Not filing is more serious than many people think when it comes to taxes. If the IRS believes that you have not filed in a deliberate attempt to commit tax evasion, you can face criminal charges and even jail time.

At Paladini Law, we help people across New Jersey and the United States understand the consequences of not filing taxes—and, more importantly, how to avoid those consequences. In most cases, you don’t need to worry about jail time for unfiled returns. Still, you need to be aware of other consequences, such as penalties, unwanted tax assessments, and involuntary collection actions.

If you haven’t filed taxes in months or years and are worried about possibly ending up behind bars, we are here to help. Call 201-381-4472 or fill out our contact form to schedule a consultation today.

Can You Really Go to Jail for Not Filing Taxes?

Yes, you can go to jail for not filing taxes, but it’s uncommon. In tax law, there’s a difference between a simple oversight and intentionally ignoring your filing obligations. The IRS and state tax authorities prioritize getting taxes filed, but they may pursue criminal charges and jail time when they believe there’s intentional noncompliance.

Jail time isn’t just about owing money. Taxpayers do not typically face jail time for not paying taxes unless convicted of tax fraud or tax evasion. Instead, the consequences of unpaid taxes are civil, such as monetary penalties, wage garnishments, and bank account levies.

That said, if you don’t pay or file in a willful attempt to evade or defeat taxes, you may be charged with a crime, and one of the consequences may be jail time.

What Are the Tax Crimes That Can Lead to Jail for Not Filing?

The IRS considers “willful failure to file” a crime. This means you knowingly didn’t file your taxes when you were required to do so.

To determine whether or not a crime has been committed, the IRS looks for patterns of avoidance, like ignoring tax deadlines year after year, and they’ll investigate to see if you intentionally avoided filing. If they find that you simply forgot or didn’t realize you needed to file, they’re more likely to assess penalties than pursue jail time. But if there’s evidence of willful intent—like moving assets around to avoid detection or using offshore accounts—that can lead to criminal charges.

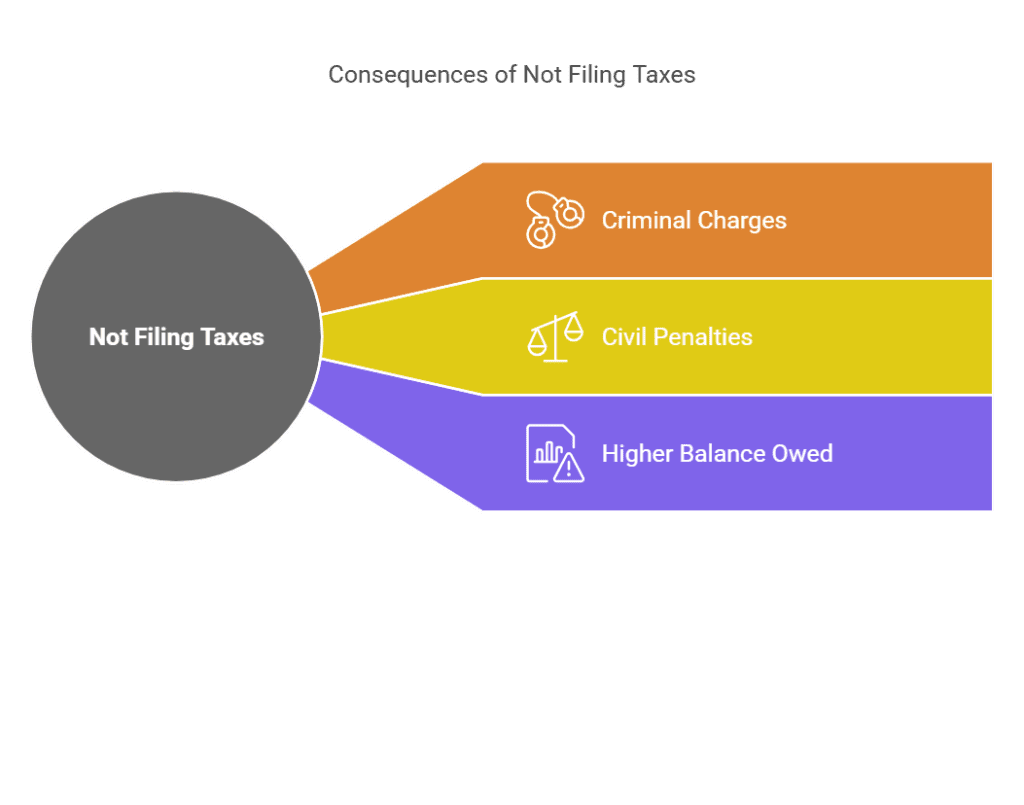

Civil vs. Criminal Penalties for Not Filing Tax Returns

Not filing your taxes can lead to civil and/or criminal penalties. Failure-to-file penalties are different from the late payment penalties for not paying taxes. Civil penalties are based on the amount you owe, and you will face a penalty of 5% of the unpaid taxes for each month your tax returns are late, up to 25%.

Criminal charges, on the other hand, are far more serious. If you’re convicted of misdemeanor charges for willful failure to file, you could face up to a year in jail and fines of up to $25,000. If you are convicted of felony tax evasion charges, the jail time may be up to five years, and the penalties up to $100,000.

The IRS is generally more focused on getting people to file, but repeated or blatant non-filing can push a case into criminal territory. Contact a tax attorney immediately if you have a pending IRS criminal case for unfiled taxes.

Real-Life Examples: People Who Went to Jail for Not Filing Taxes

Several high-profile cases in the U.S. highlight how seriously the IRS takes non-filing. For example, actor Wesley Snipes was convicted of willfully failing to file his taxes for several years. He ended up serving time in jail and paying substantial fines. Cases like these show that when people consistently avoid filing, the IRS will take legal action, which can lead to jail time if the non-filing is deemed willful.

What if You File a False Tax Return?

Filing a false return is even riskier than not filing at all. If the IRS discovers you filed inaccurate information on purpose, like having unreported income or using false deductions, they may charge you with tax fraud. Tax fraud is a felony, which means it can lead to longer prison sentences, as well as significant fines. The IRS has a higher tolerance for people who come forward to correct errors than for those who file false information intentionally.

Unique Cases: When Failing to File Leads to Jail

Most people don’t end up in jail for not filing. However, some unique scenarios exist where jail time may become more likely. For example, if someone earns income from illegal activities, doesn’t report the income, and pays taxes on it, the government may use tax laws to pursue criminal tax fraud charges. Yes, reporting illegal income is required by law!

Most infamously, Al Capone was jailed for income tax evasion due to not reporting and paying tax on his illegal source income. However, even if you’re not involved in illegal activities, ignoring taxes for years can raise red flags, leading the IRS to pursue harsher penalties.

Could an Audit Lead to Jail if You Haven’t Filed?

An audit itself won’t send you to jail, but if the IRS uncovers years of unfiled taxes during an audit, it can turn a civil case into a criminal one. If an audit reveals evidence of intentional non-filing, the IRS might refer your case to its criminal investigation division. To avoid this, file your taxes and promptly respond to any IRS notices.

Statutes of Limitations for IRS Criminal Cases on Unfiled Taxes

The IRS has a time limit on how long it can pursue criminal charges for unfiled taxes. Generally, there’s a six-year statute of limitations for failure to file criminal cases. However, this time limit doesn’t mean ignoring unfiled taxes is safe, as the IRS may assess civil penalties indefinitely.

The Serious Consequences of Not Filing a Tax Return

Beyond potential jail time, possible consequences of not filing taxes may lead to severe financial penalties. If you don’t file, the agency may use the information it has to generate a substitute return for you. These returns generally show a higher tax liability than you owe, allowing the IRS to start the collections process.

At that point, the IRS may charge late-filing penalties, late-payment penalties, and interest. Additionally, non-filing can lead to tax liens, wage garnishment, bank levies, and loss of refunds owed to you.

Get Help with Unfiled Taxes Before It’s Too Late

If you’re behind on filing, acting before the IRS does is crucial. Professional help to file past returns can reduce penalties and help you avoid criminal charges. At Paladini Law, we focus on helping individuals and businesses throughout New Jersey and beyond navigate the complexities of tax issues.

Don’t let unfiled taxes become a legal problem—reach out to us for a confidential consultation to get back on track. Call 201-381-4472 or send us a message online to get started.