Received an IRS Notice CP503? This IRS letter is a second reminder that you have an unpaid tax balance, and the IRS still hasn’t heard from you. In plain terms, CP503 means you owe money to the IRS, and you didn’t fully pay or respond to earlier notices. It’s not an audit or fraud notice—it’s about collecting taxes you already owe. Understanding what CP503 is, why you got it, and how to respond is crucial to avoid escalated collection actions like liens or levies. This article will walk you through everything you need to know about IRS Notice CP503 (aka “IRS CP503 second notice” or “CP503 IRS collection letter”)—including official IRS references, real-life examples, a timeline of the IRS collection process, state-specific considerations, and answers to frequently asked questions. By the end, you’ll know exactly how to handle a CP503 notice and what steps to take before the IRS takes more serious action.

What Is IRS Notice CP503?

IRS Notice CP503 is a letter the IRS sends as a second reminder of a tax balance due. In the IRS collection sequence, CP503 indicates that you still owe money on a tax account, and the IRS has not received your payment or response to a previous notice. Essentially, it’s a follow-up to the initial bill and the first reminder that your tax debt remains unpaid.

According to the IRS, “This notice is your second reminder that you still owe a balance on one of your tax accounts.” You likely received an earlier notice (such as CP14 or CP501) about the same tax debt. If you didn’t pay or arrange payment after those, the IRS issues CP503 to get your attention. The CP503 notice shows how much you owe, including tax, penalties, and interest, the due date for payment, and how to pay. It may also include a payment stub and instructions for payment methods.

Important: Receiving CP503 does not mean you’re being audited or accused of wrongdoing. It’s purely a collection notice. Unlike an audit letter (which would ask for more information or verification of your tax return), CP503 is about a balance due that the IRS is trying to collect. It’s a common misconception that any IRS letter means an audit—CP503 simply means you have an outstanding tax bill, not that the IRS is examining your return. The IRS is essentially saying, “We reminded you once, and we still haven’t gotten payment—please address this now.”

Why Did I Receive a CP503 Notice?

You received IRS Notice CP503 because you have an unpaid tax debt and failed to respond to earlier notices about that debt. Typically, the sequence is as follows: after you file a tax return and owe money, the IRS sends a CP14 Notice (the initial Notice and Demand for payment). If you don’t pay, they might send a CP501 (a first reminder notice). If there’s still no payment or response, the IRS issues CP503—the second reminder that the balance is still due.

In short, CP503 means the IRS has tried to contact you at least once before about this tax bill, and you haven’t paid the full amount or set up a plan. The IRS is getting more urgent with this second notice. In fact, the CP503 usually includes a warning along the lines of: “If you don’t act now, the IRS may consider levying (seizing) your income or bank account.” This indicates the IRS is serious about collecting the debt.

A few key points about who gets CP503:

- Not everyone will get a CP503. The IRS is not required by law to send this second reminder before moving on to more serious notices. In many cases, they do send it as part of their standard process, but if you have a history of not paying or multiple years of debt, the IRS might skip directly to the next enforcement notice.

- Timing: The CP503 typically arrives several weeks (historically about 5–8 weeks) after the first reminder (CP501) if the debt is still unpaid. For example, if you got a CP14 in June and a CP501 in late summer, a CP503 might come in the fall if no action was taken. The IRS recently adjusted its timeline to give taxpayers more breathing room—now about eight weeks between the CP501 and CP503 notices.

- Amount due updates: By the time of CP503, your balance might have grown due to ongoing penalties and interest. The notice will show the updated amount. The IRS is required by law to charge applicable penalties (e.g. failure-to-pay penalty of 0.5% per month) and interest on overdue taxes. So if you notice your balance is higher than before, that’s why.

Bottom line: If you received CP503, it’s because the IRS still believes you owe them money and they haven’t heard from you. It’s a red flag that you’re midway through the IRS’s collection process. Don’t panic, but don’t ignore it either—this notice is a sign that you need to take action before things escalate.

IRS Collection Process Timeline (Where Does CP503 Fit In?)

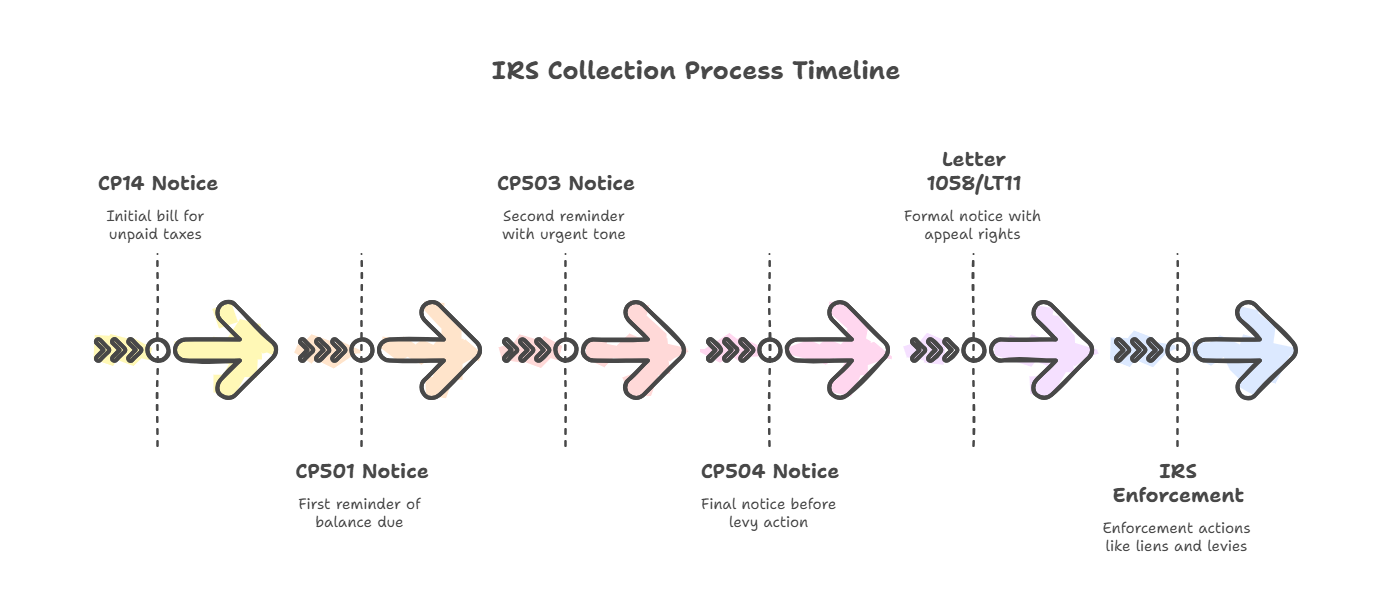

Appreciating the urgency of a CP503 helps to understand the IRS collection process timeline. The IRS doesn’t jump straight to levying your assets; it sends a series of notices first. Here’s a simplified timeline of the IRS collection notice stream and where CP503 falls in that sequence:

- CP14 – Notice and Demand for Payment (Initial Bill): This is the first notice you get if you owe taxes after filing your return. As required by law, it typically arrives within 60 days of the IRS assessing the tax. The CP14 shows the amount of tax, penalties, and interest due and requests payment in full by a certain date.

- CP501 – First Reminder Notice (Balance Due): If you don’t pay or resolve the CP14, the IRS often sends a CP501 about 5–8 weeks later. This is a friendly reminder that you still have a balance due. It reiterates the amount owed and suggests payment options.

- CP503 – Second Reminder Notice (Balance Due, Urgent): Roughly another 5–8 weeks after the CP501 (depending on IRS timing) comes CP503, the second reminder that your tax debt is unpaid. This notice is more urgent in tone. It typically warns that if you don’t act, the IRS “may levy (seize) your income or bank account.” The CP503 gives you 21 days from the notice date (in many cases) to pay the balance or respond before the IRS considers further action. (Like the CP501, this notice is optional for the IRS, but if you’ve received it, it means they’re still trying to prompt you to voluntarily pay before enforcement.)

- CP504 – Final Notice (Notice of Intent to Levy): If no payment or arrangement is made after CP503, the IRS will issue a CP504, usually about 8 weeks later. CP504 is a critical letter—it’s labeled “Notice of Intent to Levy” and is the final reminder before the IRS can start taking your assets. This notice (sent by certified mail) cites Internal Revenue Code § 6331(d), meaning the IRS is giving you the required 30-day notice that it intends to levy. The CP504 specifically warns that the IRS can levy (seize) your state tax refund and will “begin searching for other assets” to levy if you don’t pay immediately. It also mentions that the IRS may file a federal tax lien if not already done. At this point, the IRS has the authority to levy certain assets, like state refunds, once the notice is issued.

- Letter 1058 / LT11 – Final Notice of Intent to Levy (with Appeal Rights): In many cases, after the CP504, the case may be handed off to an IRS Collections department or a local Revenue Officer. You might receive a Letter 1058 or LT11, which is a Formal Final Notice of Intent to Levy AND Notice of Your Right to a Hearing. This letter (also sent certified) fulfills the IRS’s obligation under IRC § 6330(a) to give you a chance to appeal before they levy most assets. You have 30 days from an LT11/Letter 1058 to request a Collection Due Process (CDP) hearing with the IRS Independent Office of Appeals. If you don’t, the IRS can proceed with levying your wages, bank accounts, and other property after 30 days. This is essentially your last chance to formally dispute or delay collection via appeals.

- IRS Enforcement (Liens, Levies, etc.): After all required notices are sent (or if you don’t timely respond to them), the IRS can take enforcement actions. This may include filing a Notice of Federal Tax Lien in the public records, and/or issuing levies on your bank accounts, wages, or other assets. In fact, by the time of or shortly after CP503, the IRS is legally allowed to file a federal tax lien on your property (the lien arises by law when you neglect to pay after the first notice). A lien is a claim against all your property and can impact your credit and ability to sell assets. Levies are actual seizures of assets—for example, the IRS can garnish your paycheck or take funds from your bank. The CP504 and subsequent final notices set the stage for these actions if you don’t resolve the debt. (As an extreme consequence, if your tax debt is over a certain threshold (currently around $59,000, indexed annually), the IRS can also certify it for the State Department to restrict your passport under the FAST Act – CP504 notices often include a paragraph about this.

Key takeaway: The CP503 is roughly mid-way through this timeline. It’s the “last polite reminder” before the very serious CP504 notice. By the time you get CP503, you’re only one step away from the IRS moving from letters to leverage (i.e. actually claiming your assets). That’s why it’s so important to take CP503 seriously and act promptly. The earlier in the process you engage with the IRS, the easier it usually is to resolve.

What Should You Do After Receiving CP503?

First, don’t ignore the CP503. You generally have about 3 weeks (21 days) from the date on the notice to respond or pay before the IRS may proceed to the next step. Here are the steps you should take upon receiving a CP503 notice:

- Read the notice carefully. Review the amount the IRS says you owe and the due date for payment. The notice will outline your payment options and provide a payment coupon. Double-check that the tax year and amount due match your records. Sometimes a CP503 can cover multiple tax years (each with its own section in the notice). Make sure you understand which debt it’s referring to.

- Verify or clarify the debt (if needed). If you believe you don’t owe the amount or you already paid it, you should contact the IRS right away. The CP503 will have a toll-free number. Call that number if you disagree with the notice or need to clarify anything. It’s possible a payment crossed in the mail or there’s an error. Have your documentation (receipts, prior notice, etc.) handy when you call. The IRS can investigate and correct mistakes if, for example, you did pay and they didn’t credit it properly.

- Pay what you can, or set up a plan. Ideally, if you agree you owe the money, paying the balance in full by the due date is the simplest solution (this will stop the collection process). You can pay electronically on the IRS website or by mail as instructed on the notice. If you cannot pay in full, don’t panic – the IRS offers payment plans (Installment Agreements) and other arrangements. . Even by the time of CP503, you are still eligible to set up an installment agreement in most cases. Paying something now, even a partial amount, can reduce penalties and shows good faith. In addition, you might explore options like an Offer in Compromise (settling the debt for less) or Currently Not Collectible status (if you’re in financial hardship), though those require more paperwork and usually the help of a tax professional. The key is to respond—either by paying or by arranging an alternative – rather than ignoring the notice.

- Keep records and all IRS notices. File your CP503 notice (and any earlier notices) in a safe place. If you call the IRS or correspond, keep notes of who you spoke with, when, and what was said. If you set up a payment plan or take any action, save confirmation of that. Having a paper trail is useful, especially if there’s any confusion later or if you seek help from a tax professional.

- Prepare for the next notice if no resolution. If, for some reason, you cannot resolve the CP503 by the deadline (and you haven’t made arrangements or payments), be aware that a CP504 will likely follow. Anticipate it and know that CP504 will be more severe (intent to levy). It might arrive by certified mail. Avoiding surprises is helpful so use the time after CP503 to either fix the issue or, at minimum, get ready for the next step by understanding your rights. For example, if you know you can’t pay and CP504 comes, you’ll have 30 days to request a Collections Due Process hearing—you might start researching tax attorneys.

In summary, responding to CP503 means taking some action: pay in full if you can; if not, communicate with the IRS and set up a plan or resolution. Do not ignore CP503. Ignoring it will trigger automated next steps (a lien filing or CP504 notice) which only make the situation more serious. The IRS actually wants you to reach out—the CP503 even provides contact info and suggests solutions. By being proactive, you can often stop the escalation and avoid levies or liens altogether.

Real-Life Examples of Handling a CP503

To illustrate how CP503 situations can play out, let’s look at a couple of hypothetical examples. These examples show different responses and outcomes for taxpayers receiving a CP503 notice:

Example 1: Prompt Action Avoids Further Trouble

John owes about $45,000 in taxes for last year. He received a CP14 and a CP501 but overlooked them due to moving houses. Now he gets CP503. John is startled by the mention of possible levies. He immediately checks and realizes he did forget to pay. John decides to take action. He can’t pay the full $45,000 at once, but he goes online to the IRS payment portal and pays $1,000 right away. Next, he applies for an installment agreement for the remaining balance of $44,000, spreading it over 12 months. He calls the IRS at the number on CP503 to confirm they received his installment plan request. The IRS representative sees John made a good faith payment and set up a plan. Outcome: John’s timely response stops the IRS from issuing the next notice. He receives confirmation of his installment agreement by mail. No tax lien is filed since he addressed the debt. By acting during the CP503 stage, John resolves the issue with minimal additional penalties and avoids any levies on his bank account.

Example 2: Ignoring Notices Leads to Escalation

Sarah owes $120,000 from a couple of years of taxes. She received a CP501 and then a CP503, but she’s been overwhelmed and in denial about her debt. She stuffs the CP503 in a drawer and does nothing. After the 21-day response period passes with no payment or contact, the IRS moves forward. About two months later, Sarah receives a CP504 (Intent to Levy) by certified mail. It now warns that the IRS can levy her wages and bank account and also mentions the debt has been classified as “seriously delinquent,” potentially affecting her passport. Still, Sarah doesn’t respond—she doesn’t open her certified mail out of fear. The IRS files a Notice of Federal Tax Lien in the county records against her, and later, the IRS issues a levy on her bank account. One day, Sarah finds out her checking account is frozen and $20,000 was taken by the IRS. Outcome: By ignoring the CP503 (and CP504), Sarah allowed the situation to reach the enforcement stage. Now she has a public lien and lost funds to a levy. She will likely need professional help to get on a payment plan and remove the lien later. This all could have been avoided (or handled in a more controlled way) if she had reached out to the IRS or a tax professional back when CP503 arrived.

These scenarios show that how you respond to a CP503 can significantly change the outcome. Promptly paying or arranging a plan can keep you out of collection trouble. Ignoring the notice can lead to liens, levies, and more stress. And if you think the IRS is wrong, engaging with them early can clear up the issue before it snowballs. While every taxpayer’s situation is unique, the overarching lesson is: take CP503 seriously and act sooner rather than later.

Frequently Asked Questions (FAQs) About CP503

Don’t Wait – Tackle Your Tax Notice Now

IRS Notice CP503 is a warning that demands your immediate attention. It’s easy to procrastinate or feel overwhelmed, but acting now can save you from much more serious trouble down the line. Every day you wait, interest and penalties are adding up, and the IRS is moving closer to enforcing collection. Time is truly of the essence.

If you’ve received IRS Notice CP503 in the mail and you’re panicking, we’re here to help. The sooner you take action, the more options you have. Call Paladini Law at 201-381-4472 or contact us online to set up a consultation immediately.