Are you looking for a way to deal with your tax debt? The 433-F form is an essential resource, as it serves as a collection information statement that can help the IRS decide if you are eligible for payment plans or other resolutions. Don’t be overwhelmed by this document – learning how to use and complete it accurately will enable you to take control of your financial situation and solve the problem.

In this guide, we’ll explain in-depth what is required to fill out the 433F form. There’s info about permissible expenses under IRS Financial Standards, which should also be considered when completing the form. Last, we’ll discuss potential outcomes after submitting this to the IRS.

Key Takeaways

- Form 433-F is an IRS form used to assess your financial situation and determine the best strategy for settling tax debt.

- It requires personal information, bank account records, real estate & other assets details, employment & income info, as well as expenses.

- Taxpayers should seek professional help from a tax attorney if uncertain about how to proceed with their taxes.

Table of Contents

Understanding IRS Form 433-F

Form 433-F, a Collection Information Statement from the IRS, is instrumental in helping assess financial information to decide if someone qualifies for payment plans and other resolutions such as uncollectible status. Submitting this form accurately can assist you with getting desirable terms on your payment plan. You may find it helpful to consult a tax professional (like us) when completing it.

Definition of Form 433-F

Form 433-F is a simpler version of Form 433-A, designed to provide the IRS with an understanding of your financial circumstances to assess the best strategy for resolving any tax debt. This form tends to be less complex than its counterparts.

Differences Between Forms 433-A, B, and F

Form 433-F is the more common form for taxpayers with a balance owed since it covers most circumstances that require financial data to resolve tax obligations and is much easier to fill out than Forms 433-A or B. This simplified version is not as in-depth as the other forms. You can think of it as a “streamlined version” of the Form 433-A.

Who Should File Form 433-F?

Taxpayers facing financial hardship for overdue taxes should fill out Form 433-F to apply for uncollectible status (aka hardship status) or a payment plan. Generally, this form is suitable for taxpayers whose cases are being handled by the Automated Collection System (“ACS”), which is essentially a call center for IRS agents to try and collect past-due tax debt. If your case is being handled by a Revenue Officer—a professional debt collector for the IRS—you’ll need to provide Form 433-A, Form 433-B, or both. You won’t need to complete this form if you owe less than $50,000 and qualify for a streamlined installment agreement.

Completing Form 433-F: Step-by-Step Guide

Completing Form 433-F requires furnishing your personal details, income information, assets and liabilities, as well as monthly living expenses and data about dependents. Being precise with the paperwork can ensure a smooth procedure when submitting to the IRS.

This article will assist you in successfully completing each section of Form 433 F by highlighting what is necessary, along with tips on how to fill out each area correctly.

Personal Information and Bank Accounts

Form 433-F must be filled out with your name, address, contact details, and Social Security Number. If you or your spouse have self-employment income, you also need to include the name of the business, employer identification number, and number of employees. If a box doesn’t apply to you, write “N/A.” If you leave it blank, the agent reviewing won’t know if you forgot to fill it in or if it doesn’t apply. We want to make their jobs as easy as possible—which gets you the best results possible.

Accounts/Lines of Credit (Section A)

Section A of Form 433 f wants all of your personal bank account information. This includes checking and savings accounts, money market accounts, PayPal, and Venmo accounts. You should include both personal bank accounts and business bank accounts as well.

You also need to list your current investments and retirement accounts, like IRAs, 401(k)s, stocks, bonds, mutual funds, and any other investments you have. Taxpayers are sometimes tempted to leave the account number blank, believing that providing it will lead to a bank levy. The IRS can very easily find bank accounts, so there’s no need to try to play hide the ball.

It’s also important to accurately provide the current value or balance in the account. Some taxpayers want to guestimate, but this form needs to be completed as accurately as possible. And don’t forget to list any cryptocurrency you have.

Real Estate (Section B) and Other Assets (Section C)

IRS Form 433-F requires comprehensive details regarding real estate and other assets, such as cars, recreational vehicles, and life insurance policies. This includes the date of purchase, what was paid initially (purchase price), and current value. You also need to include the balance owed on any loans so the IRS can assess the asset’s equity value.

There are plenty of websites out there to help determine the value of real estate and other assets. The IRS is looking at this section to see if any assets have enough equity to be liquidated to pay them in full, so exaggerating the value is not a good idea. The IRS won’t generally try to kick you out of your primary residence, but if it’s their best option to collect the tax debt, they will consider it.

Business assets such as tools, equipment, and inventory also need to be included in this section.

Credit Cards and Business Information (Section D and Section E)

Make sure to complete this section, including business credit cards, minimum monthly payment, and credit limit. Credit cards are generally considered a method of payment rather than a specific expense. There are certain types of payment plans where minimum monthly payments can be included, like a payment plan under the six-year rule. The IRS also wants to know about any business accounts receivables to see if there’s a chance of future income increasing dramatically.

Employment Information and Non-Wage Household Income (Sections F and G)

In Section F, you must list your employment information, such as current employer name and pay frequency, along with pre-tax and post-tax amounts of income earned over what period of time. This can be trickier than you think. The IRS asks for the pay period for wage earners, but unlike on Form 433-A, you are not required to calculate how much that means you are paid monthly. Nevertheless, you will want to do that calculation as it will be vital later.

You also need to list all other income sources, like child support, rental income, social security payments, unemployment income, and, for self-employed individuals, self-employment income. If you receive child support or unemployment income on a weekly basis, you’ll need to do some math to calculate the monthly payments. Looking at last year’s tax return for items like rental and business income is helpful.

While it’s not on the form, you’ll want to add all the income and figure out your monthly household income.

Monthly Necessary Living Expenses

Here’s where things get dicey. This section shows two columns: “Actual Monthly Expenses” and “IRS Allowed.”

Allowable Living Expenses are standard expenses that the IRS deems reasonable. If your expenses exceed the standard, the IRS will often limit your actual expenses to the standard. You must be intimately familiar with the standard to minimize your monthly payment plan. Let’s take it section by section.

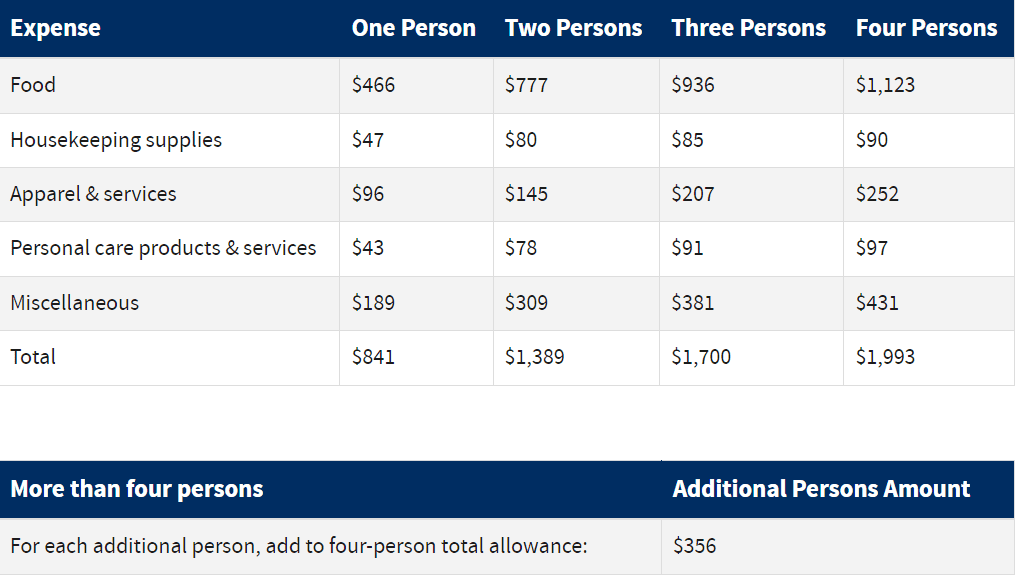

There’s a single national standard for food, housekeeping supplies, clothing, and personal care products. It’s a whopping $841 a month for one person. It increases from there, as you can see below (please keep in mind these standards change frequently, so it’s possible this is out of date already):

Credit card payments are technically a “miscellaneous” expense already factored into this category. If your monthly expense exceeds the standard, the IRS will often limit you to the standard.

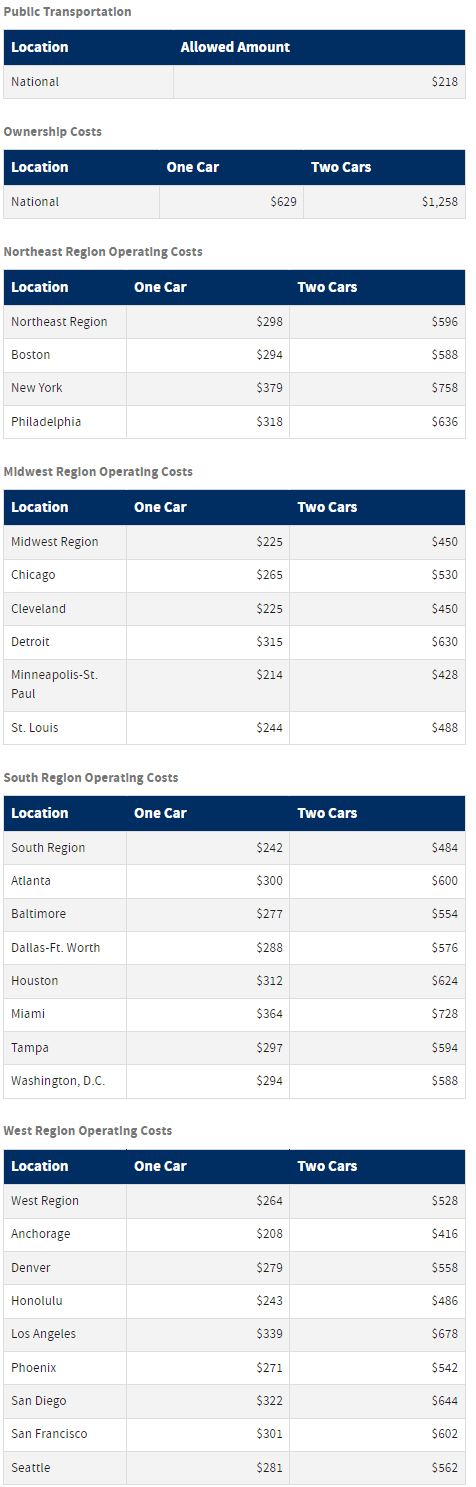

Transportation costs include gas, insurance, parking, and public transportation. Here are the standards, some of which are local, meaning it will depend on your geographic location:

Ownership costs mean the monthly payment for the vehicle, whether it’s leased or financed. Operating costs are the gas, maintenance, and insurance costs. As you can see, this expense varies by location in the USA.

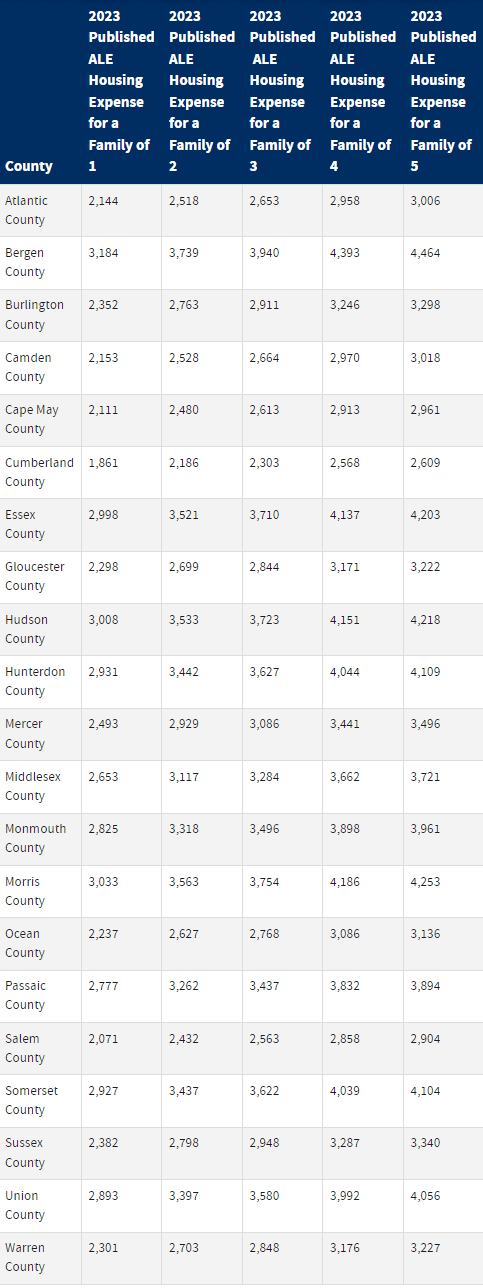

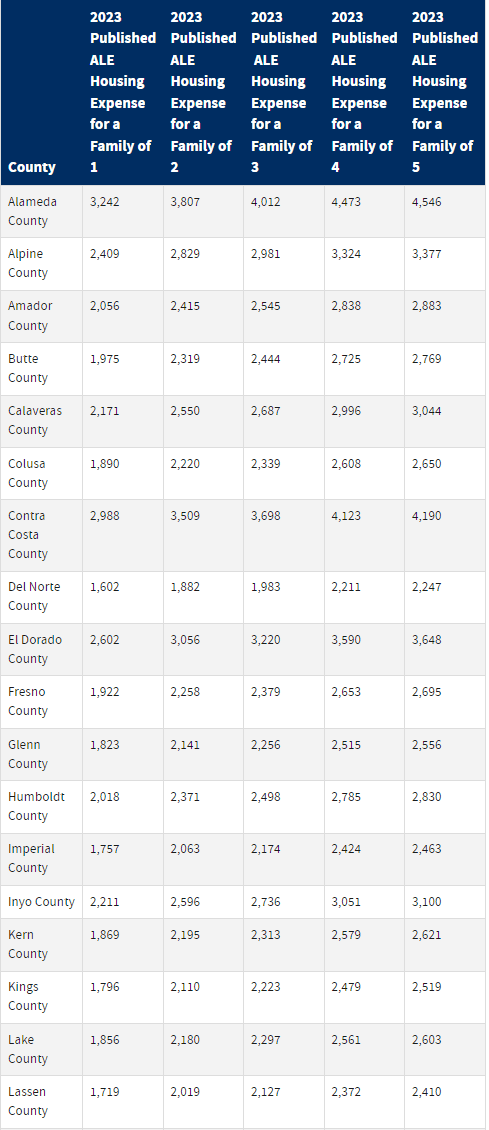

Housing and utilities are the bane of our existence because it’s so rare that a taxpayer is within the standard. These standards are localized by county, but here’s an idea based on New Jersey and California standards.

When you factor in your mortgage or rent payment, utilities, maintenance, HOA, and insurance, it’s pretty darn tough to fit within the “standard.” Again, whether the IRS accepts the actual amount or the standard will depend on various factors, including the total in delinquent taxes, the type of payment plan you’re seeking, and your proposed monthly payment.

Medical expenses are health insurance and out-of-pocket health care. The IRS will allow the full health insurance premium, but you may have to provide proof, such as a receipt. The standard for out-of-pocket health is $79 if you’re under 65 and $154 if you’re 65 and older. The IRS is more likely to accept an out-of-pocket health cost that exceeds the national standard, but they are going to want supporting documentation, such as doctor’s bills.

Other expenses are essentially a laundry list of other expenses not found elsewhere on the form. We’ll tackle a few common ones.

Child and dependent care expenses may be allowed if both parents are working. If only one parent works and the child attends daycare, the IRS likely won’t permit this expense.

Estimated tax payments are vital to getting on an installment agreement. If you’re a business owner, you need to be making estimated tax payments to prevent future tax debt.

The IRS will generally allow federally backed student loan payments but will want proof of payment. Similarly, the IRS will generally allow an expense for past-due state taxes, but it will likely adjust the amount based on a formula.

Submitting Form 433-F: What to Expect

There are two ways to submit the Form 433-F. First, you can mail it in. The mailing address is on the instructions on the form. If you select this option, you must include all the supporting documentation. Send it by certified mail so you have proof.

Our preferred method is to submit it over the phone. You can do this by either verbally providing the information or by faxing it to the agent on the phone. This helps resolve the issue faster. Moreover, the agent on the phone will tell you specifically what supporting documentation is needed. Submitting it by telephone can help avoid a prolonged back and forth where the IRS asks for additional information by letter, you provide it, they want more, you provide it, etc. You can also have a direct debit installment agreement request ready to submit as well while you’re on the phone.

Payment Options

There are several options to resolve the tax liability. The most common is an installment agreement. There actually isn’t just one type of installment agreement, but several depending on your facts and circumstances. A direct debit installment agreement would allow the IRS to take money directly from your bank account, which can be a convenient option. If you call in the financial information statement, you should be prepared to make an installment agreement request. You might also be eligible for currently non-collectible status, which basically means you don’t need to make any payments for now.

Other options exist, but they’re extremely fact-dependent—contact a tax professional if you need help.

When to Seek Professional Help

To better understand IRS Financial Standards and Allowable Expenses, as well as filing Form 433-F correctly, a taxpayer may wish to employ the help of a tax attorney. This will ensure that their installment agreement or economic hardship request is properly presented. Professional assistance like a tax attorney should be considered if you’re struggling with your payment plan, are uncertain about how much information regarding financials needs sharing, or need guidance on whether Form 433-F or another form would suit you best.

Summary

In sum, it is critical to thoroughly understand IRS Form 433-F and competently fill out the form if you are looking for ways to address your tax liability. This guide has provided comprehensive insight to help you take charge of your financial state and make informed choices in finding suitable payment plans.

Frequently Asked Questions

Need Help with your IRS Form 433 F? Contact Paladini Law Today.

We help taxpayers nationwide with their IRS Form 433 F needs. Call us today at (201) 381-4472.