If you’re a business owner struggling with tax debt, Form 433-B might be your savior. Here, we will unveil the secrets of Form 433-B, a vital tool for businesses in resolving their tax issues. By following our comprehensive step-by-step guide, you’ll learn the ins and outs of completing this form and be on your way to a better financial future.

Key Takeaways

- Form 433-B is a Collection Information Statement that reports assets, income, and expenses to the IRS for certain businesses.

- Obtaining and preparing Form 433-B requires acquiring the form from the IRS website, gathering required financial documents, and ensuring the accuracy of information.

- Professional help or filing services can be utilized for accurate reporting.

Table of Contents

Understanding Form 433-B: Purpose and Usage

When a business owes federal taxes and cannot pay immediately, Form 433-B comes to the rescue. This Collection Information Statement is designed for businesses, such as s-corporations, partnerships, or c-corporations, to report assets, income, and expenses. Once the IRS receives a comprehensive overview of your business’s financial situation through this form, they can then determine your eligibility for an installment agreement, a temporary delay in tax payment, or other relief.

Submitting precise information on Form 433-B is paramount; pertinent financial records, including business bank account statements, should accompany this. This ensures the IRS can assess your business’s capacity to pay taxes and make a fair decision based on your current financial situation.

Who Needs to Complete a Form 433B?

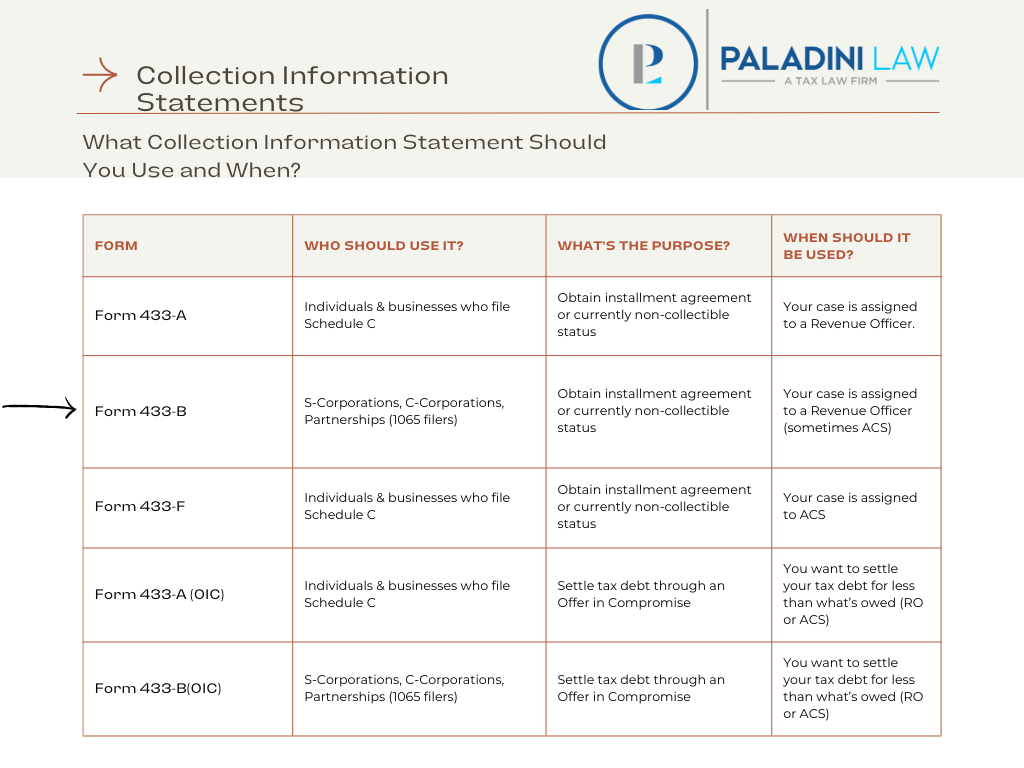

The IRS has different Collection Information Statements for different purposes: Form 433-A, Form 433-B, Form 433-F, Form 433-A (OIC), and Form 433-B (OIC). Here’s when you should use which form:

Form 433-B should be used if your S corporation, C corporation, or partnership owes tax debt. You may also need to file one if you owe personal tax debt and own one of these businesses.

If you want to settle your tax debts through an offer in compromise, you’ll need to use Form 433-B (OIC).

Obtaining and Preparing Form 433-B

To start, obtain Form 433-B from the Internal Revenue Service website. Before you start filling out the form, ensure all vital financial documents, like business income information, are available. Ensuring you have a clear understanding of your financial standing will make completing the form a much smoother process.

Must Do’s Before Completing the Form

Most businesses required to submit this form have unpaid payroll taxes, income taxes, or both.

Usually, the case will be assigned to an IRS Revenue Officer, a professional debt collector for the IRS. A Revenue Officer is unable to work with you to resolve your tax issues unless two things happen:

- The business is current on its federal tax deposits and estimated tax payments, and

- The business is current on filing returns.

The IRS will work with you to resolve a past-due debt, but they need to see that it won’t happen again. For payroll taxes, we highly recommend using a payroll service provider. A payroll service provider will automatically deduct the taxes from your bank account and file the required returns. This helps prevent accumulating new liabilities.

Filling Out Form 433-B: Section-by-Section Breakdown

Having assembled the required documents and selected the appropriate form, you can now proceed to handle the specifics. We’ll walk you through each section of Form 433-B, providing a comprehensive guide on reporting your business information, assets, and liabilities and analyzing your income and expenses.

Business Information Essentials (Sections 1 & 2)

In Section 1 of Form 433-B, you’ll need to provide several pieces of basic information about your business. This will include:

- Company name

- Employer Identification Number (EIN)

- Contact information

- Number of employees

- Frequency of tax deposits

- Average gross monthly payroll

Be thorough and precise in providing this information, as it sets the foundation for the rest of the form.

If a section doesn’t apply, write “N/A” in that box so the IRS knows it doesn’t apply. The frequency of tax deposits refers to payroll taxes if your business has employees. If you’re using a third-party payroll provider, they should be able to supply this information. If you don’t know how frequently you’re supposed to make deposits, the IRS has a publication that explains the requirements.

Additionally, you’ll need to include the percentage of ownership and annual salaries of the business owners. If the business owes payroll taxes, the IRS will try to assess individuals for the trust fund recovery penalty. They ask if the person is “responsible for depositing payroll taxes.” So be especially careful about how you complete this.

Other Financial Information (Section 3)

Section 3 asks about specific issues related to the business. It’s trying to determine if the business lent owners money that could have been used to pay taxes or if any business assets were sold for less than fair market value.

It also asks about any anticipated increase or decrease in income. Sometimes, a business hits a rough patch and doesn’t look like it could continue to operate. But perhaps a big job is coming up, or some other change will ensure the IRS gets paid (or at least partially paid). If the business loses a tremendous amount of money monthly, the IRS may ask, “Why is this business even open?” and could move to seize assets. Hence, you need to provide a thoughtful answer and explanation here.

Business Asset and Liability Information (Section 4)

In the financial information section, you’ll report your business assets, including business bank accounts, investment accounts, and business equipment.

You’ll also need to report any accounts receivables. The Internal Revenue Service can levy this money from your vendor if you can’t resolve the matter.

The IRS will evaluate the business’s assets to determine whether they should ask you to sell the property to satisfy taxes owed or, if you cannot resolve this, to seize the assets. It’s important to include the loan balance so the IRS can determine whether an asset has equity. Generally, the IRS won’t go after business equipment that is income-producing assets, but it’s a case-by-case basis.

Look at your last income tax return—it often includes a depreciation statement with a list of assets. The IRS may cross-reference that list to this one to make sure you provided accurate information. So, you want to ensure every business asset is listed in the business asset information section.

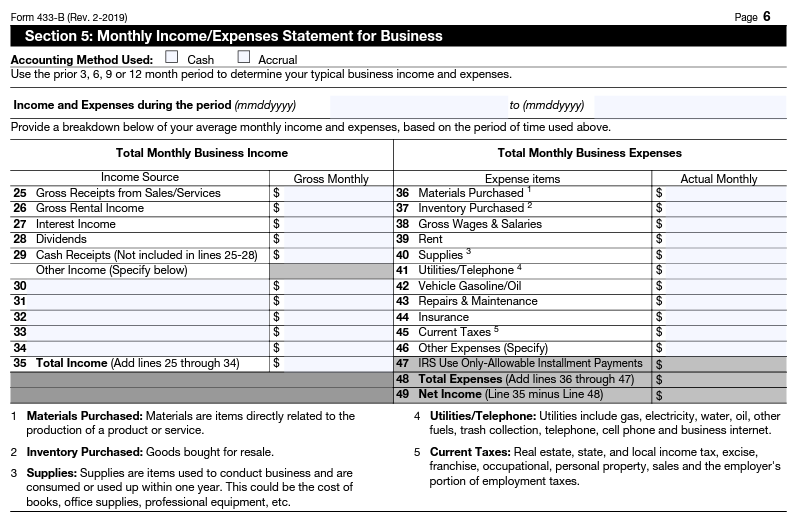

Income and Expense Analysis (Section 5)

This is the most important section of IRS Form 433 B. In this section, you’ll analyze your business income and expenses using average monthly figures supported by documents such as profit and loss statements. This analysis allows the IRS to ascertain whether your business qualifies for an installment or partial payment installment agreement.

You need to fill in this section completely—don’t just put the totals and tell the IRS to see the attached profit and loss statement. They don’t like that.

A business can use a 3, 6, 9, or 12-month average to determine typical business income and expenses. Here’s what you want to do:

Ask your accountant for an income statement for the last 12 months. If your accountant can’t provide this, your accountant sucks, and you should fire them :).

You want the profit and loss in Excel format. Then, you want to determine your average gross monthly income for the abovementioned periods. You want to do the same thing for the expenses. Then, you want to look at the net income for each period.

This is a bit like the story of Goldilocks. If you present a period when the business is losing a tremendous amount of money, the IRS won’t believe it’s viable and may ask to close it. Conversely, if you’re showing a massive profit, the IRS will ask for a massive payment plan.

Your payment plan will generally be the average net income for the period presented. Keep in mind that certain tax deductions aren’t included on this form. For instance, you’ll notice there’s no box for depreciation. The IRS doesn’t care about it since that’s not a cash expenditure.

The IRS may also ask for proof of certain expenses, so ensure you have a solid paper trail.

Let’s run through an example:

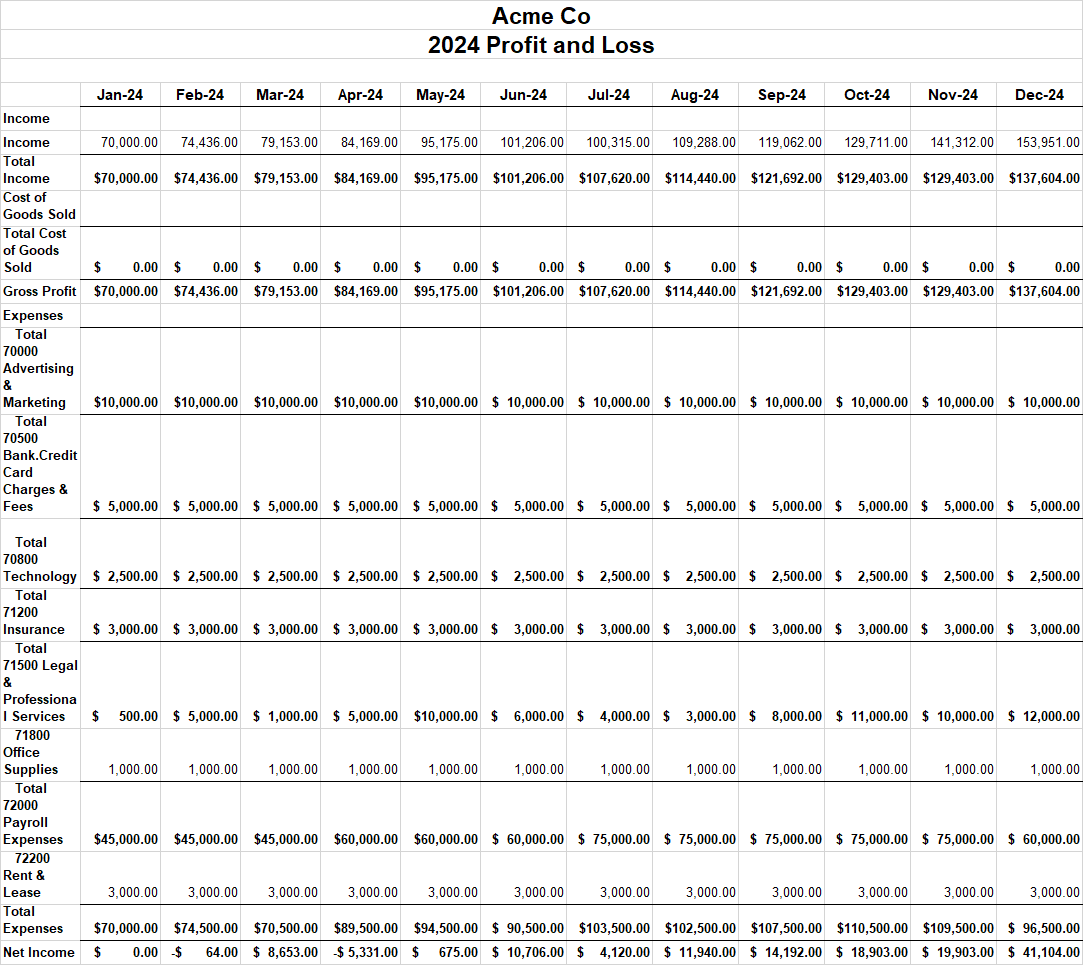

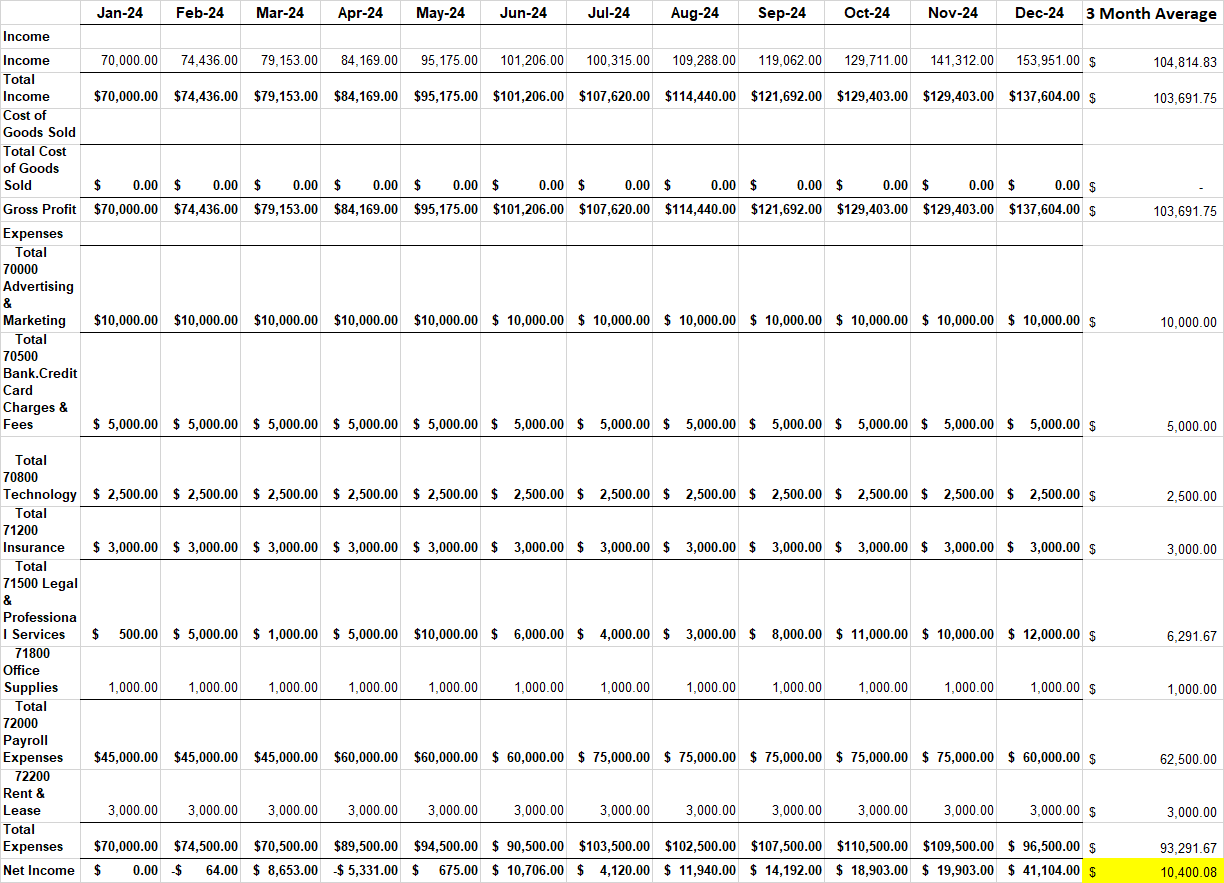

Here’s a made-up profit and loss for the year 2024:

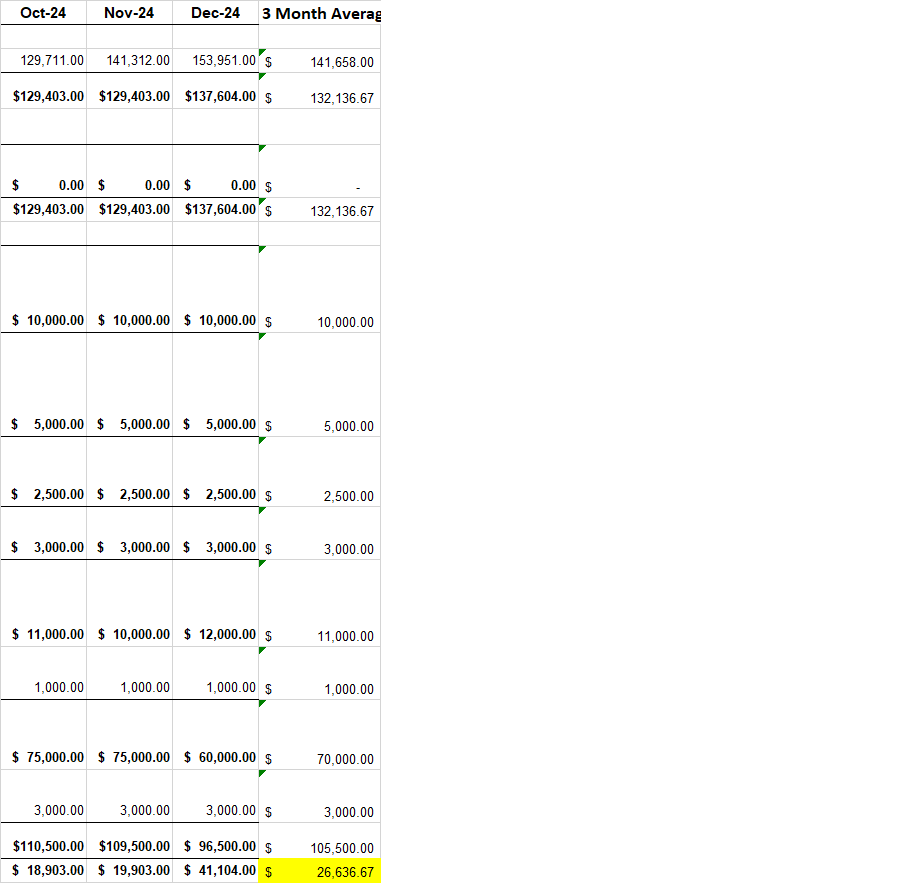

Now, let’s say we decided to use the last three months of the tax year for the profit and loss:

According to three months of information, your average net income is around $26,000. Guess what? The IRS will want you to pay $26,000 monthly for your installment agreement! Yikes. That’s probably too much. Now let’s see what happens if we use the whole year:

Using a 12-month average, we’re looking at an average net monthly income of $10,000. Much better than $26,000! Most businesses have seasons where they are busier than others. Only using a 3-month average could show a distorted view of the business’s ability to pay. As such, you want to present information that accurately reflects the business’s financial health. Remember, the IRS will generally want the net monthly income, so if that number is high, the IRS will demand a high payment.

Providing Additional Information and Signatures

Once you’ve completed all sections, don’t forget to sign the form under penalty of perjury, providing your business name, title, and date. Your signature verifies the accuracy of the information provided, so again, make sure all the information is correct.

Submitting Form 433-B and Next Steps

In addition to providing a signed copy of this form, the IRS will probably ask for supporting documentation, such as bank statements. The IRS will look at your bank statements to verify the information submitted. For instance, in the above example, the gross receipts for December were around $150,000. You submit December’s bank statements, which show $300,000 in deposits. In the words of Scooby Doo, “Ruh Row”.

You’ll need an explanation prepared—perhaps there was a loan deposit or some other nontaxable deposit. Without an adequate explanation, the IRS will assume the business made $300,000 with the same expenses, and you’re looking at a high payment plan.

The IRS may also ask for proof of business expenses. They want copies of checks for your rent payments or proof of contractor pay. Have that ready to go if you need it.

Common Mistakes and When to Seek Professional Help

There are plenty of situations where you could deal with the IRS yourself. In my humble and extensive experience, this is not one of them. While I tried to provide comprehensive information, there are so many intricacies that it’s impossible to cover every scenario—unless you want to read a 10,000-word book…maybe I’ll publish that one day.

In the meantime, if you have an outstanding tax liability for your business, and you can’t cover the tax bill in full, and you want to minimize your monthly payments, you should consider hiring a tax attorney. That doesn’t mean you need to hire us—there are a ton of good tax attorneys throughout the United States. But if you want to hire us, call us at +1 (201) 381-4472.

Summary

In conclusion, Form 433-B is a powerful tool that can help you resolve your business’s tax debt and get back on track toward financial stability. By following our step-by-step guide and being thorough in providing accurate information, you can confidently navigate this form’s complexities. Remember, seeking professional assistance when necessary and implementing financial management strategies can make all the difference in achieving a successful tax resolution. Take charge of your financial future today!

Frequently Asked Questions

Need Help with Completing Your Form 433-B?

If your business owes back taxes and needs help resolving it, call us at (201) 381-4472.