Bergen County Tax Attorneys Assisting with IRS Payment Plans and IRS Installment Agreements Throughout New Jersey

An Internal Revenue Service payment plan allows taxpayers to repay their tax debt over time. It’s essentially a loan with a bank, but instead of Bank of America or Chase being the lender, it’s the U.S. government.

To qualify for any IRS payment plan, you must have filed all your tax returns. If you haven’t filed your tax returns, you will not qualify for an IRS payment plan.

Being current on your taxes for the present tax year is another IRS installment agreement requirement. If you’re a W-2 wage earner, you must have sufficient withholding from your paychecks. If you’ve added dependents to your W-4 to reduce the taxes withheld, contact your HR department and submit an updated W-4 that reflects the proper withholding.

If you’re self-employed, you must be making estimated tax payments. Estimated tax payments are due 4 times a year: April 15, June 15, September 15, and January 15 of the following year. You can base the payments either on what you paid in tax last year or on what you think you’ll need to pay this year. The goal is to estimate accurately so at the end of the year, you do not need to pay much, if at all. You also do not want to over withhold. If you do and the IRS owes you a refund, the IRS will take the refund and apply it to the outstanding liability.

There is a fee for obtaining an installment agreement. The fee ranges from $43 to $225 depending on your income and how you elect to make the payments. Finally, while the payment plan is pending, the IRS cannot issue levies, so you can use your bank accounts without fear the funds will be seized.

Once your payment plan is active, the IRS will not pursue collections against you. However, you must make payments on time—missing a payment can put you into default.

There are different IRS installment agreements:

1. IRS Guaranteed Installment Agreement

2. IRS Streamlined Agreement (if you owe $50,000 or less)

3. Test IRS Streamlined Agreement (if you owe between $50,001 and $100,000)

4. In-business Trust Fund Express Installment Agreement (business taxes only)

5. Negotiated IRS Installment Agreements

What You Should Know About the Five Different IRS Payment Plans:

- When to apply for a guaranteed installment agreement

- When to apply for a streamlined agreement

- What is the maximum amount you can owe to be eligible for the IRS’s streamlined installment agreement?

- What is an In-Business Trust Fund Express Installment Agreement?

- What is a Negotiated IRS Installment Agreement?

1. You Can Apply for a Guaranteed Agreement If You Owe $10,000 or Less.

There is only one IRS installment agreement statutorily guaranteed: the IRS guaranteed installment agreement. Under 26 U.S.C. section 6159(c), individuals—not businesses—are legally entitled to installment agreements if certain conditions are met. The conditions are:

1. The total tax owed (not including penalties and interest) cannot exceed $10,000.

2. You must have timely filed and paid all taxes for the past 5 years and has not entered into an installment agreement.

3. If the IRS requires financial statements, they show you cannot pay the balance in full.

4. The installment agreement provides for full payment in 3 years.

5. You must agree to comply with all tax laws during the 3 years.

Even if you do not qualify for a guaranteed installment agreement, you can still apply for a streamlined agreement.

What You Should Know Before Hiring an IRS Installment Agreement Attorney for Guaranteed Installment Agreements

If you qualify for a guaranteed installment agreement, you probably do not need to hire an IRS installment agreement attorney. Obtaining a guaranteed installment usually requires a phone call with the IRS, so it’s something you likely can handle on your own. It’s tough to find a cost-efficient IRS installment agreement lawyer because to qualify for the guaranteed installment agreement, you must owe $10,000 or less.

If you have questions about obtaining a guaranteed installment agreement, give me or another IRS installment agreement attorney a call. It’s better to err on the side of caution, and many tax attorneys (including me) provide free consultations.

2. If You Owe $50,000 or Less, You Can Apply for an IRS Streamlined Agreement.

If you are an individual and owe $50,000 or less, you may be eligible for an IRS streamlined installment agreement. The $50,000 threshold includes tax and assessed penalty and interest. It does not include accrued penalty and interest.

The great part about streamlined installment agreements is you need not provide financial statements, which saves a tremendous amount of time and money. You must pay the balance within the lesser of 72 months or before the collection statute of limitations expires.

If the IRS hasn’t filed a lien yet, they will not do so if you continue to meet the terms of the agreement and agree to make payments using direct debit or payroll deduction. If the IRS has filed a lien, you can get it released by paying the balance down to $25,000 and agreeing to direct debit or a payroll deduction.

What You Should Know Before Hiring an IRS Payment Plan Lawyer in NJ for Streamlined Installment Agreements

In terms of difficulty, IRS streamlined payment plans rarely have as many hurdles as other types of plans. The main difficulty is navigating the IRS bureaucracy to make sure the streamlined installment agreement is completed quickly and correctly. Sometimes, there are technical errors and the streamlined payment plan is not yet up correctly. If there’s miscommunication between you and the IRS, the IRS will sometimes levy your bank account or garnish your wages because they believe you are not complying.

3. The IRS Is Currently Testing Streamlined Installment Agreements If You Owe Between $50,001 and $100,000.

Through September 30, 2017, the IRS is testing streamlined processing for individual taxpayers who owe between $50,001 and $100,000. The payment term is 84 months, unlike the 72 months for traditional streamlined installment agreements. You can avoid providing financial information if you agree to direct debit payments or a payroll deduction.

If you make a lot of amount of money, you can avoid making larger payments to the IRS by trying to qualify for this type of IRS payment plan. There is no guarantee you can avoid a lien, however. The IRS will determine whether to file one on a case by case basis.

What You Should Know Before Hiring a Bergen County IRS Installment Agreement Attorney for a Test IRS Streamlined Installment Agreement

This is an IRS pilot program. Not all IRS employees are up to speed on the process, so it’s important the IRS installment agreement law firm is familiar enough with the program to gently inform IRS employees of the intricacies. These plans are only slightly more difficult than traditional streamlined agreements.

4. If Your Business Owes $25,000 or Less in Business Taxes, You Can Apply for an In-business Trust Fund Express Installment Agreement.

If your business owes $25,000 or less in business taxes, you can qualify for an in-business trust fund express installment agreement. If you owe more than $25,000 in business taxes, you can make a lump sum payment prior to get the balance to $25,000.

The payment term is 24 months for in-business trust fund express installment agreements. If you qualify, you do not need to provide financial statements. The IRS does not have to file a lien, although they may still do so. Finally, if you qualify, you may avoid the Trust Fund Recovery Penalty under an in-business trust fund express installment agreement.

What You Should Know Before Hiring an IRS Payment Plan Attorney for IRS In-business Trust Fund Express Installment Agreements

Even though there may not be substantial money at stake, IRS In-business Trust Fund Express Installment Agreements are more serious than other types of IRS payment plans. Often, there is a revenue officer assigned to the case. Revenue officers are specially trained tax collectors. They are generally assigned to cases if you owe more than $250,000, but they are also assigned in cases involving payroll taxes. The IRS has various initiatives involving business taxes and is sterner in their collection than income taxes. The IRS is more likely to issue levies when payroll taxes are at stake. If you’re a repeat offender, the IRS may try to take injunctive action.

5. If You Owe More Than $100,000 or Cannot Pay Within the Required Time Frame, You’ll Need a Negotiated IRS Payment Plan.

There are two scenarios where you’ll need a negotiated IRS installment agreement: (1) if you owe more than $100,000 or (2) you owe less than $100,000 but cannot pay the balance within the required period. You can also modify an existing installment agreement with this plan. Since you do not qualify for a streamlined agreement, you must provide financial information to the IRS. They will require a 433-f, 433-a, or a 433-b. These forms ask about your assets, debts, and income and expense information.

Besides filling out the form, you may also need to provide substantiating documentation. This includes copies of paychecks, proof of housing expenses, and bank statements. The substantiating documentation is used to prove the information provided on the financial statement.

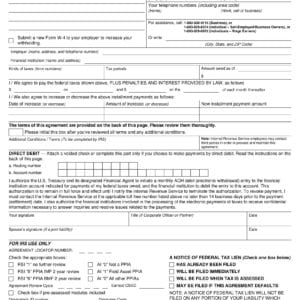

If you do not have enough equity in assets to cover the liability, your payment will be based on the difference between income and reasonable living expenses. There are national and local standards for items like housing and utilities, food, vehicle payments, and vehicle operating expenses. If what you pay for an item exceeds the national or local standard, the IRS will usually limit the expense to the standard. The goal should be to make the minimum monthly payments — you can always pay more if you want to pay down the debt faster. The IRS will likely file a federal tax lien if you opt for this plan, but your monthly payment is usually lower than on another type of agreement. You’ll also need to complete an IRS Form 433d to formalize the agreement.

What You Should Know Before Hiring an IRS Installment Agreement Attorney for Negotiated IRS Payment Plans

Tax professionals add the most value to negotiated agreements. While the IRS forms seem straightforward, there are a lot of nuances to completed them accurately while obtaining an installment agreement you are comfortable with.

IRS Payment Plans: What Paladini Law Can Do For You

There’s often a lot of stress and anxiety when you owe money to the IRS. It’s my goal to lift that stress and burden by handling 100% of the communications between you and the IRS. Rather than having a matter drag on, my goal is to obtain the IRS installment agreement quickly. The cogs at the IRS move slow, but I utilize all avenues to provide a quick resolution.

IRS Payment Plan Success Stories

In my career, I’ve negotiated countless IRS payment plans. Here’s my favorite:

A client had been negotiating his own IRS installment agreement with a revenue officer. The client owed several hundred thousand dollars.

Negotiations broke down after the revenue officer requested almost $17,000 a month for the installment agreement. After I took over the matter, I negotiated an agreement for $2,500 a month, saving the clients over $14,000 a month.

Call Today to Discuss an IRS Payment Plan with a Jersey City Tax Lawyer

If you’d like to set up a payment plan with the IRS, give me a call or fill out a contact form.