Confused about New Jersey sales tax laws? Or maybe you’re behind in payments? You’re not alone. A New Jersey sales tax attorney can clarify complex regulations, handle audits, and help negotiate a repayment structure to get your business back on track. This guide covers how NJ sales tax attorneys can help, strategic benefits, and common scenarios NJ businesses encounter.

How Does Sales Tax Work in New Jersey?

New Jersey has some of the most aggressive sales tax rules (and highest rates) in the country. According to the Tax Foundation, it ranks 8th in the country in state sales tax rates at 6.625% (not including local sales tax rates). The rate is high, and the laws can be confusing to apply.

For instance, acne cleansers or soaps are subject to NJ sales tax, but acne creams and lotions are exempt. Does this make sense? Of course not, but that’s the way the law works.

While sales tax generally applies to tangible goods, it also applies to some personal services, making it even more difficult to comply. Fortunately, a pretty good New Jersey sales tax guide tells you what is subject to sales tax and what is not.

Collecting New Jersey Sales Tax

The general rule is that every New Jersey business that sells taxable items or services must collect and remit New Jersey sales tax when the items are delivered within New Jersey or the services are performed in New Jersey. Notice we bolded “collect and remit.” While the business is responsible for making the actual payments, it should not bear the financial burden of this payment. Unlike income tax or payroll tax, sales tax is added to the cost of the product or service. It must be separately stated on the invoice or receipt.

This is one of the more common issues we see when businesses charge sales tax. Rather than state the sales tax separately on an invoice, it’s lumped into the total. This is incorrect and makes it more difficult to prove you are properly collecting sales tax if you are ever audited.

The consumer is charged sales tax while the business collects and turns it over to NJ. This is an important distinction because, as we’ll discuss later, since the business owner is holding this money “in trust,” he or she can be personally liable if the business doesn’t pay the sales tax.

Filing New Jersey Sales Tax Returns

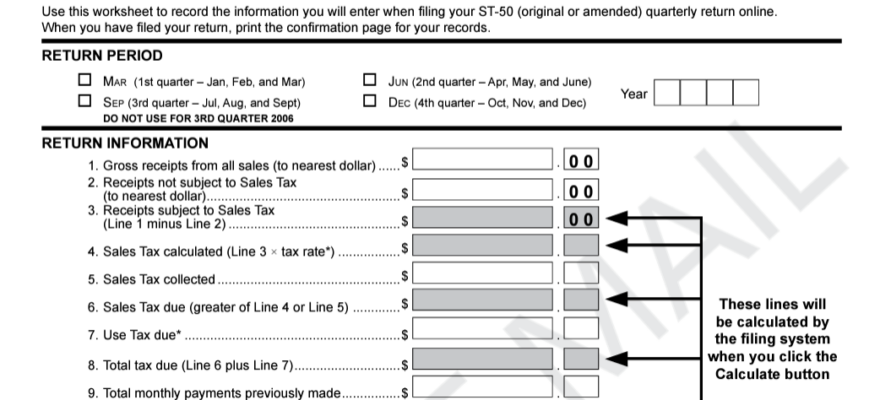

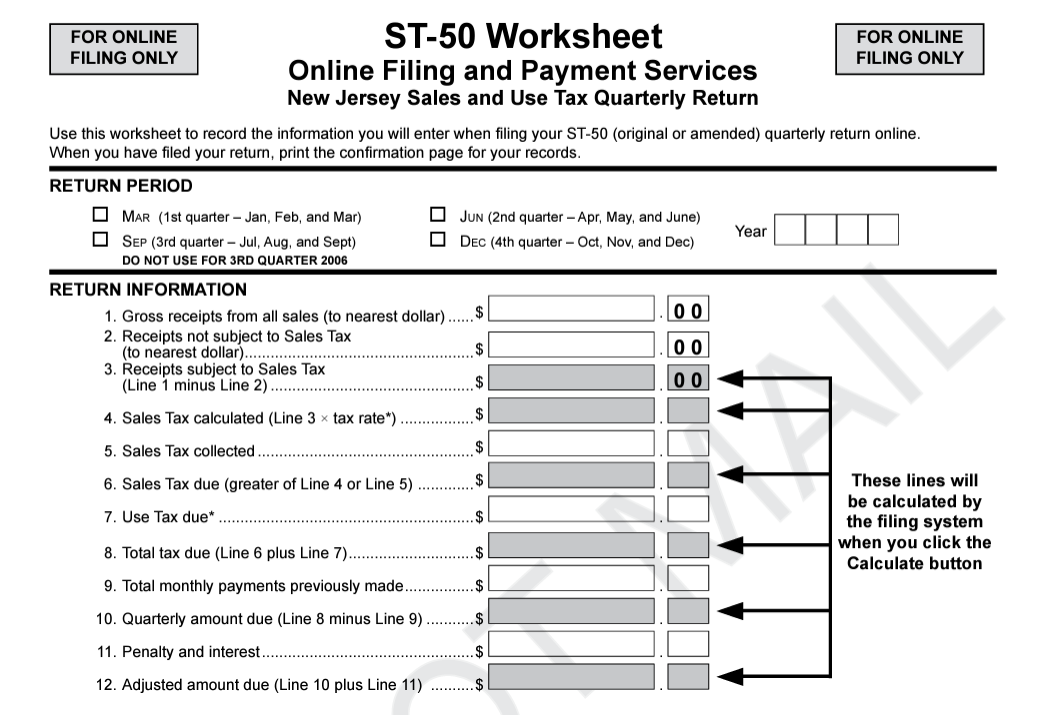

New Jersey Sales Tax returns, Form ST-50, are done quarterly. They must be filed online. The filing deadlines are:

- 1st Quarter: Due April 20th

- 2nd Quarter: Due July 20th

- 3rd Quarter: Due October 20th

- 4th Quarter: Due January 20th

We see two errors most commonly when it comes to completing the ST-50s.

First, gross receipts are reported on an accrual basis, not a cash basis, no matter which accounting method you use for income tax. What’s the difference? Cash basis accounting records revenue when you actually receive the cash, whereas accrual basis accounting records the revenue when the transaction occurs.

Let’s run through an example. On March 15, you perform taxable services for a customer and send them an invoice for $5,000 of services plus $331.25 in sales tax. (Remember, the sales tax needs to be stated separately.)

The customer doesn’t actually pay you until April 20th. Since sales tax uses an accrual method of accounting, that sales tax is due in the first quarter—even though you haven’t been paid yet! If you’re using a cash method of accounting, it won’t show as revenue until the second quarter.

The second error we see frequently is misreporting the gross receipts on the return. The gross receipts on the sales tax return are the total sales for the quarter, not just sales subject to sales tax. Lines 2 and 3 on the ST-50 will account for sales subject to sales tax vs. not subject to sales tax.

Use Tax vs. Sales Tax

New Jersey also has use tax laws. Use tax is due when personal property or services are purchased in New Jersey, but New Jersey sales tax is not collected or is collected at a lower rate than NJ’s rate. Let’s say your business purchases supplies from an out-of-state vendor, and that vendor does not charge sales tax. Your business must pay use tax on that purchase to NJ.

How many small businesses do this properly? Not many. But that doesn’t mean it’s not the law!

Common New Jersey Sales Tax Problems

A business is responsible for collecting sales tax. You must ensure you charge sales tax and then remit sales tax to New Jersey. So how do businesses end up owing sales and use tax to the New Jersey Division of Taxation?

New Jersey Sales Tax Audits

To be blunt, New Jersey sales tax audits suck. They are incredibly invasive, time-consuming, and generally unpleasant.

Avoiding New Jersey Sales Tax Audits

Some New Jersey sales tax audits are random, meaning there’s no rhyme or reason your business was selected for audit. But there are some patterns we’ve seen that may increase your odds of a New Jersey sales tax audit.

New Jersey audits some industries more frequently than others. For instance, liquor and tobacco stores, contractors, landscapers, and many “blue-collar” businesses are audited more frequently than others—at least, that’s been our experience. Our best guess is that these businesses are more likely to deal in cash and often don’t have the same financial controls as other businesses.

We’ve also found that businesses that tend to be subjected to New Jersey sales tax audits have a large discrepancy between the gross receipts reported on the sales tax returns and those reported on the income tax returns.

For instance, on each quarter’s ST-50s, the business reports $50,000 of gross receipts. The total gross receipts would be $200,000 ($50,000 x 4 quarters) for the year. There are $1,000,000 in gross receipts on the income tax return. While the gross receipts on the sales tax returns and those on the income tax return might not match perfectly (see the cash vs. accrual discussion above), you’d expect them to be close. A large discrepancy between the two signals that sales tax may have been underreported.

Dealing with a New Jersey Sales Tax Audit

We don’t recommend handling a sales tax audit yourself for many reasons. First, you want protection between yourself and New Jersey, as they can make criminal referrals and assess civil fraud penalties. Second, unless you have lots of experience handling sales tax audits in New Jersey, it’s incredibly difficult to navigate yourself. Third, New Jersey auditors don’t always know what they are doing and may provide wrong or inaccurate information. Fourth, New Jersey often has crazy high assessments that can be avoided or mitigated.

But let’s say you don’t take our advice and try to do it yourself (don’t say we didn’t warn you). New Jersey will typically pick a period as the “sample.” It will then look for discrepancies during that sampling period and apply those changes to the entire audit period. New Jersey will often require you to provide:

- bank statements

- tax returns

- invoices

- purchase invoices

- accounting records

These items aren’t optional to provide. And if you don’t provide them, New Jersey can make an “arbitrary” assessment, which means they roll a wheel to determine how much sales tax you should owe (we’re only partially joking).

New Jersey will review all receipts for anything purchased from your business. It will look to see if sales tax was properly charged and how much sales tax was supposed to be paid for the quarter. The New Jersey Division of Taxation will compare this information to the tax returns. It will also review bank statements to see if there’s a large discrepancy between deposits for a quarter and the gross receipts reported on the return. It will also review any exemption certificates you are claiming.

This would be one of the more straightforward audits, where NJ checks to see if you (1) charge sales tax appropriately and (2) pay sales tax appropriately. But it can get even more complex.

If you operate a restaurant, for example, it may look at all the food you purchase and try to determine if it’s in line with all the food you sell. Let’s say you bought 1,000 pounds of chicken for a month. But your receipts show you only sell 10 pounds of chicken a month. NJ could estimate how much chicken you should be selling and how much sales tax should have been paid. To say it gets a bit complicated would be an understatement.

“Borrowing” New Jersey Sales Tax

Some businesses will “borrow” the New Jersey sales tax they collected. The business will properly charge and collect sales tax and comply with its sales tax filing. However, the business will then fail to remit sales tax and use that money to pay other expenses like rent and insurance.

Sales tax (and payroll tax) are the last loans you want to borrow from. Those taxes are not yours, they are merely be held on behalf of the consumer (or employee). The New Jersey Division of Taxation does not like this. So much so that it can and will hold certain individuals at the business personally liable for the tax debt. Even if the business stops operating, New Jersey can still go after those individuals’ income and assets. New Jersey sales tax is simply not to be messed with.

Addressing Late Filing and Payment Penalties

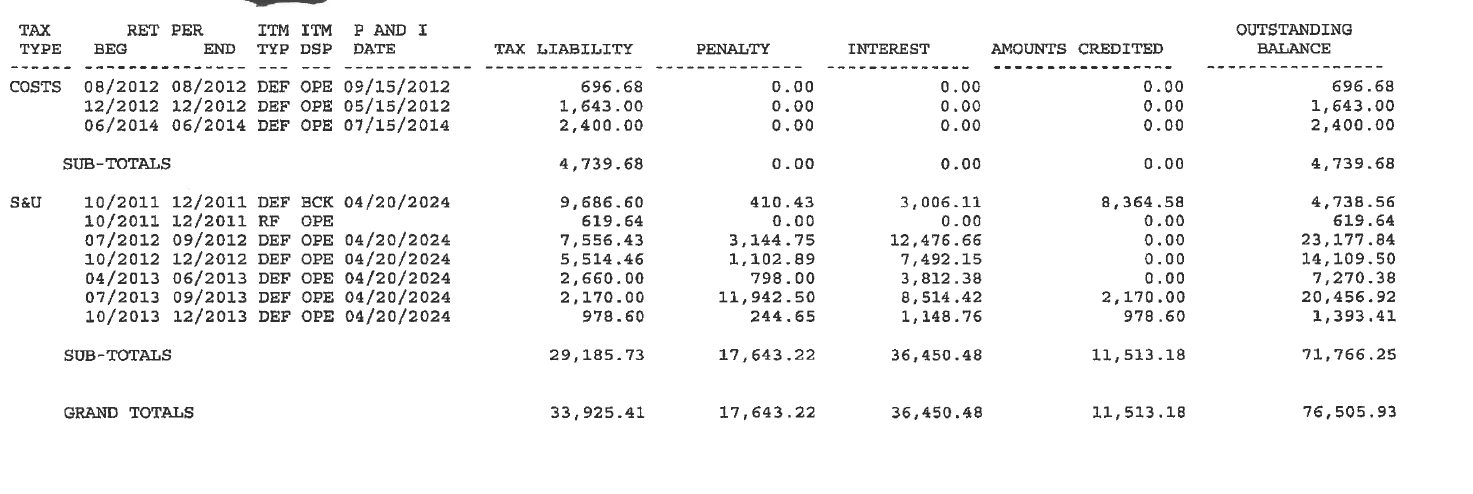

New Jersey has a heavy hand regarding late filing and paying penalties. On top of that, there’s interest. This can all add up very quickly:

As you can see here, the original sales tax due was around $29,000. “Costs,” penalties, and interest increased that by almost $60,000!!!!

Even if a business is in difficult financial circumstances, borrowing New Jersey sales tax to fund operations is not a good idea. Not only can New Jersey hold you personally liable for that debt, but the interest and penalties are beyond even the worst loans.

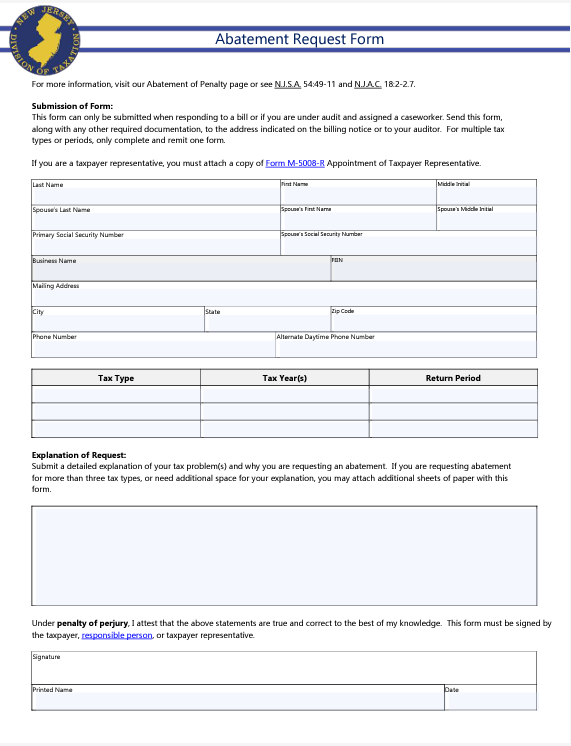

Fortunately, there is relief for penalties and interest. New Jersey offers a penalty abatement program for sales tax (and other types of taxes). To get relief on both the late filing penalty and late payment penalty, you must complete the New Jersey abatement form and demonstrate “reasonable cause.”

New Jersey is reasonably flexible when it comes to removing penalties. It helps to show a commitment to repaying the sales tax but entering into an installment agreement.

Repaying New Jersey Sales Tax

If you do not pay sales tax timely, you can repay it through an installment agreement. New Jersey does not offer as many repayment options as the IRS does. New Jersey also farms some of its debt collection to a third-party debt collector, Pioneer Credit.

Depending on where you are in the collection process, you’ll need to pay the sales tax back over one year or up to six years. It is possible to stretch your payment plan out over a longer period, but there is no formal way. It would involve negotiations directly with New Jersey to try and get more time.

If you’ve fallen behind on your sales tax obligations, remember a few things if you want a repayment plan. You need to pay sales tax timely from now on. New Jersey will work with you on past due sales tax, but they want to see that a line in the sand has been drawn and that you do not continue to collect sales tax but do not pay it. You also want to ensure you file sales tax returns timely. The goal is to show the state that future compliance will not be an issue.

If you’re having trouble keeping up with your sales tax obligations, software automates the process. While we don’t personally endorse this software, some clients have happily used it. It not only helps calculate the sales tax but automatically pays it for you as well.

Settling New Jersey Sales Tax

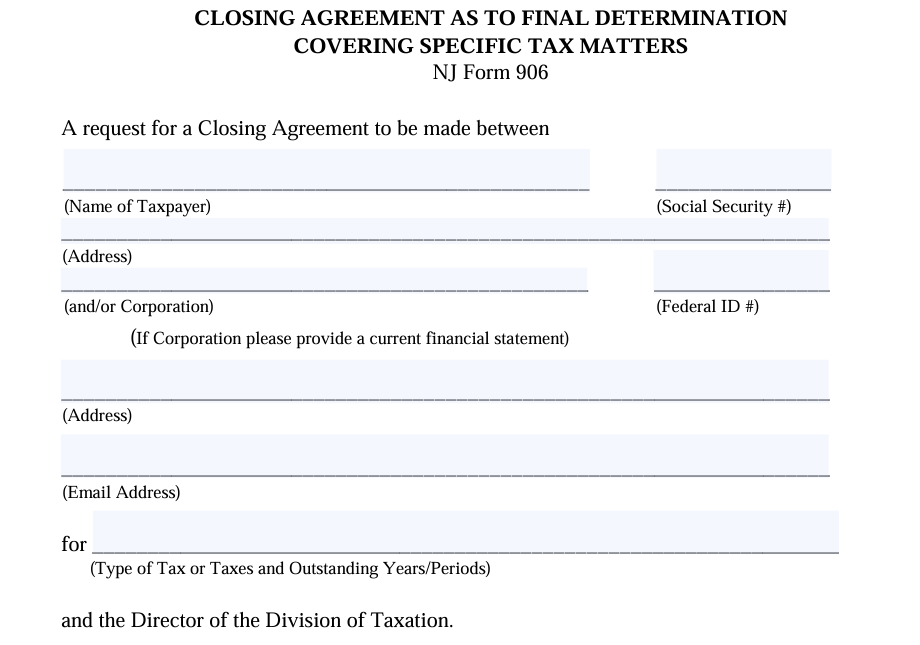

You can settle New Jersey sales tax through a closing agreement. A New Jersey closing agreement is similar to an IRS Offer in Compromise, where you settle your debt for less than what is owed. There’s very little formal guidance out there on New Jersey closing agreements. Here are some helpful tips from our experience doing New Jersey closing agreements.

They are more rarely accepted than their IRS counterpart. It should probably not be the first go-to option for resolving sales tax debt.

You must provide financial information demonstrating your inability to repay your sales tax debt.

Typically, New Jersey wants to see an inability to repay the debt. If you owe $50,000 in sales tax and you have $100,000 in your bank account, a closing agreement is unlikely.

It helps if the sales tax debt is old and the business no longer operates. New Jersey has 20 years to collect sales tax once a judgment has been filed. It can renew the judgment for an additional period. But if you are 10 or 15 years into it and New Jersey hasn’t received much money, it is more open to settling the sales tax debt, especially if it cannot collect sales tax from the business.

New Jersey also typically wants to settle for no less than the sales tax owed. So if you owe $100,000 in sales tax, $60,000 in penalties, and $50,000 in interest, New Jersey typically wants at least $100,000.

Now, again, this is not a formal policy from New Jersey. It’s also not impossible to settle for less than the principal sales tax owed. But if you entertain this option, you should have realistic expectations about how much you’ll need to pay. Because New Jersey typically wants the entire principal sales tax paid, it is sometimes better to abate the penalties, which is a relatively easier and more streamlined process.

Frequently Asked Questions

Don’t Navigate NJ Sales Tax Alone!

If you’re feeling overwhelmed by the prospect of NJ sales tax audits, penalties, or figuring out your repayment options, you’re not alone.