Avoid Tax Relief Scams—How to Find Real Tax Relief Few financial issues are as stressful as unpaid taxes. The IRS can seize your assets, revoke your passport, and leave you financially destitute. That’s why the tax relief industry has grown so rapidly over the last 30 to 40 years—promises to handle state and federal tax […]

Blog

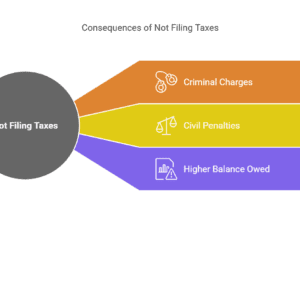

Can You Go to Jail for Not Filing Taxes?

Not filing is more serious than many people think when it comes to taxes. If the IRS believes that you have not filed in a deliberate attempt to commit tax evasion, you can face criminal charges and even jail time. At Paladini Law, we help people across New Jersey and the United States understand the […]

The IRS 10-Year Collection Rule: Taxpayer Hope or Hype?

What is the IRS 10-year collection rule, and how could it impact your tax debt? Officially called the Collection Statute Expiration Date (“CSED”), this critical tax law generally limits tax collection efforts to 10 years from the assessment date. But certain events can pause or extend this period. Let’s dive in. Key Takeaways The IRS’s […]

IRS Fresh Start Program: Myth vs. Fact

If you’ve been dealing with overwhelming tax debt, you’ve probably seen or heard ads for the IRS Fresh Start program. The ads likely promise that the program will provide options to pay down or settle the tax debt. But what’s the truth about the IRS Fresh Start process? Keep reading to find out. Understanding the […]

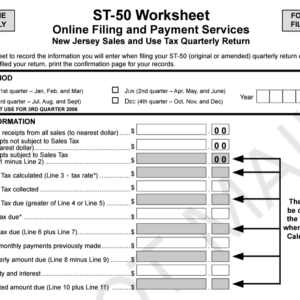

How a New Jersey Sales Tax Attorney Can Help Navigate Complex Sales Tax Laws

Confused about New Jersey sales tax laws? Or maybe you’re behind in payments? You’re not alone. A New Jersey sales tax attorney can clarify complex regulations, handle audits, and help negotiate a repayment structure to get your business back on track. This guide covers how NJ sales tax attorneys can help, strategic benefits, and common […]