Dealing with tax debt can be nerve-wracking and frustrating, especially when the IRS is involved. If you’re unable to pay what you owe all at once, you’re not alone—and there are options to help you manage your tax debt.

One of the most useful tools for setting up a manageable payment plan with the IRS is Form 433-D. This IRS relief form allows you to establish a direct debit installment agreement, spreading out your tax payments over time with automatic deductions from your bank account. This makes it easier to get back on track without the stress of a lump sum payment.

In this guide, we’ll walk you through everything you need to know about Form 433-D. We’ll cover what it is, who should file it, and how to submit and complete this form. Plus, we’ve included answers to some common questions to help you understand the process and avoid pitfalls.

Key Takeaways

- What? Form 433-D is the IRS form for setting up an installment agreement, which allows you to pay off your federal income tax debt in manageable monthly payments.

- Who? This form is ideal for taxpayers who can’t pay their full tax balance immediately and prefer a structured payment plan with automatic bank withdrawals.

- How? If taxpayers owe more in taxes than they can pay right away and don’t know how to get out of this situation, they should seek professional help from a tax lawyer.

Table of Contents

What Is Form 433-D?

Form 433-D is the IRS’s official “Installment Agreement” form. In simple terms, it’s used to set up a payment plan. After an installment agreement request, this form is used to formalize the payment plan. If you owe the IRS more than you can pay in one lump sum, this form lets you propose a series of monthly payments to satisfy your debt over time.

You’ll need to propose an amount you can pay each month, and once approved, the IRS will automatically withdraw this amount from your bank account. You also use Form 433-D to share your bank account information with the IRS for automatic payments.

Who Should File Form 433-D?

Anyone who owes the IRS and can’t pay the full amount immediately should consider filing Form 433-D. This form is ideal if:

- You owe more than you can afford to pay at once.

- You need a structured way to pay off your tax debt without risking immediate collection actions.

- You’re comfortable with the IRS withdrawing payments directly from your bank account each month.

If you’re already in collections or have received a notice, filing Form 433-D might help you avoid further collection action. However, not everyone is eligible for an installment agreement. Sometimes, a different approach might work better, so it’s a good idea to consult a tax professional to explore your options.

Terms and Conditions of Form 433-D

Before you submit Form 433-D, you must understand what you’re agreeing to. Here are the terms and conditions you’re accepting when signing on the dotted lines:

- Monthly payments: You agree to pay a set amount to the IRS each month.

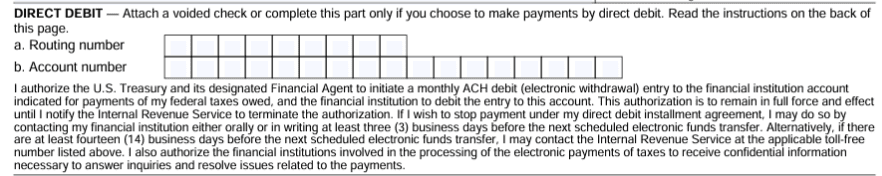

- Direct debit requirement: Form 433-D typically requires you to set up a direct debit, meaning the IRS will automatically withdraw funds from your designated bank account on a set date each month. This helps ensure payments are made on time but requires you to keep sufficient funds in your account.

- Interest and penalties continue to accrue: Although a payment plan may protect you from immediate collection actions, it doesn’t eliminate interest or penalties. These charges accumulate on your outstanding balance until it’s fully paid.

- Potential for liens: Even if you’re in a payment plan, the IRS may still file a federal tax lien, particularly for larger debts. This lien acts as a claim against your property, ensuring the IRS’s ability to collect if you default on your payments.

- Missed payments and default: Missing a payment or failing to keep enough funds in your account could lead to defaulting on your installment agreement. Defaulting may result in the IRS terminating the agreement, leading to wage garnishment, levies, or other collection actions.

If your financial situation changes, you may request an adjustment to your agreement. However, this process requires IRS approval, and it’s not guaranteed. Consider discussing your options with a tax professional if you’re facing financial hardship.

How to Complete IRS Form 433-D

Filling out IRS Form 433-D accurately is crucial for getting your IRS installment agreement approved. Here’s a breakdown of each section and what information you’ll need:

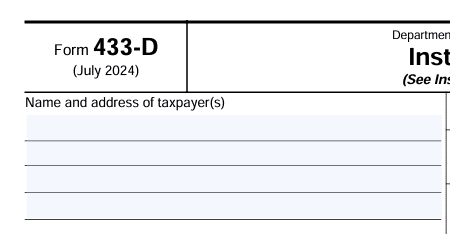

- Name and address of taxpayer: Start by entering your full name (or your business’s legal name if you’re filing for a business) and current mailing address. Make sure the address matches the information on file with the IRS to avoid processing delays.

- Social Security Number (SSN) or Employer Identification Number (EIN): If you’re an individual taxpayer, enter your Social Security Number (SSN). For businesses, provide the Employer Identification Number (EIN). This unique identifier helps the IRS link the form to the correct account.

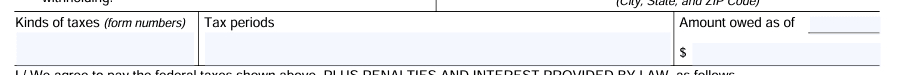

- Kinds of federal taxes: Specify the type of federal taxes you owe. For example, if it’s individual income tax, write “1040.” For businesses, it might be payroll tax or corporate income tax. This section clarifies which tax type the payment agreement applies to.

- Tax periods: Indicate the specific tax periods associated with the debt. For example, if you owe taxes from 2022, write “2022.” For businesses, you may need to list multiple periods, such as quarterly periods for payroll taxes.

- Amount owed: Enter the total amount of tax debt you owe for the tax periods you listed. This should include any penalties and interest that the IRS has added to your original tax balance. This figure helps the IRS understand the full scope of your debt.

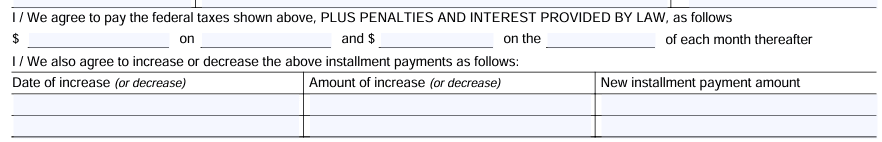

- The amount of your initial payment: If you plan to make an initial lump-sum payment, enter that amount here. An upfront payment may reduce your monthly installments and demonstrate a willingness to resolve the debt, which could positively influence the IRS’s decision.

- The amount of and date of your monthly payments: Propose the amount you can afford to pay each month. Choose a payment amount that is manageable within your budget, as you’ll be required to make this payment consistently. You’ll also need to enter the date each month you’d like the IRS to withdraw this amount.

- Future increases/decreases to monthly payments: If you anticipate being able to pay more in the future (or less if your circumstances change), this should be indicated here. This section lets the IRS know if you’re planning to increase payments over time, helping to shorten the debt term. Keep in mind that any changes to your payment amount typically require IRS approval.

- Routing number and account number for direct debit payment: Enter your bank’s nine-digit routing number and your account number. These numbers are essential for setting up the automatic monthly withdrawals. Be sure to double-check these numbers; any errors could result in missed payments and potential penalties.

Before you sign, double-check the details. By signing the form, you agree to the terms, including allowing the IRS to withdraw funds monthly. After submission, the IRS will review your form and contact you to confirm details or adjust the payment amount or timeline.

WAIT! We’ve been doing this for a very long time. And if we had a dollar for every time we’ve seen this mistake, we’d have….a lot of dollars. Hidden in the middle of the page, above the Routing and Account Number, but below the box showing the amount you want to pay each month, is a small box that says:

Nearly everyone glances over this box, which causes the installment agreement request to be rejected. Ensure it’s initialed before submitting.

Submitting IRS Form 433-D

Once you’ve completed IRS Form 433-D, the next step is to submit it to the IRS for processing. You have three options for submission: by mail, online, or over the phone.

- By Mail: If you prefer to mail your form, use the correct mailing address provided on any IRS notices you’ve received. Include all required documentation to avoid any delays. It’s a good idea to send your form via certified mail to ensure it reaches the IRS.

- Online: For a quicker submission, you can use the IRS’s online portal. You must create an account and log in to upload your form and supporting documents. This method is convenient and allows you to track the status of your submission.

- Phone: You can also get a live IRS agent on the phone, who will give you an access code to upload the Form directly to the agent. This (in theory) allows for faster processing and fewer IRS errors.

Regardless of your chosen method, always keep a copy of your form and all supporting documentation for your records. This can be crucial if any issues arise or if you need to reference your submission in the future.

Alternatives to Installment Agreements

If paying your tax debt in full through an installment agreement isn’t feasible, there are other options you might consider:

- Offer in Compromise (OIC): You can settle your tax debt for less than the full amount owed. It’s a good option if you can prove that paying the full amount would cause significant financial hardship.

- Currently Not Collectible (CNC) Status: If you’re facing temporary financial hardship, you might qualify for CNC status. This delays the payment of your tax debt until your financial situation improves.

- Bankruptcy: In some cases, filing for bankruptcy can help eliminate or restructure your tax debt. This is a more drastic measure and should be considered carefully.

Consulting with a tax professional can help you determine the best course of action based on your specific financial situation.

Frequently Asked Questions (FAQs) About Form 433-D

If you’re unsure about completing Form 433-D or need advice on structuring your payment plan, don’t go it alone. Contact a tax lawyer at Paladini Law to discuss your specific situation. Call 201-381-4472 or fill out this contact form to request a consultation.