The Employee Retention Tax Credit (ERTC) is a federal program aimed at helping eligible businesses keep their employees on payroll during the COVID-19 pandemic. While the program has been immensely helpful for many organizations, it has also drawn the attention of the IRS.

Unfortunately, many less-than-ethical companies sprung up overnight to take advantage of ERC claims — including taking a large percentage of the refund as a fee. ERTC audits are now being conducted to ensure that businesses are claiming the employee retention credit correctly, and adhering to program guidelines. In this article, we’ll explore what ERTC audits are, how the audit process works, and how businesses can prepare for them.

What is an ERTC Audit?

An ERTC audit is a review of a business’s ERC claim filed with the IRS. The goal of an ERTC audit is to verify that the business has followed the guidelines set forth by the ERTC program, and that they have accurately calculated their ERC claims. An ERTC audit may be initiated as part of a regular IRS audit, or it may be an independent audit solely focused on ERC claims.

Definition and Purpose of ERTC Audits

The primary purpose of ERTC audits is to ensure that eligible businesses are not misusing the program or claiming credits they don’t qualify for. ERTC audits ensure that the government is reimbursing businesses correctly so that funds are distributed as intended to keep workers employed during the pandemic. ERTC audits are not meant to be punitive but rather to ensure that the program is being used correctly and effectively.

During an ERTC audit, the IRS will typically review the business’s financial records, including payroll records, tax returns, and other relevant documents. They may also conduct interviews with employees or management to gain a better understanding of the business’s operations and how they have utilized the ERTC credit.

It is important for businesses to keep accurate records and documentation related to their ERTC claim, as this will make the audit process smoother and more efficient. Businesses should also be prepared to provide additional information or clarification if requested by the IRS during the audit process.

The Employee Retention Tax Credit (ERTC) Program

The ERTC program provides eligible businesses with refundable tax credits for keeping their employees on payroll. The goal of the program is to encourage employers to keep their employees working, even during periods of economic downturn. The ERTC credit is calculated based on qualified wages paid, up to a maximum amount. Businesses can claim the credit on their quarterly employment tax returns, or they can file an amended employment tax return.

The ERTC program has undergone several changes and updates since its inception in March 2020. Businesses should stay up-to-date on the latest guidance and regulations related to the program to ensure that they are utilizing the credit correctly and effectively. In addition to qualifying based on decline in gross receipts, there are other ways to qualify based on partial suspension of business operations.

Overall, the ERC program has been a valuable resource for many businesses during the pandemic, providing financial support to help them retain their employees and stay afloat during a challenging time. ERTC audits play an important role in ensuring that the program is being used correctly and that funds are being distributed as intended.

The ERTC Audit Process

An ERC audit can vary depending on the specific case being investigated, but typically follows a few basic steps.

Employers who claimed the ERC credit during the COVID-19 pandemic may be subject to an audit by the Internal Revenue Service (IRS). The ERTC is a refundable tax credit designed to help businesses keep employees on their payroll during the pandemic. The IRS may conduct an ERTC audit to ensure that a business has correctly calculated the credit and has followed the guidelines set forth by the ERTC program.

Selection Criteria for ERTC Audits

The IRS selects businesses for ERTC audits based on various criteria, including but not limited to claim size, geographic location, and industries that are more prone to fraud. IRS audit specialists typically use data analytics and automated systems to identify ERTC claims that require further investigation. An ERTC audit may be triggered by substantial refunds requested or a series of credits claimed that are beyond the norm of comparable businesses. The IRS will examine ERC claims carefully, especially if they believe there was a false or fraudulent return filed. Unfortunately, there’s been a trend in the ERTC industry where many businesses are wrongfully being advised and improperly claiming the employee retention credit.

The IRS may also conduct a random audit of a business’s ERTC claim, even if the business does not meet any of the criteria for selection.

Steps Involved in an ERTC Audit

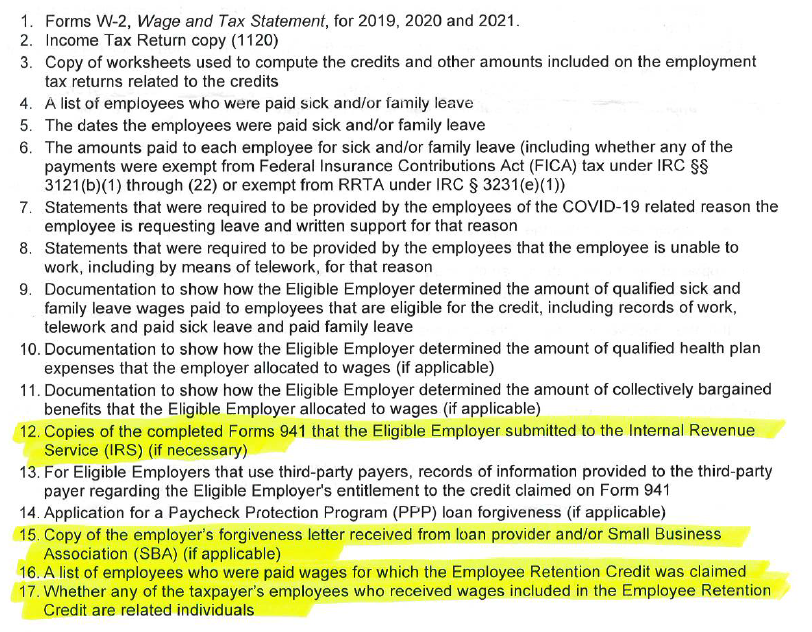

The steps involved in an ERTC audit involve the IRS audit team requesting documentation from the business to substantiate their credit. The IRS auditor will begin by reviewing the ERTC claim, then gather additional information to support it. This may include payroll records, employment tax forms, financial statements, and any other supporting documentation that will show how the ERTC was calculated and disbursed. The IRS audit team may also interview employees to ensure that the business has followed the guidelines set forth by the ERTC program. Here’s an example list of what the IRS might request:

It’s important for businesses to keep thorough records of their ERTC calculations and disbursements to make the audit process smoother. If the IRS audit team finds discrepancies in the business’s records, they may request additional information or even disallow the ERTC claim.

Timeline and Duration of an ERTC Audit

The timeline and duration of ERTC audits depend on the size and complexity of the claim and resources available to the IRS audit team. ERTC audits can take several months or even years to complete, depending on the situation under review. The IRS audit team will typically provide several milestones and deadlines that a business must comply with during the auditing process. It’s essential for businesses to be promptly responsive to the audit team’s requests.

During the audit, the business may work with an IRS auditor to resolve any discrepancies or issues that arise. If the audit results in disallowance of the ERTC claim, the business may have the opportunity to appeal the decision.

It’s important for businesses to take ERTC audits seriously and comply with all requests from the IRS audit team. Failure to comply may result in penalties or further investigation by the IRS.

Common ERTC Audit Triggers

There are a few common triggers that may cause the IRS to initiate an Employee Retention Tax Credit (ERTC) audit for a business. While the ERTC can be a valuable tax credit for businesses that have been impacted by the COVID-19 pandemic, it is important to ensure that the credit is being claimed correctly and in accordance with IRS guidelines.

Discrepancies in Employee Information

Discrepancies in employee information can also trigger ERTC audits. Businesses that have issues with employee classification or proper reporting of wages may be flagged for an audit. For example, if a business incorrectly classifies an employee as an independent contractor, this can result in the employee retention credit being disallowed for that employee.

It is important for businesses to ensure that they are properly classifying their employees and reporting their wages correctly. This includes accurately reporting any qualified wages and health plan expenses for each employee.

Inconsistencies in Tax Credit Calculations

Inconsistencies in the tax credit calculations can cause employee retention credit audits. If there is a sudden or substantial change in tax credits claimed, this may trigger an audit. Businesses should ensure that they are using the correct calculations and taking into account any changes in eligibility or qualified wages.

It is also important for businesses to keep up-to-date with any changes to the ERTC guidelines and regulations. The IRS may update its guidance or issue clarifications, and businesses should ensure that they are following the most current guidance.

By taking the necessary steps to ensure accurate documentation, proper employee classification and reporting, and consistent tax credit calculations, businesses can reduce their risk of being audited for the employee retention credit.

Preparing for an ERTC Audit

Given that ERTC audits can last several months, businesses must prepare for them. Below are a few steps that businesses can take to prepare for an ERTC audit.

Organizing and Maintaining Proper Documentation

The first step in preparing for an employee retention credit audit is to organize and maintain proper documentation. Businesses should ensure that their payroll records, employment tax forms, and financial statements are accurate, complete, and up-to-date. This is crucial to avoid any discrepancies that could lead to an audit. If a business needs to amend a tax return, it should make the changes immediately to reflect accurate information.

Businesses should keep all records related to employee retention credit claims for at least four years after the due date of the tax return on which the credit is claimed. This includes all documents that support the eligibility of the employees, the amount of qualified wages, and the amount of the credit claimed.

Ensuring Compliance with ERTC Guidelines

Businesses should ensure that they are complying with all employee retention credit guidelines to avoid any compliance issues that could trigger an audit. This includes verifying employee eligibility, qualified wages paid, and properly filing and reporting necessary tax forms.

Conducting Internal Reviews and Assessments

In preparation for an ERTC audit, businesses can conduct internal reviews to identify any potential issues with their claims. An internal review should be a comprehensive analysis of all information related to ERTC claims, including qualified wages paid and financial statements.

It is recommended that businesses engage a qualified third party to conduct the internal review. This can help ensure that the review is objective and thorough.

During the internal review, businesses should identify any discrepancies or errors in their refundable tax credit calculations and take corrective action as needed such as filing an amended employment tax return. This can help prevent any issues from arising during the audit.

Overall, preparing for an ERTC audit requires careful planning and attention to detail. By organizing and maintaining proper documentation, ensuring compliance with ERTC guidelines, and conducting internal reviews and assessments, businesses can help ensure a smooth and successful audit process.

Conclusion

In conclusion, ERTC audits are serious and can be time-consuming and sometimes expensive for businesses that are audited. However, by understanding the ERTC program guidelines and having a proactive approach to compliance, businesses can prepare for an audit and navigate the process successfully. Businesses that prioritize compliance and stay up-to-date on ERTC updates can avoid costly mistakes and protect themselves from audits.