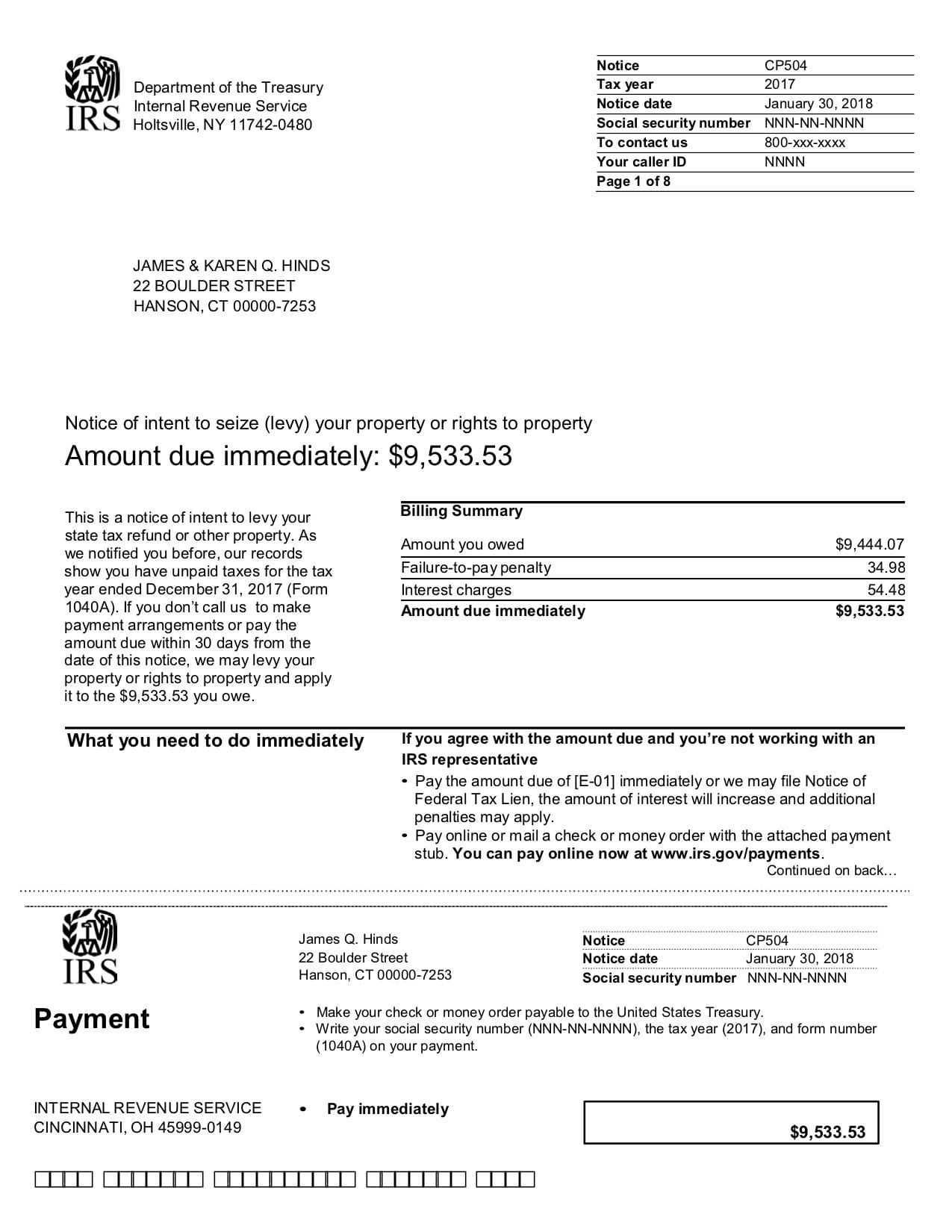

If you’re receiving a CP504B or CP504 notice, it means you have a past-due bill with the IRS. It also means the IRS has sent you letters before, and you haven’t been able to take care of the issue because either you can’t pay the balance due, dispute that it’s owed, or aren’t sure how to fix it.

But the Notice CP504 and CP504b letter shouldn’t be ignored. And it’s important to know you have legal rights you can utilize the prevent the IRS from taking money from you. You also have various procedural rights to enter into payment plans or possibly even settle the debt for something less.

What Does Notice CP504B Mean?

By sending a CP504B notice, the IRS is one step away from satisfying the legal requirements to seize your personal assets, levy your bank account, and garnish your wages. If the balance isn’t paid, the IRS will begin searching for assets to issue a levy on. The IRS may also file a Federal Tax Lien if a lien hasn’t already been filed. It is extremely difficult to borrow against or sell property with a lien in place. Moreover, depending on your line of work and professional licenses, a federal tax lien can be a huge headache.

Don’t Ignore the IRS: Doing Nothing Changes Nothing (and Actually Makes Things Worse)

If you fail to contact or pay the IRS within 30 days, the IRS will then send you a notice giving you a right to a hearing before the IRS Office of Appeals (if such a notice hasn’t already been received). This is one of the most important IRS notices you’ll ever receive. If you do not timely file an appeal, the IRS will then proceed to seize your property or the rights to your property. Property that can be levied or seized includes:

- Wages and other income

- Bank accounts

- Business assets

- Personal assets (including your car and home)

- State tax refund

- Social security benefits.

Responding to Notice CP504B

It’s important to speak with a knowledgeable tax attorney before responding to the IRS. An attorney can correspond with the IRS and help you develop a strategy to avoid aggravating the situation. The first step in responding to Notice CP504B is to contact the IRS and appease collections to prevent levies.

The next step in the process will be obtaining the IRS account transcripts. If you agree that you owe what the IRS says you do, your attorney can help you devise a plan to reduce or mitigate the tax. Often, the amount owed is disputed. Depending on the situation, you may be able to file amended returns to reduce the amount owed along with a penalty abatement request.

Speak with A New Jersey IRS Tax Attorney

If you’ve received Notice CP504B and have questions or would like legal advice, contact Paladini Law by calling (201) 381-4472 or schedule your free consultation now. Attorney Brad Paladini has helped taxpayers across New Jersey and the country avoid penalties and save thousands. Attorney Paladini can review your case, help you determine if hiring an attorney makes sense, and plot a course of action to resolve your tax issue.