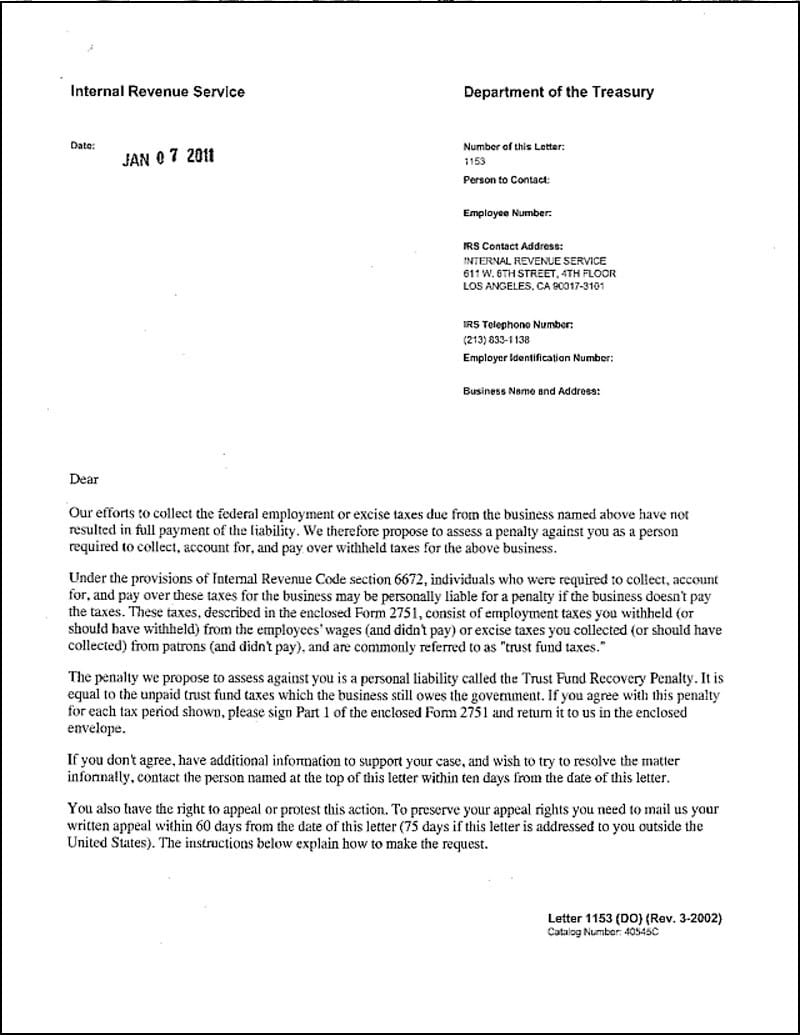

The receipt of Letter 1153 from the IRS can be cause for concern. The letter is essentially a warning that the IRS is looking to hold you responsible for outstanding company tax debt. The last thing you want is to be left paying for debt that was never truly yours to begin with. Thus, it’s important to understand what Letter 1153 means and how you can fight an impending penalty.

What Does Letter 1153 Mean?

When a business fails to pay employee withholding taxes, the IRS can hold an employee or owner at the company personally responsible for the debt under Internal Revenue Code section 6672(a). When an employee or owner is held personally liable for the willful failure to collect, account for, and pay employment taxes, the resulting penalty is known as the Trust Fund Recovery Penalty (TFRP). Unlike most penalties, a Trust Fund Recovery Penalty isn’t an added deficiency in the amount of tax due. Rather, the penalty acts as a collection device that allows the IRS to impose liability on a “responsible individual”.

The purpose of Letter 1153 is to notify an individual that the IRS is proposing an assessment of the Trust Fund Recovery Penalty against them. The IRS will try to collect from an individual within the company who could have been empowered to collect the tax or pay it. Individuals who could be held responsible for the tax include:

- An officer or employee of a corporation

- A member or employee of a partnership

- A corporate director or shareholder

- A member of a board of trustees for a nonprofit organization

- An employee with control and authority over company funds

- Payroll Service Providers A responsible party within a Payroll Service Provider

- A responsible party within a Professional Employer Organization

The IRS must also determine if failure to pay employment taxes was willful. Willfulness can only exist if the responsible individual should have been aware of the outstanding taxes and either intentionally disregarded the tax or was indifferent to the requirements of the tax.

What Happens After A Letter 1153 Is Received?

If you fail to appeal the IRS within 60 days from the date of the letter, the IRS will make an assessment. Once an assessment is made, you can attempt to appeal a levy or lien with a Collection Due Process Appeal.

Nevertheless, this isn’t the best course of action to take. The preferred option would be to pay all or a portion of the tax. Once you’ve paid part of the outstanding tax, you can file a claim for refund using Form 843. If the IRS ignores your claim, you can sue in US District Court 6 months after the claim is filed. The Court will be able to review your case independently from the IRS and may award you a refund. A refund suit must be filed within two years from the date the tax was paid or two years from the date that a Notice of Disallowance was issued.

Winning a Trust Fund Recovery Penalty case requires extensive preparation. All of the business records, correspondances, and emails surrounding the tax will need to be collected and combined with affidavits from third parties to prove lack of willfulness and limitations on authority for the potential responsible individual. Collection of documentation and development of a convincing argument will increase the likelihood of successfully fighting a Trust Fund Recovery Penalty.

Consult a New Jersey IRS Tax Attorney

If you’ve recently received Letter 1153 from the IRS, it’s important to obtain critical guidance from a New Jersey tax attorney. Attorney Brad Paladini has helped residents across the state of New Jersey avoid penalties and save thousands of dollars. Contact Paladini Law by calling (201) 381-4472 or filling out a contact form to schedule a consultation. Attorney Paladini can review your case to help you determine if hiring an attorney makes sense for your situation.