Dealing with unfiled tax returns can be daunting. Many taxpayers wonder how long the IRS can pursue them or whether there’s a time limit after which tax issues expire. This article breaks down the rules in plain language, focusing on IRS deadlines and statutes of limitations, and explains what happens when you haven’t filed the […]

Federal Income Taxes

What to Do After the IRS Rejects Your Offer in Compromise

If the IRS rejected your Offer in Compromise (OIC), you’re not alone—the IRS rejects a large portion of OIC applications. In fact, out of 30,163 OIC proposals in FY 2023, the IRS accepted only 12,711, representing approximately 42% of the proposals. This means the majority of offers are not approved on the first try. A […]

IRS Options for Tax Debt Under $50,000: Payment Plans & More

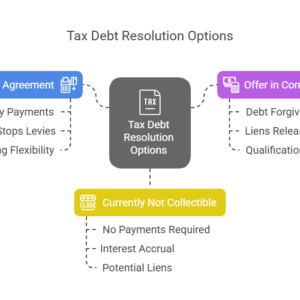

If you’re struggling with IRS tax debt under $50,000, you’re not alone—and the good news is that the IRS offers several tax debt resolution options to help. Owing a large tax balance can be stressful, but the IRS offers payment plans and other relief programs designed for individuals in your situation. In this article, we’ll […]

What If You Miss an Installment Agreement Payment?

Setting up an installment agreement with the IRS is one of the quickest, most effective ways to stay in good standing and get your balance paid off over time. However, sometimes, you might miss a payment and fear your agreement will be canceled or the IRS will come after you. If you’ve missed a payment […]

Do Tax Relief Companies Really Work? How to Avoid Rip-Offs

Avoid Tax Relief Scams—How to Find Real Tax Relief Few financial issues are as stressful as unpaid taxes. The IRS can seize your assets, revoke your passport, and leave you financially destitute. That’s why the tax relief industry has grown so rapidly over the last 30 to 40 years—promises to handle state and federal tax […]