Forgot to File Taxes? Now’s the time to take care of it.

If you forgot to file your taxes this year, or haven’t filed in several years, consider taking care of it now. There are many reasons you should file your tax returns:

- It’s a crime not to.

- Besides the tax due, you’ll also owe failure to file penalties.

- If you don’t file, the IRS will do it for you—and you’ll owe more money.

Will I go to jail for not filing my taxes?

Probably not, but under 26 U.S.C. section 7203, it is a crime to willfully not file a tax return. It’s still a crime even if there’s no tax due. Failure to file is also one of the most common tax crimes prosecuted by the government, in part because it is easy to prove. Even though it’s one of the most common tax crimes prosecuted, it’s still unlikely you’d ever go to jail for not filing your taxes. However, you are at an increased risk if you have a history of not filing, and you have the financial means to pay taxes, but choose not to.

You may be afraid to file a tax return because you cannot afford to pay the balance due. And while it’s also a crime to not pay your taxes, you are less likely to be charged with a failure to pay crime than a failure to file. It’s far better to file and owe than not to file.

This isn’t intended to be a scare tactic—the government doesn’t prosecute most taxpayers who fail to file. But for most people, any risk of criminal prosecution is too much, especially when you can mitigate the risk by simply filing the return.

Will I be penalized for not filing my tax return?

If you forgot to file your taxes, there are three main penalties you could face: (1) failure to file, (2) fraudulent failure to file, and (3) failure to pay. The fraudulent failure to file penalty is rarely used, but it is a 15% penalty per month, up to 75% of the tax due.

The general failure to file penalty is 5% per month of the tax due, up to 25%. The penalty starts as soon as the return is late. If you did not file an extension, the due date is April 15 for individual taxpayers. If you file the return late and have good reason—or “reasonable cause” in IRS jargon—you can have the penalty abated or removed.

If you didn’t file your taxes, chances are it’s because you didn’t have the money to pay. Besides the failure to file penalty, the IRS will also hit you with a failure to pay penalty. The failure to pay penalty is 0.5% per month, up to 25%. If the failure to file and failure to pay penalties apply at the same time, the failure to file penalty is reduced by 0.5%, meaning the total monthly penalty will be 5%.

But as with avoiding criminal prosecution, it’s better to timely file the return and avoid the failure to file penalty than not file or file late. You’ll still owe the same about of tax and will at least be able to avoid the additional failure to file penalty.

What else can the IRS do if I don’t file my tax return?

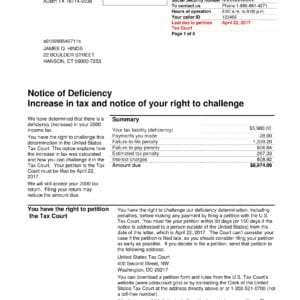

If you don’t file your taxes, under 26 U.S.C. section 6020(b), the IRS has the authority to prepare a substitute for return (“SFR”). An SFR is a return the IRS creates based on available information. If the IRS uses the SFR process to determine a tax liability and issues a statutory notice of deficiency, you can become liable for the tax due on the SFR, even if that amount is not correct.

How does the SFR program work?

After a tax year has ended, you should receive information returns summarizing your sources of income. For instance, if you are an employee, you will receive a W-2 from the employer. If you are an independent contractor, you will receive a 1099 from the company you performed work for.

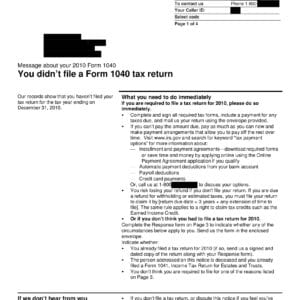

Besides sending the information return to you, the employer or company will also send a copy to the IRS. If the IRS sees you have received income in a tax year but have not filed a return, the IRS will try to secure a return from you by sending you correspondence saying they have not received a tax return.

If, after the initial notice, you still do not file the tax return, the IRS will send additional notices warning you that if you do not file, the IRS may determine the tax for you. The IRS will then send a notice showing the proposed amount due based on the information returns and other information collected from third parties. If you still do not file a return, the IRS will send a statutory notice of deficiency with the proposed tax. If you ignore the statutory notice of deficiency, you will then owe the tax due on the notice.

An SFR will hurt you in 3 ways: First, you cannot file bankruptcy for tax due from an SFR. Second, if you are married, you will receive none of the potential benefits of filing Married Filing Jointly under the SFR program. Third, the SFR does not consider many credits, exemptions, and deductions you may be entitled to. Therefore, the tax owed from an SFR is usually substantially more than if you voluntarily filed a tax return.

Even if the IRS uses an SFR to determine your tax liability, you can usually undo this through the IRS’s audit reconsideration process. To use the audit reconsideration process, you must file the original tax return for the tax year the SFR was prepared. The IRS does not have to accept the return, but if the return is prepared accurately, they usually do. Once the original return is accepted, the amount due on the SFR will be abated or reduced and you will owe the amount showing only on the filed return, plus penalties and interest.

This is a roundabout way of doing things. It’s far better to voluntarily file the return in the first place, rather than wait for the IRS to prepare the SFR.

To summarize, if you haven’t filed taxes because you cannot pay the balance due or forgot to file taxes, you should file as soon as possible. You’ll limit your exposure to criminal prosecution, reduce the penalties, and avoid the IRS’s SFR program.