Imagine receiving an unexpected visit from an IRS Revenue Officer at your home or business. It’s a situation that can be overwhelming and intimidating. But fear not! In this comprehensive guide, we’ll explore the world of Revenue Officers and equip you with the knowledge and tools to navigate these encounters. Prepare to dive deep into […]

Blog

Tax Court Takeaways: Even Tyga Needs To Make Estimated Tax Payments to Get an Installment Agreement

Background Michael R. Stevenson, aka Tyga, recently sought review in Tax Court of an Intent to Levy Notice issued by the IRS. Tyga timely filed his 2019 federal income tax return but failed to pay the reported liability of $2,166,469. In an effort to collect this liability, the IRS issued a notice of intent to […]

IRS Tax Resolution Services: Helping with Federal Tax Problems

Are you dealing with tax issues that are causing you sleepless nights? Do you feel overwhelmed by the complexity of your tax situation? It may be time to consider finding tax resolution solutions with the help of a qualified tax resolution attorney. In this article, we will take a closer look at tax resolution and […]

Understanding ERTC Audits and How to Prepare for Them

The Employee Retention Tax Credit (ERTC) is a federal program aimed at helping eligible businesses keep their employees on payroll during the COVID-19 pandemic. While the program has been immensely helpful for many organizations, it has also drawn the attention of the IRS. Unfortunately, many less-than-ethical companies sprung up overnight to take advantage of ERC […]

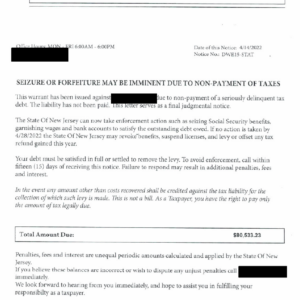

Owe Back Taxes? Everything You Need to Know

IRS back taxes creep up on unsuspecting individuals who haven’t settled their dues with the Internal Revenue Service (“IRS”) or state taxing authority by the due date. These liabilities can be income taxes, payroll taxes, self-employment taxes, and more, even encompassing taxes assessed during an IRS audit. When taxes are not paid, the IRS unsheathes […]