Payroll Tax Attorney Serving all of New Jersey

Owing payroll taxes to the IRS or State differs from owing most other types of taxes. This is because payroll taxes consist of money withheld from employees’ earnings. This money does not belong to the employer but rather is withheld by the employer for the employee to be paid over to the IRS.

Not timely paying the payroll taxes can have series repercussions, including civil and criminal penalties.

What You Should Know About Payroll Taxes:

- What are payroll taxes?

- When do payroll taxes need to be paid?

- What actions can the IRS take if a business is behind on payroll taxes?

- What civil penalties can the IRS enforce for unpaid payroll taxes?

- What is a trust fund recovery penalty?

- What criminal penalties can the IRS enforce for unpaid payroll taxes?

- Payroll tax FAQs

Payroll Taxes: What Are They?

Payroll taxes (or employment taxes) consist of:

- Income taxes withheld from employees’ wages.

- Social Security and Medicare Taxes, which are also withheld from the employees’ wages and matched by the employer.

- Additional Medicare taxes, which are withheld from employees’ who make more than a specific amount.

- Federal Unemployment taxes, which are paid only by the employer and not withheld from employees’ wages.

When Are Payroll Taxes Due?

Employers must make deposits towards the federal income tax withheld and both the employer and employee social security and Medicare taxes. Employers must make these deposits either monthly or semi-weekly, depending on the size of payroll. All deposits must be made online via the Electronic Federal Tax Payment System.

Failing to make federal tax deposits timely will cause a failure to deposit penalty of up to 15%.

Besides to making timely deposits, all payroll tax returns must be filed timely. If not, you’re also subject to failure to file penalties.

What Happens If I’m Behind in Payroll Taxes?

There are many actions the IRS can take if the business owes payroll taxes. Some are more severe than others. The severity of the IRS’s action is almost always in proportion to the amount of taxes at issue, the number of tax periods not fully paid, and the effort or lack thereof of the taxpayer to pay the back taxes.

Civil Penalties for Unpaid Payroll Taxes

There are many civil penalties for unpaid payroll taxes. First, there is the failure to deposit penalty for not making the federal tax deposits on time. Depending on how late the deposits are made, the penalty ranges from 2% to 15%.

Second, there is a failure to file penalty of the payroll tax returns are not filed timely. The penalty is 5% per month, up to 25%.

Third, there is a failure to pay penalty for not paying the payroll taxes on time. The penalty is 0.5% per month.

Fourth, if you do not file the W-2s or Form 1099s timely, there are additional penalties.

And of course, there’s interest. The interest rate varies every quarter but is generally around 4%.

Civil penalties are best case scenario for unpaid payroll taxes. If you can provide reasonable cause, these penalties can be reduced or removed.

Trust Fund Recovery Penalty

Let’s say you set up a legal entity (like an LLC, C-corporation, or S-Corporation) to protect your personal assets. The Trust Fund Recovery Penalty allows the IRS to ignore the corporate veil and hold you—the owner, CEO, CFO, check signer—personally liable for the unpaid taxes. Once you are personally liable, the IRS can try to seize your personal assets to satisfy the business’s tax liability.

The trust fund recovery penalty can hold individuals responsible for the business’s tax debts.

The Trust Fund Recovery Penalty can be assessed against anyone who is (1) responsible and (2) willful. A responsible person is someone with the power and authority to pay the payroll taxes. Some examples:

Trust Fund Recovery Penalty: Responsible Persons

-

- Officers and employees,

-

- Corporate directors and shareholders

-

- Members of partnerships

-

- Member of the board of trustees of nonprofits

-

- Member or employee of a partnership

- Individual listed on the bank signature card

You’ll notice a big catch-all of “individual listed on the bank signature card.” The Trust Fund Recovery Penalty investigation is handled by a revenue officer. When the investigation begins, the revenue officer will summons the bank signature card. If your name is listed as having check signing authority, the revenue officer will almost always want to conduct an interview.

While check signing authority, by itself, cannot make someone responsible, revenue officers place a heavy weight on it to make responsible person determinations.

Willfulness is the second part to the Trust Fund Recovery Penalty. Willfulness does not mean you acted with any evil intent. It simply means you knew or should have known of the liability and didn’t pay it. Paying other bills, such as rent to utilities, instead of the taxes is enough to demonstrate willfulness.

Criminal Penalties

In recent years, the IRS has made a push for pursuing criminal penalties in payroll tax cases. You can read about some here. Generally, the IRS rarely prosecutes people for not paying their income tax liability. But payroll taxes are different. Part of the payroll taxes do not belong to the employer—they are merely held “in trust” for the benefit of the employee. So if you’re withholding money from employees and using it to pay bills instead of turning it to the IRS, you’re essentially stealing from the employees for your own benefit. The government does not look kindly on this behavior and is much more likely to criminally prosecute.

Payroll Taxes FAQs

What If I Run My Business as a Schedule C, Sole Proprietorship? Can I Still Be Assessed the Trust Fund Recovery Penalty?

If you run your business as a Schedule C, Sole Proprietorship, the IRS does not need to go through the Trust Fund Recovery Penalty process. You have no liability protection as a sole proprietor. You are not only personally liable for the trust fund portion of the taxes but all payroll taxes without any need for a personal assessment.

How Long Does the IRS Have to Assess the Trust Fund Recovery Penalty?

The IRS has 3 years from the filing date to assess the trust fund recovery penalty. But under 26 USC 6501(b)(2), “filing date” means April 15 of the following year. So if you file the second quarter return timely in 2017, the 3-year statute of limitations does not begin until April 15 of 2018.

If My Business Pays the Payroll Taxes in Full, Do I Still Owe the Trust Fund Recovery Penalty?

No. The trust fund recovery penalty makes the liable joint and several, meaning the IRS can collect the full amount from the individual or the business, but it cannot double collect. If the business pays down the liability, you will only owe what is left.

Can I File an Offer In Compromise to Settle the Payroll Tax Debt?

The IRS does allow Offers in Compromise for payroll taxes. But the IRS rarely accepts offers in compromise for ongoing businesses. If you are an individual who has been assessed the trust fund recovery penalty, the IRS will settle the liability if trust fund determinations have been made on all responsible persons.

Do I Have Any Appeal Rights if the IRS Thinks I Should Be Liable for the Trust Fund Recovery Penalty?

The investigation of the trust fund recovery penalty is handled by an IRS Revenue Officer. If the Revenue Officer believes you should be liable, you can appeal her findings. The case would then be reviewed by IRS appeals.

Can I Be Held Personally Liable for Unpaid Payroll Taxes?

Yes. The IRS may use the Trust Fund Recovery Penalty to hold an individual personally liable for a business tax debt, and then to seize personal assets. They may occur when a person is (1) responsible (has the power and authority to pay the payroll taxes) and (2) willful (knew or should have known of the tax liability and failed to pay it). If the Trust Fund Recovery Penalty is used, then the IRS can ignore the corporate form of your business (such as an LLC or corporation) and personally go after a person who is deemed both responsible and willful. This may include members of a partnership, officers and directors, employees, or anyone listed on a bank signature card. If the business pays the unpaid payroll taxes in full, then the IRS will not go after an individual.

Need a New Jersey Payroll Tax Attorney?

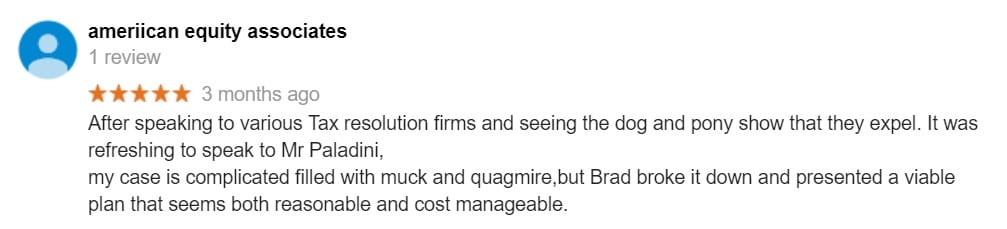

Payroll tax problems should not be handled alone. The potential civil and criminal penalties are too steep. If you’re a business in New Jersey who owes payroll taxes, you should contact an attorney before it’s too late. We have experience handling payroll cases with the IRS, and we will work tirelessly to reach an agreement you’re satisfied with. Below is a review from one of our past clients:

For help with payroll tax issues, contact me today.

Also Read: