Filling out IRS Form 433-A can be intimidating, but it’s possible to confidently approach tax liabilities and relief options with the correct information. This comprehensive guide will help you understand this critical form and its purpose in determining program eligibility. We’ll also outline how mastering these nuances gives individuals control over their financial future when facing complex issues concerning taxes and debt repayment plans.

So strap yourself into a deep dive exploring what makes up Form 433-A!

If you prefer watching to reading, here’s the video version:

Table of Contents

Understanding IRS Form 433-A

Form 433-A, or the Collection Information Statement for Wage Earners and Self-Employed Individuals, is used by the Internal Revenue Service (“IRS”) to evaluate a taxpayer’s financial standing. This document helps assess taxpayers’ ability to pay their tax liabilities and can help them qualify for various tax relief programs. Form 433-A provides the IRS detailed insight into an individual’s financial status, including wages earned and self-employment income—thus assisting in deciding how the taxpayer should repay the debt.

Purpose and Function of Form 433-A

Form 433-A is a necessary part of the IRS’s process in determining your Reasonable Collection Potential (“RCP”). The form offers insight into your assets and liabilities and income versus expenses, giving the IRS a comprehensive view that will dictate how much they ask you to pay back and how quickly.

Who Needs to Complete Form 433-A?

Form 433-A is designed to be filled out by wage earners and self-employed individuals looking to repay their tax debt over time. Based on the information provided in the form and supporting documentation, the IRS will determine how much you can afford to pay per month. Depending on what type of tax debt you owe and how your business is structured, you may also need to complete a Form 433-B. Moreover, if you want to settle your tax debt via an offer in compromise, you’d need to complete Form 433-A (OIC).

Key Sections of IRS Form 433-A

When filling out Form 433-A, it is essential to understand the importance of its sections. Each section needs to be completed fully. Every component matters in completing this form accurately so that the IRS can evaluate your reasonable collection potential thoroughly.

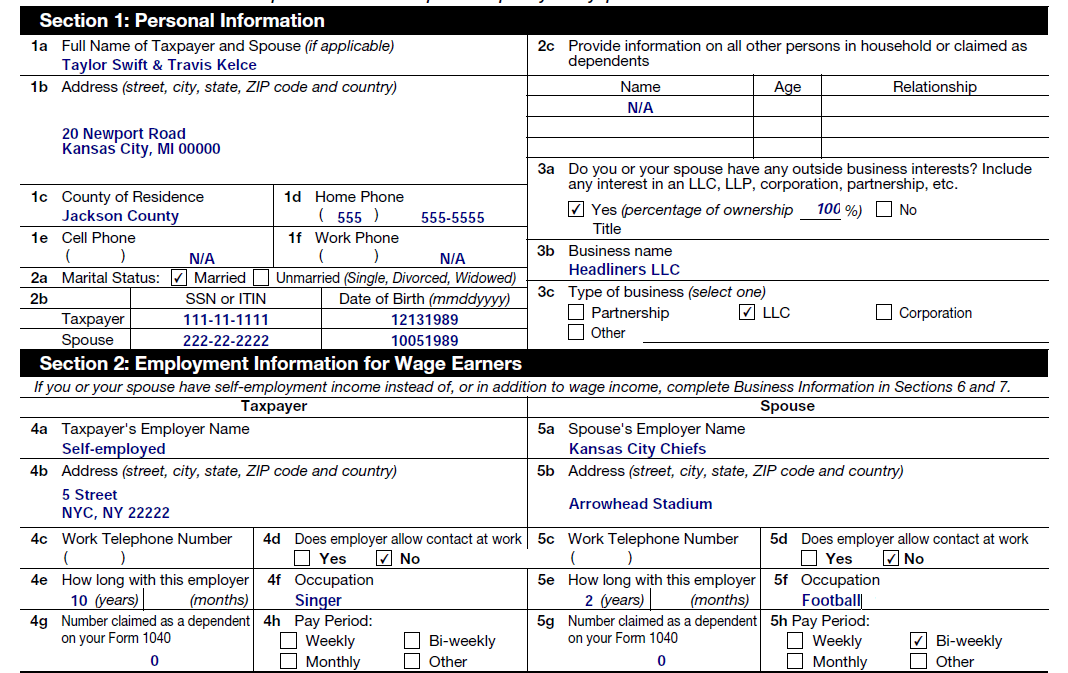

Personal and Employment Information & Employment Information for Wage Earners (Sections 1 & 2)

Form 433-A requires individuals to provide specific information regarding their personal and employment details in sections 1 and 2. This includes name, address, and social security number. It also asks about any business you or your spouse own.

As with the entire Form 433, make sure to fill it out completely. If a section does not apply to you, such as having no dependents, write N/A. If you leave it blank, the IRS doesn’t know whether you forgot to complete the section or if it doesn’t apply. We want to make their jobs as easy as possible (which helps us get the results we want)!

Wage earners must provide details about their employer and occupation, including their name, address, and contact information. If you’re married, include your spouse’s employment details. Remember to note any bonuses or commissions which can affect your perceived income. You may need to prorate these over the year and attach an explanation for the IRS.

Other Financial Information (Section 3)

Section 3 covers other financial information and is essentially a catch-all section. The IRS wants to know if you are a party to a lawsuit because if you were injured in an accident and are expecting a large settlement, the IRS will factor that into the equation.

It also asks about trusts and life insurance policies to see if you might be coming into money in the future. Similarly, the IRS wants to know if you’re hiding money in a safe deposit box.

Last but certainly not least, the IRS wants to know if you’ve transferred any assets for less than fair market value to see if you perhaps tried to conceal assets from them. And on that note, we want to remind you that this document is signed under penalty of perjury, and there are severe consequences for lying about it.

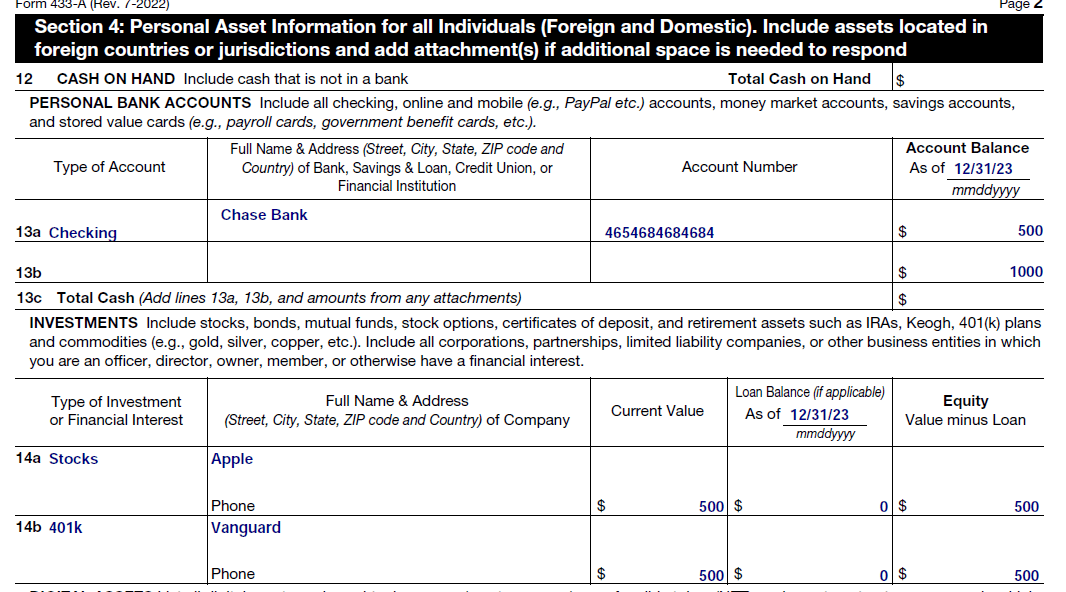

Personal Asset Information (Section 4)

Now, we start to get into the good stuff. Section 4 is asking about all of your personal assets. Personal assets include personal bank accounts and investment assets such as stocks, bonds, money market accounts, retirement accounts, mutual funds, etc. In the personal assets section, you don’t include business assets like business bank accounts.

Here’s one of the many ways people go wrong when they complete this form—they guestimate. For example:

How do we know this is a guestimate? Because of the round numbers. It’d be quite a coincidence if every bank account and all personal assets were rounded numbers. You want to be as accurate as possible with this form—that means downloading your most recent bank for all your bank accounts, money market accounts, retirement account, etc., and putting the exact number down.

Don’t be afraid to put the account numbers down. Some people think if they don’t put this information in, the IRS won’t be able to levy the bank account—not true. The IRS has a system to look up all account numbers under your SSN.

New in the last few years is the digital assets section—yes, the IRS wants to know about that bitcoin you have stashed away.

The IRS also wants to know whether you have a life insurance policy. For this particular section, the IRS only wants to know about a life insurance policy with a cash value—it’s not worried about term life insurance policies here.

The real estate section can be a bit tricky to complete. Unless you have a recent appraisal, you must make the best guess about the fair market value. Some taxpayers are tempted to inflate their home’s value— this is terrible. If the IRS sees that you have a lot of equity in your real estate, it may require you to (1) refinance, (2) sell, or (3) in certain circumstances, the IRS may try to foreclose on the property. The IRS will do similar research, so don’t try to list your $1 million home as worth $100,000. And don’t forget to include an accurate loan balance. This means the loan balance from the first mortgage and any additional mortgages or loans you took against the property.

The same applies to the vehicle section. You probably don’t know how much your car is worth, but you can use Kelly Blue Book or something similar to get an idea. The monthly payment will be used later, so don’t forget to include that.

Don’t sweat the personal asset information section too much. They’re not looking for every piece of costume jewelry you own. But they do want to know about that Van Gogh collection…

Monthly Income and Expenses (Section 5): This Will Make or Break You

The monthly income and expenses section is the most crucial section on the collection information statement. It’s also the most difficult to complete, with many traps for the unfamiliar. Knowing how to fill out this section is vital to getting the best possible result to resolve your outstanding tax liability.

You have all your income sources on the left side of the section. On the right side, you have all your living expenses. Let’s dive in.

Monthly Income

Calculating wages can be a bit trickier than you’d think. This section is completed on a monthly basis, but very few people are paid monthly. So you first need to determine how often you’re paid and then do a calculation to see how much that is per month:

| Pay Frequency | Multiply By | Example |

| If paid weekly | multiply weekly gross wages by 4.3 | $425.89 x 4.3 = $1,831.33 |

| If paid biweekly (every 2 weeks) | multiply biweekly gross wages by 2.17 | $972.45 x 2.17 = $2,110.22 |

| If paid semimonthly (twice monthly) | multiply semimonthly gross wages by 2 | $856.23 x 2 = $1,712.46 |

Now, you must do the same exercise for withholding and other deductions from your wages. This will be used on the column to the right.

It can also get tricky if you receive bonuses or commissions. For instance, you get paid a commission in January every year, and you’re using your January pay stubs to determine wages. Your wages will show much higher than they are because of the bonus. So you may need to pro-rate the bonus for the year. Similarly, you may need to average several months or even a year of income to determine your wages if you receive sporadic commissions. Make a note in an attachment so the IRS can follow along.

You must figure out your average monthly net income if you’re self-employed. Having an up-to-date profit and loss statement is vital. The net business income doesn’t include all business expenses, like depreciation. You can use a 3, 6, 9, or 12-month period to determine typical business income and expenses.

Net rental income also needs to be included. You don’t get to include depreciation, which can make a massive difference if you’re relying on last year’s Schedule E. If your rental property loses money every month, you can’t put the loss. You can only put $0.

There are additional empty boxes on lines 32 and 33 for other income. The IRS is trying to determine the monthly household income, so everything must be included. Total monthly household income includes income from non-liable spouses. But it doesn’t include things like gifts.

Monthly Expenses

You’ll see boxes for your monthly living expenses on the right side. And this is the number one area where people run into trouble.

The Allowable Living Expense (“ALE”) standards, or the Collection Financial Standards, are designed to account for basic living expenses. These standards determine reasonable living expenses based on geographic location, age, and the number of people in the household. These are the maximum allowable expenses.

For instance, you live in Bergen County, NJ, with four people in the home. The maximum allowable expense is $4,393 (at least when this article was published—it changes frequently). This has two implications: First, if all your housing and utility bills total $3,000 (which might be literally impossible for a family of four in Bergen County), your maximum expense is $3,000. This means you have room, and you want to make sure you’re including all housing and utility expenses like:

- rent or mortgage

- property taxes

- insurance (renter’s or homeowner’s)

- maintenance and repair

- homeowner dues

- condo fees

- oil, gas, electricity, cell phone, internet, cable, water, trash, etc.

Some expenses might be paid quarterly or annually, so you’ll need to do the math and calculate the average monthly cost.

The second, larger, and more common implication is that your housing and utility expenses are over $4,393. The average home price in Bergen County is $650,000, meaning your mortgage, insurance, and taxes would cost $5,200.

So what is one to do? List the actual expense, even if it’s higher than the standard. But know that the IRS will try to cap the cost at the standard. Deviations are allowed but rare, so don’t rely on them. There are also different payment plans where you could essentially get credit for the actual expense. But it’s very tricky. At the risk of sounding salesy, this is where having a seasoned tax attorney is critical.

Not all expenses are capped by standards. For instance, health insurance and out-of-pocket health care costs are generally allowed, so long as you have proof they are being paid.

What Does It Mean to Be Self-Employed on IRS Form 433-A?

When completing IRS Form 433-A, being self-employed means you operate a business as an independent contractor or sole proprietor. In this role, you run your own trade or service, bearing full responsibility for its profits and losses.

Unlike partnerships, multi-member LLCs, or corporations—which would typically use Form 433-B—you alone manage the financial and operational aspects of the business. As the sole owner, you report all income and expenses, ensuring your business complies with tax regulations on this specific form.

Form 433-A and Tax Relief Options

When seeking various types of tax relief, such as payment plans, offers in compromise, and postponements due to financial hardship, Form 433-A is an important tool. By supplying the IRS with comprehensive information about your finances through this form, you can open up several options that could drastically reduce how much you owe.

Partial Payment Installment Agreements (PPIA)

Form 433-A can help you determine whether a Partial Payment Installment Agreement is an option for your tax debt. By considering income, assets, and expenses, the IRS can assess if reduced monthly payments are feasible without causing additional financial hardship. Providing accurate information on Form 433-A increases the likelihood of approval as it allows them to understand one’s ability better and offer relief in times of need.

Offers in Compromise (OIC)

To be eligible for an Offer in Compromise (OIC), you must show that your current financial situation will not allow you to pay the total tax debt due. Filling out Form 433-A (technically, it’s a Form 433-A (OIC)) and providing accurate information about your finances can help verify whether this type of relief suits you. All required returns and any estimated payments made when applicable to qualify must have been filed prior. This approach may enable taxpayers with overwhelming obligations to ease their burden by settling the matter for less than what was initially owed.

Temporary Delays and Hardship Cases

The IRS may offer individuals experiencing financial hardship the opportunity to postpone payments temporarily. This relief is typically evaluated on a case-by-case basis and is temporary. Generally, the IRS would want new financial information every two years to determine if your ability to pay has changed.

What Documentation Needs to Be Attached to IRS Form 433-A?

When preparing IRS Form 433-A, it’s essential to include specific documents to support the information provided. Here’s a checklist of what you’ll need (most of the time):

- Recent Pay Stub

- Include a copy of your most current salary statement to verify your earned income.

- Investment and Retirement Accounts

- Attach recent statements from any investment or retirement funds to detail your financial holdings.

- Income Sources

- Provide documentation from the latest period for all other income streams, such as business profits or side jobs.

- Bank Statements

- Submit statements covering the last three months from your bank accounts to showcase your cash flow.

- Lender Statements

- Each creditor should supply their latest statements, which should include information on payments, total balances owed, and any repayment terms.

- State and Local Tax Liabilities

- If applicable, offer verification of any unpaid local or state tax obligations.

By carefully organizing these documents, you’ll ensure your Form 433-A is complete and offers a clear financial picture.

Differences Between Form 433-A, 433-A (OIC), and 433-F

When applying for different types of tax relief, taxpayers must understand the various forms they must fill out. Namely Form 433-A, 433-A (OIC), and 433-F. These collection information statements differ in detail, but each has its purpose and requires thorough completion by those submitting them so the IRS can correctly assess their financial situation. Knowing which form you need is critical as this will help ensure you provide all relevant details when seeking tax relief.

Form 433-A vs. 433-A (OIC)

Form 433-A (OIC) is an advanced version of Form 433-A, explicitly created for offers in compromise. Both forms provide the IRS with comprehensive details about taxpayers’ financial states. Form 433-A (OIC) has been uniquely crafted to decide whether they are qualified for this option.

When applying for OICs, you must use Form 433 A (OIC), giving the IRS more thorough data regarding your finances to decide whether you are eligible for such an offer.

Form 433-A vs. 433-F

Form 433-F is a shortened form of the more complex Form 433-A, usually used when an amount owed on taxes meets specific criteria. This simplified version for wage earners requires less detailed information than its counterpart. By submitting either type of form (either F or A), taxpayers provide essential data needed by the IRS to evaluate financial conditions and determine eligibility qualifications for repayment programs.

Mailing Addresses and Submission Requirements

The precise mailing address for Form 433-A will vary depending on your geographic region and the reason for filing. To determine where to send it, check the instructions that come with it. Our Firm never mails these out—instead, we fax the information directly to the agent assigned to the case. This helps get a faster resolution—and the IRS loses a lot of mail.

Seeking Professional Help with Form 433-A

Filing Form 433-A can be daunting, and engaging the services of a tax attorney will give you peace of mind and ensure your adherence to regulations. We have all the necessary knowledge of complicated taxation laws and available relief options. Working with an experienced tax attorney brings numerous benefits, like guidance in financial matters, access to better outcomes for unique circumstances, and greater confidence when dealing with these situations.

Finding the Right Tax Professional

Good news—you found us already! But seriously, when seeking a tax professional to meet your needs, you must consider their level of expertise, specialization, and past experiences in dealing with scenarios akin to yours. It’s recommended that you look into credentials and reviews and have an introductory discussion to appraise their understanding or ability to aid with taxation matters.

Summary

Ultimately, IRS Form 433-A is essential for evaluating whether you can receive tax relief programs. By familiarizing yourself with its intent and components and understanding how it’s used to judge your financial standing, you can make informed decisions on the best path to move forward. Seeking advice from a tax attorney will provide more accurate answers, resulting in the best possible outcomes concerning this form and your taxes overall. With their expertise and support, tackling financial obstacles becomes much more straightforward.

Frequently Asked Questions

Need Help with Your Form 433-A

If you owe back taxes and need help determining which resolution is best, contact us at +1 (201) 381-4472