, not incarcerating individuals. In addition, Revenue Officers must permit taxpayers to seek professional representation when addressing tax cases.

Recognizing these limitations is critical for taxpayers, providing them with a clearer understanding of the extent and confines of a Revenue Officer’s authority.

And by the way, despite what you may read elsewhere on the internet, revenue officers don’t carry guns.

Revenue Officers vs. Revenue Agents

We often get people who reach out to us because an IRS agent is assigned. We ask, “Well, which type of agent?” While both Revenue Officers and Revenue Agents work for the IRS, their roles are distinct, and knowing who you’re dealing with will determine how best to resolve the issue.

Revenue Officers are professional debt collectors who focus on collecting delinquent taxes and securing overdue tax returns. Revenue Agents determine the tax liability through tax audits. Revenue agents are auditors for the IRS. Revenue agents and revenue officers are trained differently since their goals are different.

Sometimes, a matter will start with a revenue agent. The revenue agent will determine there’s an additional tax due. Once the liability becomes final, the case may get assigned to a Revenue Officer tasked with collecting the debt.

Resolving Your Case with an IRS Revenue Officer

Although less common than it used to be, a Revenue Officer can visit your home or business location unannounced. Dealing with IRS Revenue Officers can be daunting, but it doesn’t have to be. By understanding their role and responsibilities and your rights as a taxpayer, you can approach these interactions with confidence and clarity. Seeking professional representation, such as from a tax attorney, can provide invaluable support and guidance. Furthermore, proactively addressing tax issues head-on can lead to more favorable outcomes and save you time and money.

We’ve dealt with hundreds of revenue officers over the years. Many revenue officers are fair. Others are unreasonable, non-responsive, overly zealous and aggressive, and generally unpleasant. Unfortunately, you don’t get to decide who you work with, so you must make the best of a bad situation.

The key to successfully dealing with IRS Revenue Officers is to:

- Remain informed, prepared, and engaged throughout the process

- Actively participate in discussions

- Provide accurate and timely information

- Work collaboratively with Revenue Officers

Following these steps can help facilitate a smoother and more efficient resolution to your tax concerns.

Seeking Professional Representation

We often tell clients there’s no reason to hire us because the matter could be handled without an attorney. Dealing with a revenue officer is not one of them. Hiring an experienced tax attorney with expertise in tax law and business law can be a game-changer when it comes to navigating the complexities of dealing with a Revenue Officer. Tax attorneys possess a deep understanding of tax laws and regulations and can provide invaluable guidance on managing intricate tax matters and negotiating with Revenue Officers effectively. Having a professional representative on your side can provide you with a sense of control and potentially result in significant cost savings.

Let’s say you’re a contractor who builds houses. Would you hire us to build that house? I hope not—I’ve never built a house before. Similarly, if you spend your days building houses, do you think playing tax attorney is a good idea? Hopefully, you get the point. You can handle some IRS issues on your own, but this one requires a tax professional.

Know Your Rights

As a taxpayer, you have certain rights when dealing with an IRS Revenue Officer. You are entitled to representation, whether by a tax attorney, CPA, or enrolled agent, at any point during the process. Additionally, you can verify a Revenue Officer’s credentials and identity through additional methods, such as contacting the local IRS office or requesting their official identification.

Awareness of your rights empowers you to confidently and assertively approach interactions with Revenue Officers. Exercising your rights and ensuring that you are treated fairly and equitably can help facilitate a more positive and productive resolution to your tax concerns.

Resolving Your Case with an IRS Revenue Officer

Again, while becoming more uncommon, unannounced visits by a Revenue Officer are possible. They could also try to contact you by alternative means, such as by sending a letter or, in rare cases, calling you directly.

A revenue officer is contacting you for one of two reasons: First, you did not file tax returns that the IRS believes you should have filed. Second, you have an outstanding tax debt.

If a Revenue Officer is Assigned to Secure Missing Tax Returns

If a Revenue Officer contacts you because you did not file a tax return, you must act quickly. If you don’t work on filing the missing returns fast, the Revenue Officer will move to file the returns for you, often causing you to owe substantially more than if you had filed yourself. Once the IRS files the returns, the Revenue Officer will use her investigative techniques to ensure payment, like researching assets and issuing tax levies.

If you’re missing returns, it’s essential to maintain contact with the revenue officer. Always ask for the revenue officer’s manager’s contact information if you have trouble reaching them.

A revenue officer will generally provide 30 days for tax filing. If that’s not enough time, request more. A revenue officer cannot give you unlimited time to file. Suppose you’re having trouble getting the information needed. In that case, you can ask the revenue officer for a copy of your wage and income transcript, which shows all of the W2s, 1099s, and other income information the IRS has on record.

Once the returns are prepared, file them normally. You must also send the revenue officer copies directly and mark them as possible duplicates. Providing the returns to the revenue officer without filing them is insufficient—recent case law made this clear. Nor is simply filing them and not providing the revenue officer with copies. Both need to be done. With everything you do with the IRS, send this information via certified mail.

If a Revenue Officer is Assigned to Collect a Tax Bill

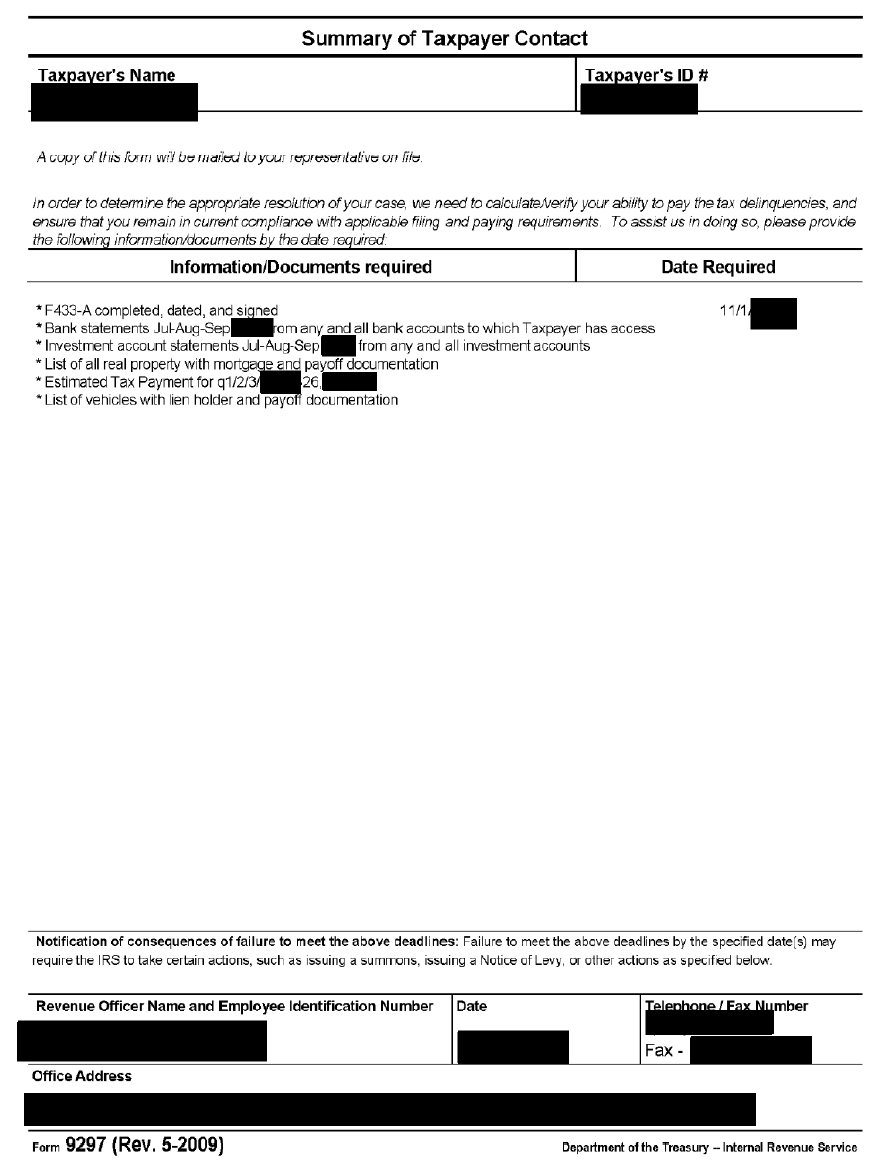

If all the returns are filed, the revenue officer must collect the taxes as quickly as possible. The process usually starts with the revenue officer issuing a Form 9297, which looks like this:

A Revenue Officer will ask for one or two forms: the Form 433-A, or the Form 433-B, or both. The Form 433-B is specific if you have a particular type of business. These two forms help the revenue officer assess your ability to pay the tax debt. Every matter is handled on a case-by-case basis. After reviewing these documents, the revenue officer will decide on the tax resolution. This usually means figuring out whether the taxpayer has a financial hardship or whether the taxpayer should be placed on a payment plan or installment agreement.

In addition to Form 433-A or Form 433-B, the Revenue Officer will also request supporting documentation, such as pay stubs, mortgage statements, bank statements, etc. The 9297 will list the documents required. At the bottom of the 9297, you’ll notice that the consequence for not providing all this information is a seizure of assets or other collection action. Many taxpayers fail to respond to Form 9297, leading to drastic consequences.

The IRS doesn’t just take your word for it. There is an investigative process in which the RO may review assets and research other information to see if anything is missing. If you have a business, the RO may require a tour to examine assets personally. Taxpayers must cooperate—they are within their rights to examine the business.

Maximizing Allowable Expenses

Experienced IRS lawyers can help taxpayers understand and maximize their allowable expenses when dealing with the Internal Revenue Service. By ensuring that all eligible expenses are claimed, taxpayers can potentially reduce their tax liability and achieve better resolution outcomes, such as demonstrating financial hardship.

Maximizing allowable expenses can significantly impact your overall tax liability and financial situation. By taking full advantage of these expenses and working with experienced professionals, you can help ensure the best possible outcome in your dealings with the IRS.

Presenting Financial Information

For a smooth and efficient resolution process, presenting financial information to the IRS clearly and succinctly is vital. By organizing your financial data in a sensible order and providing accompanying documentation, you can minimize the risk of misunderstandings and streamline the process. Maintaining meticulous records and receipts of all expenditures can also help corroborate your assertions and further support your case.

Taking the time to present your financial information clearly and concisely can make the interaction with the IRS more productive and help ensure that you are treated fairly and equitably throughout the process. Remember, the clearer and more organized your financial information, the better the chances of a favorable resolution.

Think about it another way—the RO may have 100 cases in their inventory at any given time. Who do you think the RO will try to help more? The taxpayer who gives them a shoebox full of random information, or the taxpayer who hands them a nice package of neatly organized information where everything is easy to find?

Negotiating with Revenue Officers: Strategies and Tactics

The process of negotiating with Revenue Officers can pose significant challenges and complexities. The major factor in case resolution is taxpayers’ ability to pay. Several payment plans may be available depending on the total amount owed, previous payment plan history, statute of limitations, and other factors.

It can be very challenging to navigate independently, but implementing specific strategies and tactics can help improve the likelihood of a successful outcome. Here are some tips to consider:

- Establish a positive relationship from the outset to set the stage for a more cooperative and constructive negotiation process.

- Build trust—do what you say you will do when you say you will do it.

- Be proactive, prepared, and engaged in discussions to demonstrate your commitment to paying obligations.

- Communicate your position and objectives, and be open to finding common ground.

- Understand your rights and obligations and ensure they are protected throughout the negotiation process.

Most importantly, you must stay current with the IRS on your taxes. This means paying estimated tax payments, or, for some businesses with payroll taxes, making federal tax deposits. Per the IRS’s own rules, the RO will not put you on an installment agreement unless these things are happening. By following these tips, you can navigate the negotiation process more effectively and increase the chances of achieving a favorable outcome.

Knowing when to push back against aggressive tactics, request deadline extensions, or elevate the case to a group manager is also crucial in navigating negotiations. By standing up for yourself and asserting your rights, you can help ensure a more equitable and just resolution.

Establishing a Positive Relationship

Building a good working relationship with Revenue Officers from the start can lead to less hostile negotiations and better resolution outcomes. Cultivating a positive rapport involves open and consistent communication.

A positive relationship with Revenue Officers can:

- Foster a more cooperative atmosphere

- Help ensure that both parties are working together towards a mutually beneficial resolution

- Pave the way for more productive and successful negotiations

By investing time and effort in building a strong rapport, you can achieve these benefits.

When to Push Back

Knowing when to push back against aggressive tactics employed by Revenue Officers is essential for protecting your rights and ensuring a fair negotiation process. Taxpayers and their representatives should resist aggressive tactics when:

- They are not adhering to the law

- They are not providing adequate evidence to back their assertions

- They are not allowing taxpayers enough time to respond.

In such cases, you can:

- Request additional information

- Request a meeting with a supervisor

- Submit a complaint to the IRS

- Request deadline extensions

- File a formal appeal if necessary

Identifying and Handling Fake IRS Revenue Officers

Unfortunately, not everyone claiming to be an IRS Revenue Officer is genuine. Scammers posing as Revenue Officers can cause significant harm to unsuspecting taxpayers. Recognizing the signs of fraudulent Revenue Officers and taking suitable action is key to protecting yourself from being targeted by such scams.

Signs of Fraudulent Revenue Officers

Signs of fraudulent Revenue Officers include threats of arrest and demands for payment via unconventional methods, such as gift cards or wire transfers. These scammers often use fear and intimidation to pressure taxpayers into providing personal information or making payments they do not owe.

Unfortunately, over the years we’ve received several calls from taxpayers who fell victim to this scam. And once they pay, it’s nearly impossible to get back.

By being vigilant and recognizing the signs of fraud, you can protect yourself from falling victim to these scams. Always verify the identity of the person claiming to be a Revenue Officer, and never provide personal or financial information unless you know their legitimacy. Here’s an example of how some tax resolution companies pretend to be IRS revenue officers:

Steps to Take if Harassed by a Fake Revenue Officer

Should you be harassed by a fraudulent Revenue Officer, report the incident to the IRS and local law enforcement authorities, providing them with any supporting evidence or documentation, such as phone numbers, emails, or messages.

In addition to reporting the incident, monitor your financial accounts and credit reports for suspicious activity. If you notice any unauthorized transactions, report them to the relevant bank or credit card company. By taking these steps, you can help safeguard yourself from further harassment and potential financial harm.

Summary

We’ve explored the complex world of Revenue Officers, delving into their roles and responsibilities, powers and limitations, and strategies for dealing with them effectively. By understanding the inner workings of Revenue Officers and their interactions with Revenue Agents, you can confidently approach any tax situation that comes your way.

Remember, knowledge is power. By staying informed, prepared, and engaged, you can take control of your tax issues and navigate the challenges of dealing with Revenue Officers successfully. The journey may be daunting, but with the right tools and strategies, you can successfully overcome any obstacles and achieve a favorable resolution.

Frequently Asked Questions

Need Help Dealing with the IRS?

There are plenty of situations with the IRS that don’t require a tax attorney. But dealing with a revenue officer is not one of them. If an IRS RO has contacted you, reach out to us immediately for a consultation: (201) 381-4472.