If you’re struggling with IRS tax debt under $50,000, you’re not alone—and the good news is that the IRS offers several tax debt resolution options to help. Owing a large tax balance can be stressful, but the IRS offers payment plans and other relief programs designed for individuals in your situation. In this article, we’ll explain how to resolve an IRS tax debt of $50,000 or less by exploring your options and examining real-life examples. We’ll also answer frequently asked questions about IRS installment agreements, tax liens, and how to prevent levies. By the end, you’ll know the steps you can take to resolve tax debt—and why acting sooner rather than later is crucial.

Why the $50,000 Threshold Matters

The $50,000 tax debt mark is a key threshold in IRS collections. Under the IRS’s Fresh Start Program, owing $50,000 or less makes it easier to qualify for certain relief options. For example, taxpayers who owe up to $50,000 can often obtain a streamlined installment agreement—a long-term payment plan—with minimal paperwork. The IRS raised this threshold from $25,000 to $50,000 to help more people enter payment plans without requiring extensive financial disclosure. In practical terms, if you owe under $50k, you can apply for a payment plan online and spread payments out over as long as 72 months (six years). If your balance exceeds $50,000, you may need to reduce it to below $50,000 or provide detailed financial information to qualify for an installment plan. This makes staying under the $50,000 level advantageous when seeking easy approval for IRS payment arrangements.

Another benefit of the Fresh Start changes involves tax liens. In the past, the IRS could file a Notice of Federal Tax Lien if you owed more than $5,000. Now, the IRS generally won’t file a tax lien unless your debt exceeds $10,000. This means if you keep your tax debt below $10k or actively work with the IRS on a resolution, you have a better chance of avoiding a lien. However, once your debt grows larger (especially approaching $50k), the risk of liens and other enforcement (like levies) increases. Next, we’ll review the primary IRS tax debt relief options available for individuals who owe up to $50,000, and explain how each works.

IRS Tax Debt Resolution Options (Under $50,000)

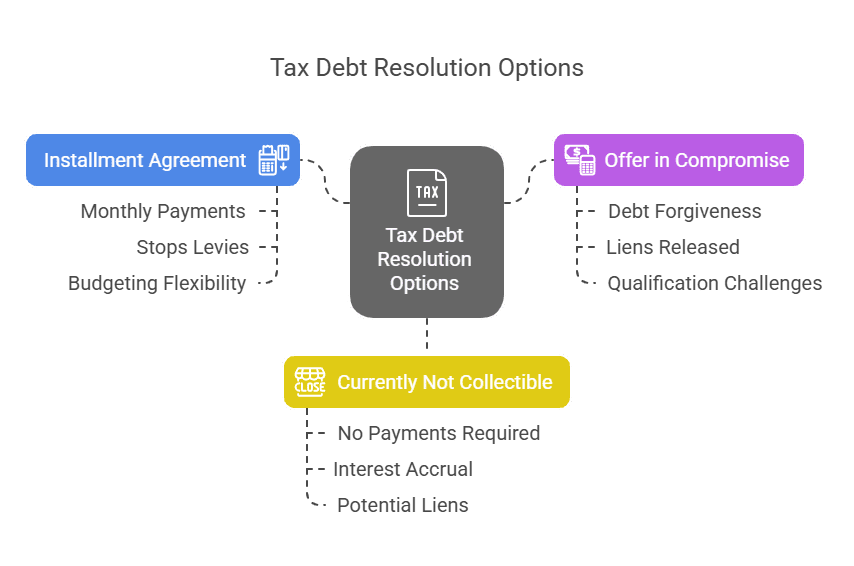

When you owe the IRS money, you have several proven options to resolve your tax debt. The most common are Installment Agreements (payment plans), Offers in Compromise (settling for less), or being placed in Currently Not Collectible status if you can’t pay at all. We’ll also discuss short-term extensions and strategies for avoiding enforcement actions. Each option has its own eligibility criteria and consequences, so it’s important to understand which might fit your situation:

1. Installment Agreement (Payment Plan)

An Installment Agreement is a monthly payment plan with the IRS. Instead of paying your entire tax bill at once, you can pay it off in affordable monthly installments. The IRS is authorized by law (Internal Revenue Code § 6159) to enter into installment agreements with taxpayers if doing so will facilitate the collection of the tax debt. For debts of $50,000 or less, the IRS offers a streamlined installment agreement that is easier to obtain. According to the IRS, if you owe $50,000 or less in combined tax, penalties, and interest and have filed all required returns, you likely qualify to apply online for a long-term payment plan. This is part of the Fresh Start program’s expansion to 72-month payment plans for debts under $ 50,000.

How to set it up: You can apply for an installment plan online through the IRS Online Payment Agreement tool or by filing Form 9465 (Installment Agreement Request). Under the streamlined plan, you usually won’t need to submit detailed financial information. However, you must agree to a monthly payment amount that will pay off your balance within 72 months or by the expiration of the collection statute, whichever is sooner. If your proposed payment is insufficient to meet IRS requirements, the IRS may request a Collection Information Statement (Form 433-F/A) to assess your financial situation. For balances exceeding $25,000, the IRS will likely require automatic direct debit payments from your bank account. In most cases, to qualify for the streamlined plan with a balance under $50,000, you must agree to direct debit. Setting up direct debit not only simplifies payments but can also help you avoid a tax lien being filed.

What it means for you: Once your installment agreement is approved and you begin making payments, the immediate threat of enforcement generally stops. The IRS will not levy your bank account or wages as long as you honor the agreement. (By law, the IRS’s ability to levy—seize your property—is suspended when you’re in an installment agreement unless you default on it.) Interest and penalties will continue to accrue on the outstanding balance until it’s fully paid, so you’ll pay a bit more over time than the original debt. But that’s often worth it to get more manageable payments and avoid drastic collection actions. Example: John owed $30,000 in back taxes. By entering a streamlined installment agreement, he agreed to pay about $500 per month for 60 months. The IRS did not file a lien on his assets, and John avoided wage garnishment. While he will pay some interest, John was able to fit the payments into his budget and clear the debt over time.

Keep in mind that even on a payment plan, a federal tax lien may still be in effect (especially if the IRS had already filed one when your debt exceeded $10,000). The lien is the government’s legal claim to your property for the amount of the debt, as established by law under IRC § 6321. But if you make your payments on time, the IRS won’t take further action, and once you pay the debt in full, the lien can be released. In some cases, you can request a lien withdrawal after making a specified number of direct debit payments, as outlined in the Fresh Start guidelines.

2. Offer in Compromise (Settling for Less)

An Offer in Compromise (OIC) allows you to settle your tax debt for less than the full amount owed, if you can demonstrate you cannot afford to pay it in full. This is a form of tax debt forgiveness, although the IRS doesn’t formally refer to it as such. The legal authority for the IRS to compromise and settle tax debts comes from Internal Revenue Code § 7122. In practice, the IRS will examine your income, expenses, assets, and future earning potential to determine whether the amount you offer is the most they can reasonably expect to collect. If so, they may accept your offer and settle the remaining balance once you have paid the agreed-upon amount.

Who should consider an OIC? If your tax debt is sizable (say, tens of thousands of dollars) and there’s no way you could realistically pay it off even over many years, an Offer in Compromise (OIC) might be worth considering. It’s also an option if paying in full would create a serious financial hardship for you (for example, you can’t pay without skipping basic needs). Under the Fresh Start initiative, the IRS made it easier for more taxpayers to qualify for OIC by expanding the criteria and considering your current income and assets. There is no strict debt threshold for an OIC—owing $10,000, $50,000, or even more can all be settled via and if you qualify. The key is your ability to pay.

How it works: You submit an offer using Form 656 and a detailed financial disclosure (Form 433-A(OIC) for individuals). You must also submit an application fee and an initial payment (for example, 20% of your offer amount for a lump-sum offer). The IRS Offer in Compromise Pre-Qualifier tool can help you gauge if you might be eligible. While the offer is being evaluated, collection activities are typically put on hold. If the IRS accepts the offer, you will pay the agreed-upon amount (in a lump sum or in installments, as specified in the offer terms), and the remainder of your tax debt will be forgiven. If they reject it, you still owe the full amount (minus any payments you sent with the offer, which will be applied to your balance). You can appeal a rejection or consider other options.

Real-life example: Maria owed the IRS about $450,000 after her small business failed. Based on her financial situation (she was unemployed and had no significant assets), it was unlikely she could ever pay the full amount. She offered the IRS $5,000 as a compromise. After reviewing her finances, the IRS accepted her offer. Maria spent the $5,000, and the IRS forgave the remaining debt of $445,000. This allowed her to start anew financially. If Maria had not qualified for an OIC, her backup plan was to enter a partial pay installment agreement or currently non-collectible status.

Important note: Not everyone will qualify for an OIC—the IRS generally won’t accept an offer if they believe you can pay your debt in full through an installment plan or other means. Offers in Compromise also require you to stay current on filing and payment obligations for the next five years, or the deal can be undone. But for those who truly can’t pay, an OIC can potentially save you tens of thousands of dollars and resolve the debt for good.

3. Currently Not Collectible (CNC) Status (Hardship Deferral)

Currently Not Collectible (CNC) status is essentially a way of informing the IRS that you can’t pay anything at this time and requesting that they temporarily pause collection. If the IRS agrees, they will mark your account as “not collectible” and delay any enforcement actions (such as levies) while you’re in that status. This is a form of hardship relief: it doesn’t eliminate the debt, but it gives you breathing room until your financial situation improves. Think of it as putting your tax debt on the back burner.

How to get CNC status: You must contact the IRS (or have your tax professional do so) and prove that paying anything would cause severe financial hardship. Typically, you’ll fill out a Collection Information Statement (Form 433-F or 433-A) detailing your income, expenses, and assets, which is similar to an OIC application. The IRS will review your account, and if they determine that, after covering your basic living expenses, you are unable to pay, they can designate your account as currently not collectible. For example, if you are unemployed or on a fixed income that barely covers rent and food, you might qualify for CNC.

Once in CNC, the IRS will stopcollections. However, interest and penalties continue to accumulate on your debt while collection is delayed. Also, the IRS may still file a tax lien to secure its claim on the debt even if you’re not collectible. The lien is in place to protect the government’s interest, but active collection is on hold.

CNC status can last until your financial situation improves or until the 10-year statute of limitations on tax debt expires, whichever comes first. The IRS may review your situation periodically (usually every couple of years) to see if you’re able to start paying. If they discover that you have a new job or a source of income, they might remove you from CNC and expect payment or set up a payment plan.

Example: Mark lost his job and owes $200,000 in old tax debt. He can’t even afford monthly payments on an installment plan, as he’s just scraping by paying rent and buying groceries. He provided the IRS with financial information showing his hardship. The IRS changed his account to Currently Not Collectible status. This meant that the IRS did not levy on Mark’s bank account or paycheck, essentially putting his debt on hold. However, they did file a notice of federal tax lien to secure the debt. Two years later, Mark found a new job. At that point, the IRS revisited his case, and Mark established a payment plan to begin resolving the debt.

CNC is a valuable option if you genuinely cannot pay anything but remember: it is not a permanent solution. The tax debt doesn’t go away (unless the statute of limitations expires), and the balance will accrue interest. Utilize the time in CNC to enhance your financial situation. If things don’t improve, you may later consider an Offer in Compromise to settle the debt entirely.

4. Other Considerations (Short-Term Extension, Full Payment, Bankruptcy)

For completeness, here are a couple of other avenues to note:

- Full Pay or Short-Term Payment Extension: If your debt is under $50,000, the simplest solution—if feasible—is to pay it in full or borrow money to pay it off (such as through a loan). If you need just a bit more time (less than 180 days) to gather funds, the IRS offers a short-term payment plan that gives you up to 180 days to pay in full with no setup fee. This is not a formal installment agreement and doesn’t typically result in a lien. For example, if you owe, say, $8,000 and can pay it off in a few months, you could request a short-term extension rather than a lengthy installment agreement.

- Bankruptcy: Certain tax debts can be discharged in bankruptcy, but this depends on the age of the debt and other factors. Bankruptcy is usually a last resort. If your tax debts are older than a few years and you meet specific conditions, Chapter 7 or Chapter 13 bankruptcy may wipe out some of your tax debt. This option extends beyond direct dealings with IRS programs and has broader financial implications; therefore, consult a bankruptcy attorney if you believe this might apply to you.

- Innocent Spouse Relief: This is a special relief if the tax debt was caused by something your spouse (or ex-spouse) did on a joint return without your knowledge. It won’t apply to most people with tax debt under $50k, but it’s worth mentioning if your situation involves questionable actions by a spouse that led to the tax bill.

Now that we’ve covered the main tax debt relief options and special cases, let’s look at some scenarios of how different taxpayers resolved (or failed to resolve) their IRS debts. These examples will illustrate the outcomes of various approaches.

Real-Life Examples of Tax Debt Resolution

Sometimes it helps to see how these situations play out in real life. Here are a few case studies (names changed) that illustrate different responses and outcomes for IRS debts under $50,000:

- Case 1: Successfully Avoiding Enforcement with a Payment Plan – Janet owed about $15,000 in taxes after under-withholding at her job for several years. The IRS sent her a bill, and although $15,000 was more than she could pay at once, she didn’t ignore it. Janet quickly applied for an IRS installment agreement online. Because her debt was under $50k and she was otherwise compliant, she was instantly approved for a long-term payment plan. She agreed to direct debit payments of $300 a month. As a result, Janet avoided any tax liens on her credit and never faced a levy. In approximately 50 months (just over 4 years), her debt will be fully paid. By being proactive and communicating with the IRS, Janet resolved her tax issue with minimal stress.

- Case 2: Settling for Less Through an Offer in Compromise. After his business closed, his income dropped dramatically. Paying $35,000, even over time, would have been impossible. Carlos decided to submit an Offer in Compromise. He offered $6,000, which was approximately equal to his remaining assets and the IRS’s calculated reasonable collection potential. During the review, the IRS verified his finances and ultimately accepted the offer. Carlos paid the $6,000 in a lump sum by borrowing from family, and the IRS forgave the remaining balance. By pursuing an OIC, Carlos became debt-free with one smaller payment, although the process took nearly a year to complete and receive approval. If the offer had been denied, his backup plan was currently not collectible status or an installment plan, but thankfully, it worked out.

- Case 3: Consequences of Ignoring Tax Debt – Emily owed approximately $20,000 to the IRS, resulting from a combination of freelance income and an early withdrawal from a retirement account. Overwhelmed and unsure of what to do, she ignored the IRS notices for over a year. Unfortunately, ignoring an IRS debt is one of the worst things you can do. The IRS sent multiple notices, filed a Notice of Federal Tax Lien, which damaged Emily’s credit, and eventually issued a levy on her bank account. Under the law (IRC § 6331), the IRS can levy assets if a taxpayer neglects or refuses to pay after notice and demand. Emily woke up one day to find that $3,000 had been withdrawn from her bank account by the IRS. Panicked, she finally sought help. A tax professional secured the release of the levy by setting up an installment agreement for Emily; however, by then, she had already incurred additional penalties, and the lien remained in place until the debt was fully paid. Emily’s story illustrates that inaction can lead to enforcement: had she reached out to the IRS early, she could likely have entered a payment plan or another program without incurring as much damage.

Each of these examples highlights a lesson: be proactive and choose a resolution path. Whether it’s a payment plan, an offer, or a hardship deferral, taking action early can prevent issues such as liens, levies, and escalating penalties. Next, we’ll address some frequently asked questions about IRS tax debt resolutions, including how to avoid liens and levies, as well as other common concerns.

Frequently Asked Questions (FAQs)

Now let’s summarize the options we discussed with a quick comparison:

Comparison of IRS Tax Debt Relief Options

For easy reference, here’s a comparison table of the main resolution options for an IRS debt under $50,000:

| Resolution Option | What It Is | Best For | Key Benefits | Drawbacks/Considerations |

|---|---|---|---|---|

| Installment Agreement (Payment Plan) | Paying your debt in monthly installments until it’s fully paid (plus interest and penalties). | Most people who can afford some monthly payment. Especially if debt ≤ $50k (streamlined approval). | Easy to set up for ≤$50k (can apply online, minimal paperwork). | Stops levies as long as you pay on time. Lets you budget payments over up to 6 years (sometimes longer). |

| Offer in Compromise (OIC) | Settling your tax debt for less than the full amount owed, if you qualify under IRS hardship guidelines. | Taxpayers who cannot pay in full or on a plan without genuine financial hardship. Those with significant debt and low income/assets. | Could save you a lot of money if accepted (debt partially forgiven). Once paid, the debt is resolved for good and liens are released. | Difficult to qualify; requires detailed financial disclosure. Lengthy process (months or more for IRS to decide). If rejected, you wasted time and must pursue another option. |

| Currently Not Collectible (CNC) | A temporary pause in IRS collections due to financial hardship – you pay nothing for now. | People who cannot afford any payment. (Income barely covers basic living expenses.) | Immediate relief from IRS collection actions (no levies while in CNC). Buys you time to improve your finances or consider other options. | Debt is not forgiven; interest and penalties keep accruing. IRS might file a tax lien while you’re in CNC. Status can be revisited; if your finances improve, collection will resume. |

As you can see, each option has pros and cons. Installment plans are the most common option, suitable for those who need more time to pay. OICs are great, but only for those who truly can’t afford to pay. CNC is a temporary safe harbor for the most hard-pressed taxpayers. There is no one-size-fits-all answer; the right move depends on your ability to pay and personal circumstances.

Don’t Wait: Take Action to Resolve Your Tax Debt

Facing an IRS tax debt can be intimidating, but the worst thing you can do is procrastinate. The longer you wait, the more interest and penalties accumulate and the closer the IRS gets to taking enforced collection action. Every day of delay is more money out of your pocket and increases the risk of liens or levies. The silver lining is that the IRS wants to work out a resolution—there are programs in place to help you, especially for debts under $50,000. By acting promptly, you maintain control over the situation rather than leaving it in the hands of the IRS.

If you have an IRS debt of under $50,000, now is the time to take action. Start by evaluating which of the options above fits your situation. You can contact the IRS directly or seek the guidance of a qualified tax professional to help you navigate the process. Remember, the IRS collection powers (and the laws behind them) are serious—IRC § 6321 gives them a lien on your property, and IRC § 6331 allows levies—but those actions are usually avoidable when you proactively set up a solution.

Don’t let tax debt hang over your life any longer. Whether it’s setting up a payment plan that fits your budget, exploring a settlement for less, or getting a temporary hardship break, there are solutions available. The sooner you get started, the sooner you’ll have peace of mind. If you’re unsure where to start or need expert assistance to maximize your relief, consider consulting a tax resolution professional. They can help you cut through red tape, potentially reduce your tax liability, and deal with the IRS on your behalf. Taking action today can prevent a minor tax issue from escalating into a significant financial crisis.

Owing under $50,000 to the IRS is indeed a problem that needs to be addressed, but it’s a solvable issue. By leveraging the IRS’s programs and perhaps professional guidance, you can resolve your IRS tax debt in a way that protects your finances and future. The key is to act now – every moment of hesitation is costly. Get started on the path to relief and put your tax debt troubles behind you. Call us today at 201-381-4472.